Publisher's note: The author of this post is Jon Sanders, who is Director of Regulatory Studies for the John Locke Foundation.

The editors of The Fayetteville Observer are interested in the film industry and with storytelling in general. An example of the latter came to my attention recently.

An editorial entitled

Our View: Film biz quitting state after loss of incentives argues, in part, that few productions would bother to compete for a state film grant here, as the program is capped at $10 million (the previous program was open-ended, a refundable tax credit worth 25 percent of qualifying production expenses, capped at $20 million per production).

The editors even considered the old tax credit, "in theory ... an awful idea." The problem for them is other states are engaging in that awful idea still: "Georgia and other states are making [film producers] offers they can't refuse."

The upshot is this: "as long as other states allow them, we need to play along." Then the overkill: "It's a smart investment."

Nevertheless, that's not what brought the editorial to my attention (I am told it was also printed by the Mount Airy News). Those points are boilerplate justifications for targeted tax incentives for hand-picked "winner" cronies. This newsletter has frequently

exposed their flaws.

For example, persisting in an awful idea because "everybody does it!" is a race to the bottom. The Economist termed film incentives a "beggar-thy-neighbor trade war (with mutually destructive tariffs)" and, in the headline, "

a stupid trend."

Also, everybody doesn't do it. Fewer states are engaged in film incentives now than they were at their heyday in 2009; now

over a quarter of U.S. states are not "playing along."

We decide what's credible around here

Here is the part that got my attention:

Legislators were misled by a John Locke Foundation study that seemed to show North Carolina was losing money on film incentives. A more rigorous and objective study by an N.C. State professor showed the opposite to be true. According to the North Carolina Film Office, the industry spent more than $300 million across some 30 North Carolina counties last year.

The article doesn't say which JLF study, but I assume it was my Carolina Cronyism report "

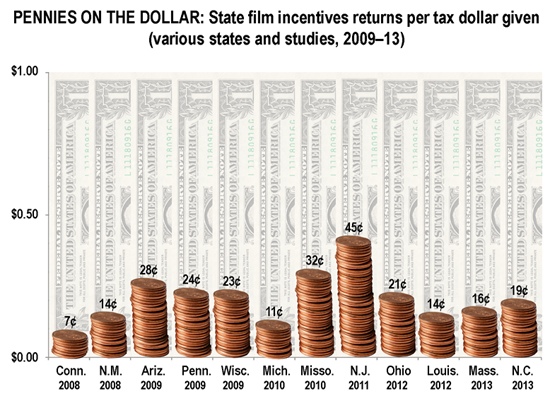

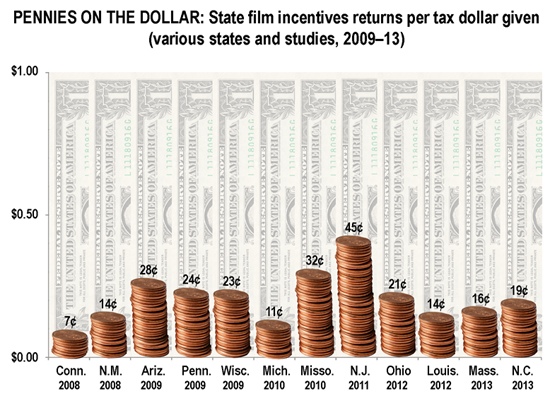

N.C.'s Film Tax Incentives: Good Old-Fashioned Corporate Welfare." My report looked at the history of North Carolina's film tax incentives, other states' incentives programs (and other nations' programs), costs and benefits (including encountering celebrities and civic pride), a preponderance of third-party studies of different states' incentives programs finding they returned pennies on the dollar, and alternatives.

It was a broad survey, essentially, and heavily sourced if the editors wished to attempt to discredit it by something other than a passive aside. It was not a peer-reviewed economic cost/benefit analysis of the program. But — and this is important — neither was the study the Fayetteville Observer's editors held up as "rigorous and objective."

The credibility of that study, by Dr. Robert Handfield, a North Carolina State University professor of

supply chain management, was practically stillborn. Shortly after its publication its manifold flaws were

exposed and demolished by the Fiscal Research Division of the North Carolina General Assembly.

The Fiscal Research memorandum prepared by Patrick McHugh and Barry Boardman eviscerated the Handfield study (emphasis in original):

The Handfield report uses a supply chain methodology that includes interviews, surveys, and payroll data from various sources. While much of the data and methodology used in this report has not been made public, the report incorrectly concludes that the Film Production Credit's net contribution to the State is positive. FRD concludes that the reported positive return on investment is based on a series of misunderstandings of the State's tax laws, invalid or overstated assumptions, and errors in accounting.

Our analysis, which corrects for the most obvious errors in the Handfield report, shows that the Film Production Credit creates a negative return on investment. The errors identified in this memo where communicated to Dr. Handfield prior to publication of the report. However, as of this date, no response has been provided. Because some of the methods used in the Handfield report have not been fully vetted, the analysis in this memorandum is preliminary. A better understanding of those methods will only allow us to fine-tune our analysis, but we would not expect our conclusion that the Film Credit does not "pay for itself" to change. In fact, a more detailed report is likely to conclude that the loss to the State is even greater than we present here.

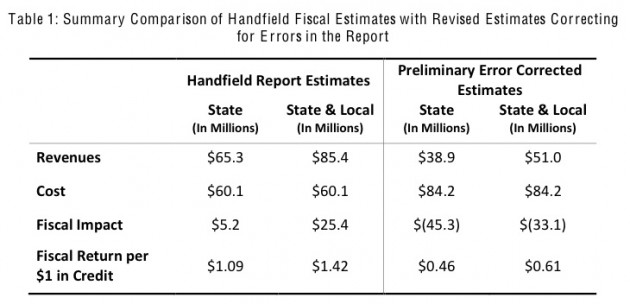

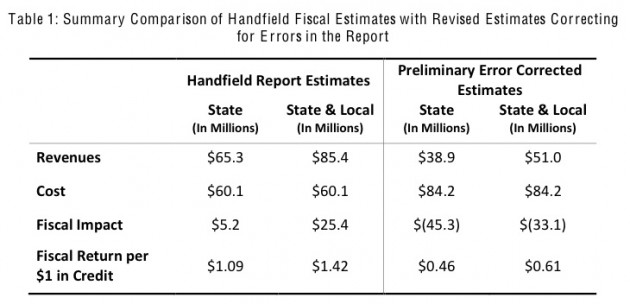

So much for rigor. McHugh and Boardman produced the following table "after adjusting for the most serious errors in the report":

They wrote:

As shown above, once the most significant errors in the Handfield report are removed, the return on investment in State revenues falls to less than 50 cents on the dollar. Even when estimated local tax revenues are included, the Film Production Credit results in a net fiscal loss. Typically, when considering the benefit of a State-level tax credit, local tax gains are not included. However, as the Handfield report includes State and local revenues, both perspectives are included here.

McHugh and Boardman discussed several errors in the report, including that it:

- "understates the cost of the Film Credit by almost $24 million"

- "overstates the amount of personal income taxes paid by film production workers"

- "overstates the sales tax revenue generated by purchases made by film productions"

- "significantly overstates the tax revenue generated when film workers spend their earnings"

They also raise questions about the report's estimation of the average salary of workers, its calculations over income and corporate taxes, and its assumptions of tourism effects.

Furthermore, because McHugh and Boardman kept "the fundamental approach used in the Handfield report," they (admittedly) made

no accounting for opportunity costs and assumed all production exists because of the tax credit. This means that the return on investment is considerably less than 46 cents on the dollar. Recall that an earlier presentation from the Commerce Dept. found a return on investment of about

19 cents on the dollar.

Such a net loss is consistent with several other states' studies of their own film tax credit programs, illustrated here:

As for objectivity, Handfield's study was an

industry study; it was

not an N.C. State study:

The report bought at $45 grand by the MPAA and regional film commissions was riddled with errors. Presumably, if the industry wanted a study that properly accounted for opportunity costs and avoided, in the words of Fiscal Research's analysis of it, "a series of misunderstandings of the State's tax laws, invalid or overstated assumptions, and errors in accounting valid assumptions," the industry would have gotten it. So it seems reasonable to assume that what the industry paid for was what they cite: the study's ready-for-distribution, incredibly over-the-top figures on return on investment and jobs involved, and maybe also the ease of saying the study was done by NC State.

Regardless, it tickled the fancies of the editors of The Fayetteville Observer and Mount Airy News, who decided to award it credibility post-mortem. It justified the state spending more money on "an awful idea" that somehow got transformed into "a smart investment" by the special effect of other states still engaging in the folly.