Your Public Square Disclosing what is True, what is Real

Where Does the Money Really Go?

Publisher's Note: This post appears here courtesy of the John Locke Foundation. The author of this post is Paige Terryberry.

Most taxpayers understand that their tax dollars fund government programs: public school systems, Medicaid, courts, and prisons, etc. But where does the majority of your tax dollars really go?

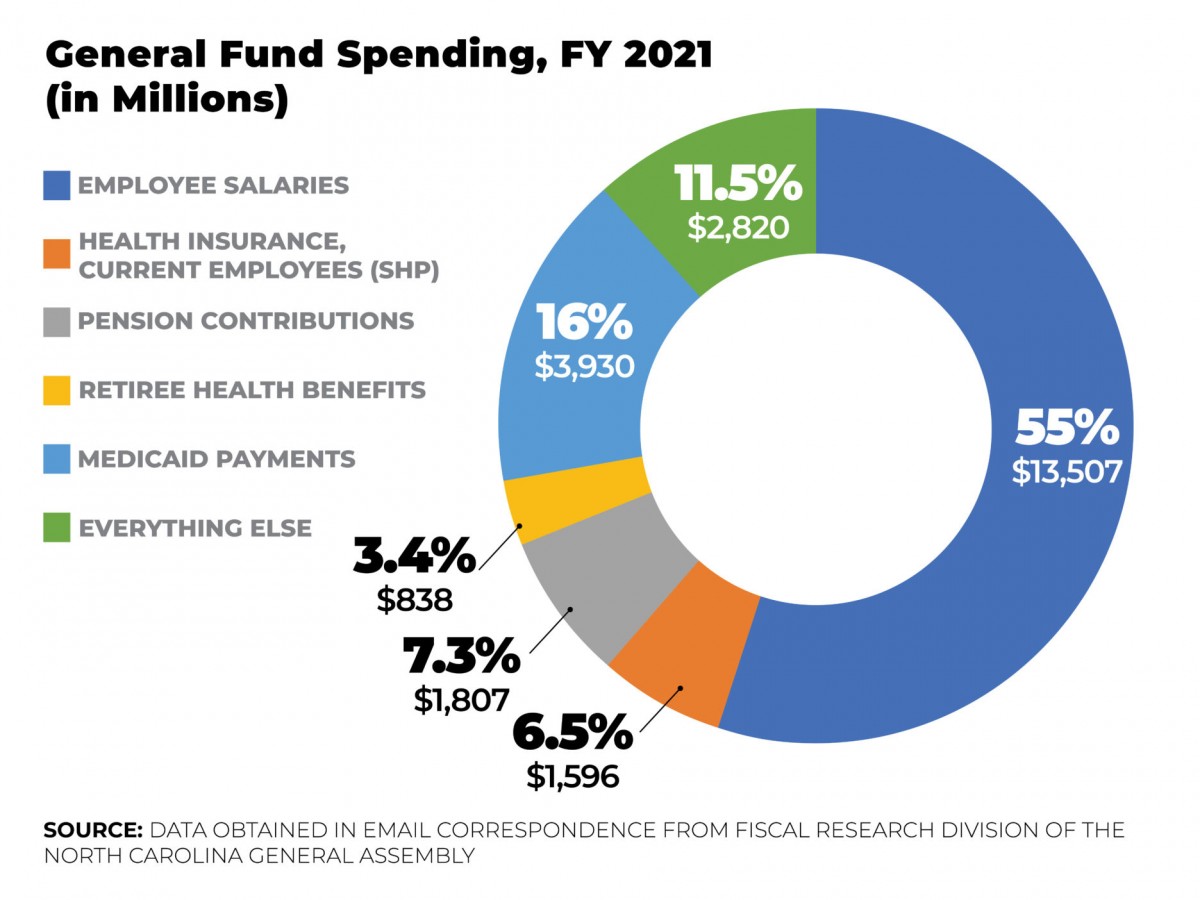

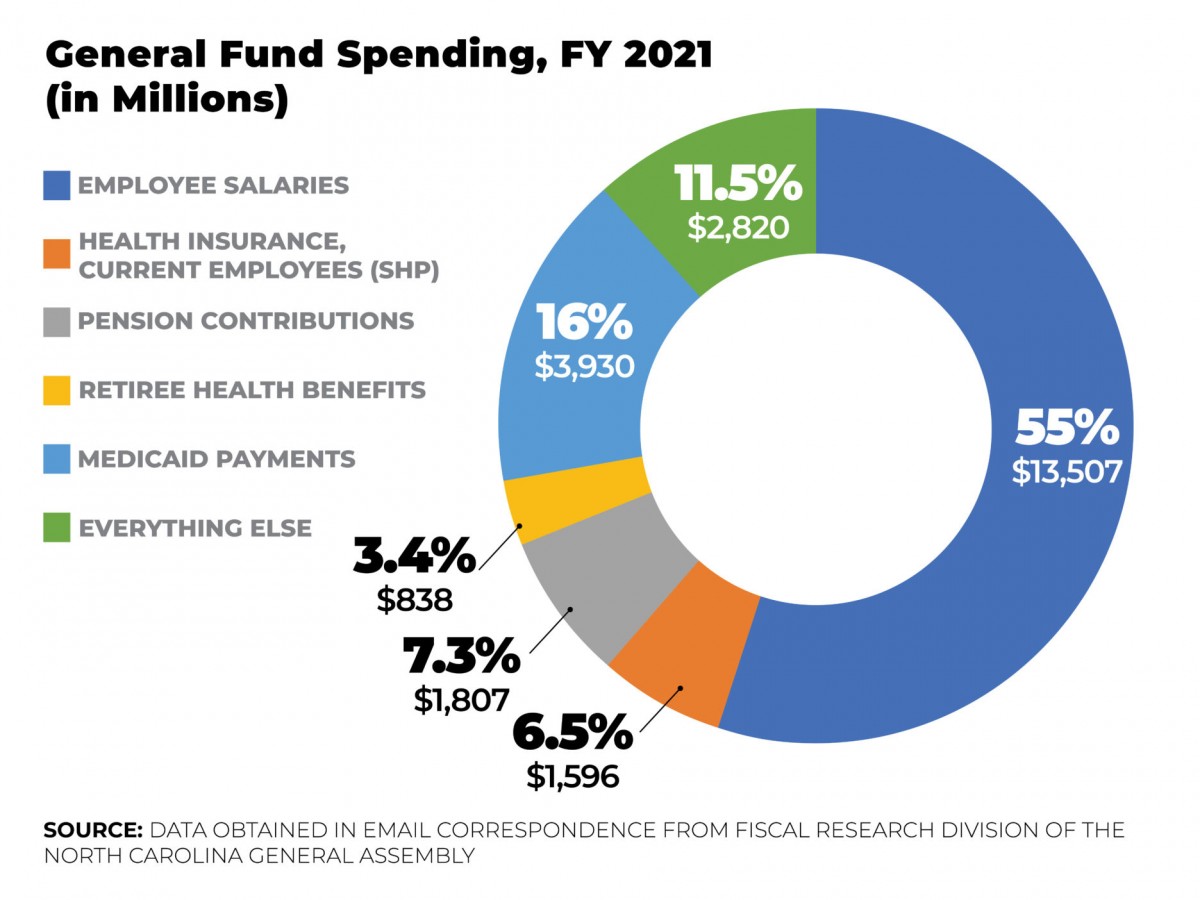

Your state tax dollars make up the majority of North Carolina's General Fund. In Fiscal Year 2020-21, the General Fund amounted to $24.5 billion.

How does the state spend these billions?

The below chart illustrates state General Fund expenditures. From the chart, we can see that more than half of General Fund spending goes to education, the vast majority of which is spent on K-12 schools, with smaller amounts designated for the UNC system and community colleges. The second-largest portion of the General Fund goes to Health and Human Services.

But what does it really mean when we say that $14 billion is going to education or $2 billion is going to Justice & Public Safety? Where is the money really going?

Although it is rarely reported as such, the majority of state tax money goes to pay state employees.

As my colleague stated in an earlier version of this analysis: "Any serious discussion about curbing or cutting state spending must look at the cost of state salaries, benefits, retirees, and Medicaid reimbursements."

Spending on salaries, benefits, etc., is significant because these are recurring spending commitments that grow with every legislatively approved pay increase, along with employees advancing up the salary scale, as well as with every increase in health care costs.

Salaries

More than $13.5 billion in General Fund spending goes to state employee salaries alone, making it the largest component of the state budget. All told, a whopping 88% goes to paying people: salaries, benefits, pensions, and Medicaid providers.

Reducing this massive annual cost is not easy - but it is necessary for any discussion on reducing state government. First, any proposal to create new state government roles should consider the long-term liability of the roles. Next, government agencies should eliminate lapsed positions and conduct regular reviews to ensure each open position serves an active purpose.

Hiring contractors when applicable would also cut down on taxpayer obligations, allow private firms to compete for the work, and save the state money. It would also significantly reduce the often-politicized public pressure on the government to increase salaries and benefits for workers.

Benefits - Health, pensions, disability, etc.

More than $4.2 billion goes to benefits in just one year, with $1.6 billion going to the state health plan for current employees, $1.81 billion to pension contributions, and $838 million to retiree health and disability benefits.

Retiree benefits represent a large part of the state budget. To finance the retiree benefits, each state agency is given General Fund dollars based on a percentage of the total payroll for that agency during the fiscal year. For the current Fiscal Year 2021-22, the state contributes nearly 23% of salaries for teachers and state employees and more than 46% of judges' salaries to the judicial retirement system for benefits. These contributions help finance state employee pensions, retiree health benefits, and disability plans.

Even so, the unfunded liability for post-employment benefits (including pensions and health care) is close to $40 billion, according to the most recent Debt Affordability Study from the State Treasurer. Unfunded liabilities represent the present value of the amount of estimated pension benefits and premium subsidies for retirees' health insurance the state will be responsible for over the next 30 years. Every dollar dedicated to funding retiree benefits means one less dollar for active employees or other current uses.

North Carolina's generous eligibility criteria contribute to the massive liability. For retirement, an individual can receive pension benefits upon retirement after just five years of service. Similarly, to qualify for at least partially subsidized state health plan coverage upon retirement, one must have completed only five years of service. However, coverage can be cheaper with a lengthier term of service.

A provision in the 2017 state budget attempted to address unfunded health benefit liabilities by closing the Retiree Health Benefit Trust. State employees hired after January 1, 2021 are not eligible for subsidized health benefits upon retirement.

Other actions to curb unfunded liabilities could include: requiring more retirees to contribute toward their health care premiums, introducing a health savings account that allows employees to utilize pretax dollars, and moving the state's defined-benefit pension plan to a 401(k). These actions are discussed in greater detail here.

Medicaid

An additional nearly $4 billion of the state budget goes to Medicaid reimbursements to providers. This amount does not include the federal funds that pour into the state for Medicaid, the lion's share of Medicaid reimbursements.

To stop the bleeding here, the first step is to hold the line and prevent Medicaid expansion.

Medicaid already covers the neediest in North Carolina. Expanding Medicaid would extend coverage to more people, crowding out those who need it most and adding to their struggle to find care. Expansion would likely cost North Carolina far more than initial estimates, with the added burden to be picked up by taxpayers.

Federal money always comes with strings attached. Expanding Medicaid would discourage private coverage, prompting more employers to drop care altogether. Indeed, research suggests that roughly half of those who would be in the expansion population already have private insurance. Coverage does not equal care, and expanding Medicaid would not adequately expand care for North Carolinians.

Conclusion

Calls to restrain the state budget are certainly less politically alluring than calls for new spending. Naturally, politicians call for salary increases and new government positions as we enter election season. Unfortunately, that means fodder for a growing government.

Fiscal responsibility requires an honest confrontation of spending and respect for taxpayer money. In the end, the majority of taxpayer dollars go to paying state worker salaries and benefits. As we enter election season, it is critical to remember what calls to expand government entail: more government employees and more long-term taxpayer liabilities.

Go Back

- Especially during an election season, taxpayers must be wary of calls to expand government

- New government spending means more government workers, salaries, and benefits, which means growing the long-term liabilities on taxpayers

- Any serious discussion of cutting spending must address the cost of salaries, benefits, and Medicaid

Most taxpayers understand that their tax dollars fund government programs: public school systems, Medicaid, courts, and prisons, etc. But where does the majority of your tax dollars really go?

Your state tax dollars make up the majority of North Carolina's General Fund. In Fiscal Year 2020-21, the General Fund amounted to $24.5 billion.

How does the state spend these billions?

The below chart illustrates state General Fund expenditures. From the chart, we can see that more than half of General Fund spending goes to education, the vast majority of which is spent on K-12 schools, with smaller amounts designated for the UNC system and community colleges. The second-largest portion of the General Fund goes to Health and Human Services.

But what does it really mean when we say that $14 billion is going to education or $2 billion is going to Justice & Public Safety? Where is the money really going?

Although it is rarely reported as such, the majority of state tax money goes to pay state employees.

As my colleague stated in an earlier version of this analysis: "Any serious discussion about curbing or cutting state spending must look at the cost of state salaries, benefits, retirees, and Medicaid reimbursements."

Spending on salaries, benefits, etc., is significant because these are recurring spending commitments that grow with every legislatively approved pay increase, along with employees advancing up the salary scale, as well as with every increase in health care costs.

Salaries

More than $13.5 billion in General Fund spending goes to state employee salaries alone, making it the largest component of the state budget. All told, a whopping 88% goes to paying people: salaries, benefits, pensions, and Medicaid providers.

Reducing this massive annual cost is not easy - but it is necessary for any discussion on reducing state government. First, any proposal to create new state government roles should consider the long-term liability of the roles. Next, government agencies should eliminate lapsed positions and conduct regular reviews to ensure each open position serves an active purpose.

Hiring contractors when applicable would also cut down on taxpayer obligations, allow private firms to compete for the work, and save the state money. It would also significantly reduce the often-politicized public pressure on the government to increase salaries and benefits for workers.

Benefits - Health, pensions, disability, etc.

More than $4.2 billion goes to benefits in just one year, with $1.6 billion going to the state health plan for current employees, $1.81 billion to pension contributions, and $838 million to retiree health and disability benefits.

Retiree benefits represent a large part of the state budget. To finance the retiree benefits, each state agency is given General Fund dollars based on a percentage of the total payroll for that agency during the fiscal year. For the current Fiscal Year 2021-22, the state contributes nearly 23% of salaries for teachers and state employees and more than 46% of judges' salaries to the judicial retirement system for benefits. These contributions help finance state employee pensions, retiree health benefits, and disability plans.

Even so, the unfunded liability for post-employment benefits (including pensions and health care) is close to $40 billion, according to the most recent Debt Affordability Study from the State Treasurer. Unfunded liabilities represent the present value of the amount of estimated pension benefits and premium subsidies for retirees' health insurance the state will be responsible for over the next 30 years. Every dollar dedicated to funding retiree benefits means one less dollar for active employees or other current uses.

North Carolina's generous eligibility criteria contribute to the massive liability. For retirement, an individual can receive pension benefits upon retirement after just five years of service. Similarly, to qualify for at least partially subsidized state health plan coverage upon retirement, one must have completed only five years of service. However, coverage can be cheaper with a lengthier term of service.

A provision in the 2017 state budget attempted to address unfunded health benefit liabilities by closing the Retiree Health Benefit Trust. State employees hired after January 1, 2021 are not eligible for subsidized health benefits upon retirement.

Other actions to curb unfunded liabilities could include: requiring more retirees to contribute toward their health care premiums, introducing a health savings account that allows employees to utilize pretax dollars, and moving the state's defined-benefit pension plan to a 401(k). These actions are discussed in greater detail here.

Medicaid

An additional nearly $4 billion of the state budget goes to Medicaid reimbursements to providers. This amount does not include the federal funds that pour into the state for Medicaid, the lion's share of Medicaid reimbursements.

To stop the bleeding here, the first step is to hold the line and prevent Medicaid expansion.

Medicaid already covers the neediest in North Carolina. Expanding Medicaid would extend coverage to more people, crowding out those who need it most and adding to their struggle to find care. Expansion would likely cost North Carolina far more than initial estimates, with the added burden to be picked up by taxpayers.

Federal money always comes with strings attached. Expanding Medicaid would discourage private coverage, prompting more employers to drop care altogether. Indeed, research suggests that roughly half of those who would be in the expansion population already have private insurance. Coverage does not equal care, and expanding Medicaid would not adequately expand care for North Carolinians.

Conclusion

Calls to restrain the state budget are certainly less politically alluring than calls for new spending. Naturally, politicians call for salary increases and new government positions as we enter election season. Unfortunately, that means fodder for a growing government.

Fiscal responsibility requires an honest confrontation of spending and respect for taxpayer money. In the end, the majority of taxpayer dollars go to paying state worker salaries and benefits. As we enter election season, it is critical to remember what calls to expand government entail: more government employees and more long-term taxpayer liabilities.

| Castelli wins close NC6 GOP primary | John Locke Foundation Guest Editorial, Editorials, Op-Ed & Politics | Governor Cooper Announces Appointments to State Boards and Commissions |