Your Basic Needs: Food, Shelter and The TRUTH

N.C. Families Would Get $1,000 Tax Credit for Each Homeschooled Child Under New Bill

Publisher's Note: This post appears here courtesy of the Carolina Journal. The author of this post is David N. Bass.

Interest in homeschooling has surged in North Carolina during the COVID-19 pandemic. Now, Republican lawmakers in the state Senate want to give these families tax relief to help meet expenses.

Senate Bill 297 would give homeschool families a $1,000 credit off state income taxes for each dependent child per year. The tax credit would be non-refundable, meaning it would only apply against any taxes owed. The credit would kick in beginning with the current 2021 tax year.

The bill defines "homeschool" in the traditional sense of an education environment where parents, legal guardians, or other members of the household "determine the scope and sequence of academic instruction, provide academic instruction, and determine additional sources academic instruction."

That means parents overseeing their child's virtual learning at home through a public or private school would not qualify.

"Families of homeschooled students have been left out of the conversation of education funding for far too long," said Sen. Chuck Edwards, R-Buncombe, the primary sponsor of the bill. "It's one more option for parents who want to be profoundly engaged and personally invested in the success of their children. COVID-19 has added more emphasis on the need for families to become involved in education at home."

"When a child is educated at home, the state avoids tremendous costs for school construction and operation," Edwards added. "These families also pay taxes, and it's only fair that a portion of their tax dollars is returned to help offset their expenses."

"Families who choose to educate their children at home sacrifice both time and money in an effort to provide the best future for their children. This legislation serves to recognize their efforts," said Sen. Vickie Sawyer, R-Iredell, another primary sponsor.

Homeschool enrollment in N.C. has increased by 78% in the past decade. As of August 2020, North Carolina had 101,406 homeschools listed in the state homeschool directory, a 6.9% jump from the 2019-20 school year. There are now well over 150,000 homeschool students across the state.

Dr. Terry Stoops, director of the Center for Effective Education at the John Locke Foundation, noted that homeschool families "make enormous financial sacrifices to educate their children at home," and while a $1,000 tax credit per child would account for "only a fraction of the amount spent on instructional materials and other expenses, I suspect that many families would welcome a small tax advantage for their hard work."

Stoops added that some homeschool families may be wary of government regulation resulting from the tax credit. "That is a legitimate concern that should be addressed assertively by bill sponsors and proponents," Stoops said.

S.B. 297 is one of several measures introduced that could expand school choice in the state this legislative session. House Bill 32 would increase the maximum tuition reimbursement (now set at $4,200 a year) for the Opportunity Scholarship Program. It would also combine the Children with Disabilities grant and Education Savings Account into one program to ensure adequate funding and reduce wait lists.

Go Back

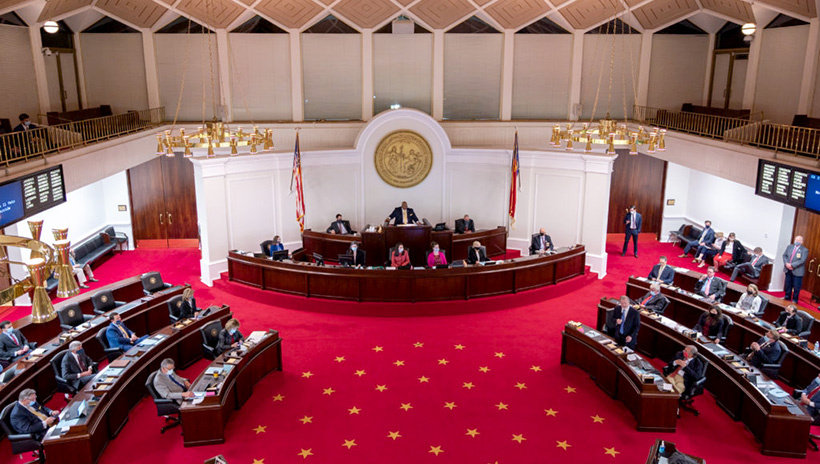

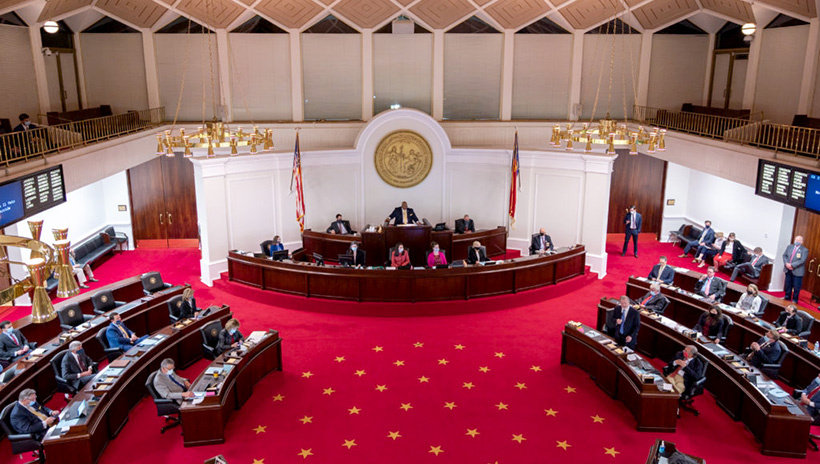

The N.C. Senate, in session Monday, March 1. | Photo: Maya Reagan / Carolina Journal

Interest in homeschooling has surged in North Carolina during the COVID-19 pandemic. Now, Republican lawmakers in the state Senate want to give these families tax relief to help meet expenses.

Senate Bill 297 would give homeschool families a $1,000 credit off state income taxes for each dependent child per year. The tax credit would be non-refundable, meaning it would only apply against any taxes owed. The credit would kick in beginning with the current 2021 tax year.

The bill defines "homeschool" in the traditional sense of an education environment where parents, legal guardians, or other members of the household "determine the scope and sequence of academic instruction, provide academic instruction, and determine additional sources academic instruction."

That means parents overseeing their child's virtual learning at home through a public or private school would not qualify.

"Families of homeschooled students have been left out of the conversation of education funding for far too long," said Sen. Chuck Edwards, R-Buncombe, the primary sponsor of the bill. "It's one more option for parents who want to be profoundly engaged and personally invested in the success of their children. COVID-19 has added more emphasis on the need for families to become involved in education at home."

"When a child is educated at home, the state avoids tremendous costs for school construction and operation," Edwards added. "These families also pay taxes, and it's only fair that a portion of their tax dollars is returned to help offset their expenses."

"Families who choose to educate their children at home sacrifice both time and money in an effort to provide the best future for their children. This legislation serves to recognize their efforts," said Sen. Vickie Sawyer, R-Iredell, another primary sponsor.

Homeschool enrollment in N.C. has increased by 78% in the past decade. As of August 2020, North Carolina had 101,406 homeschools listed in the state homeschool directory, a 6.9% jump from the 2019-20 school year. There are now well over 150,000 homeschool students across the state.

Dr. Terry Stoops, director of the Center for Effective Education at the John Locke Foundation, noted that homeschool families "make enormous financial sacrifices to educate their children at home," and while a $1,000 tax credit per child would account for "only a fraction of the amount spent on instructional materials and other expenses, I suspect that many families would welcome a small tax advantage for their hard work."

Stoops added that some homeschool families may be wary of government regulation resulting from the tax credit. "That is a legitimate concern that should be addressed assertively by bill sponsors and proponents," Stoops said.

S.B. 297 is one of several measures introduced that could expand school choice in the state this legislative session. House Bill 32 would increase the maximum tuition reimbursement (now set at $4,200 a year) for the Opportunity Scholarship Program. It would also combine the Children with Disabilities grant and Education Savings Account into one program to ensure adequate funding and reduce wait lists.

| General Assembly Advances Bill To Rein in Governor’s Emergency Powers | Carolina Journal, Editorials, Op-Ed & Politics | John Locke Foundation: Prudent Policy / Impeccable Research - Volume DCV |

Latest Op-Ed & Politics

|

given to illegals in Mexico before they even get to US: NGOs connected to Mayorkas

Published: Tuesday, April 16th, 2024 @ 11:36 am

By: John Steed

|

|

committee gets enough valid signatures to force vote on removing Oakland, CA's Soros DA

Published: Tuesday, April 16th, 2024 @ 10:32 am

By: John Steed

|

|

other pro-terrorist protests in Chicago shout "Death to America" in Farsi

Published: Monday, April 15th, 2024 @ 9:13 pm

By: John Steed

|

|

claim is needed "to meet climate targets

Published: Monday, April 15th, 2024 @ 2:07 pm

By: John Steed

|

|

Only two of the so-called “three Johns” will be competing to replace Sen. Mitch McConnell (R-KY) as leader of the Senate GOP.

Published: Monday, April 15th, 2024 @ 12:50 pm

By: Daily Wire

|

|

particularly true on economic matters

Published: Sunday, April 14th, 2024 @ 8:58 pm

By: John Steed

|

|

House Judiciary Chair Jim Jordan (R-OH) is looking into whether GoFundMe and Eventbrite cooperated with federal law enforcement during their investigation into the financial transactions of supporters of former President Donald Trump.

Published: Sunday, April 14th, 2024 @ 6:56 pm

By: Daily Wire

|

|

Turkish diplomatic sources say he did

Published: Sunday, April 14th, 2024 @ 6:08 pm

By: John Steed

|

|

Popularity of government leader crashes, even among his own party members.

Published: Sunday, April 14th, 2024 @ 2:12 pm

By: John Steed

|

|

6 month old baby fighting for life after mother killed; policewoman finally arrives, shoots knifeman

Published: Saturday, April 13th, 2024 @ 9:25 pm

By: John Steed

|

|

Biden policy driven by climate cult

Published: Saturday, April 13th, 2024 @ 3:04 pm

By: John Steed

|