Stewards of the Visual Exposition

A Taxpayer Protection Act For North Carolina: Examining Misleading Claims About Colorado's TABOR Experience

Publisher's note: This post, by Brian Balfour, was originally published in the Budget & Taxes section(s) of Civitas's online edition.

NOTE: This week the NC Senate approved a Taxpayer Protection Act that would enact restraints on the annual growth rate of the state budget. Although different from Colorado's Taxpayer Bill of Rights (TABOR) in many important regards, much of the discussion over North Carolina's measure will focus on Colorado's experience with its TABOR. Given the timely nature of the issue, we are re-posting this 2011 article that thoroughly debunks the left's primary claims about Colorado's TABOR experience.

Likely North Carolina voters overwhelmingly favor a measure to restrain the growth rate of state spending. According to the April 2011 Civitas Institute poll, 67 percent of respondents support the ideas contained in HB 188 — which would limit the growth rate of the state budget to a formula based on recent changes in state population and inflation. Support for such a measure outweighs opposition by more than a 3.5 to 1 margin.[1]

Big-government advocates, special interest groups and others interested in unfettered expansion of the size and scope of North Carolina government, however, have already began to mount baseless attacks on this fiscally sensible measure. Most of the opposition to HB 188 Taxpayer Bill of Rights is based on misleading and false claims about Colorado's experience with a TABOR.

This fact sheet examines these claims and provides the truth to counter the well- coordinated but desperately misleading attacks on a measure intended to merely slow the rate of state spending growth.

Colorado's TABOR crippled their economy.

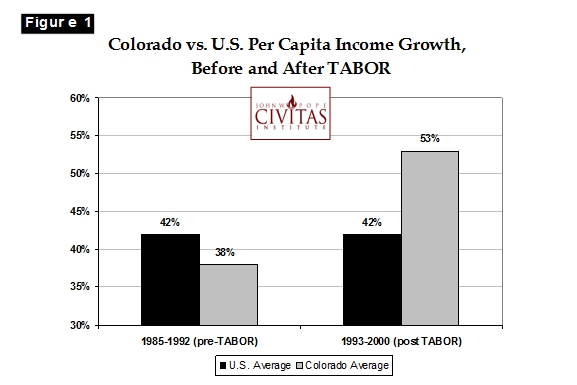

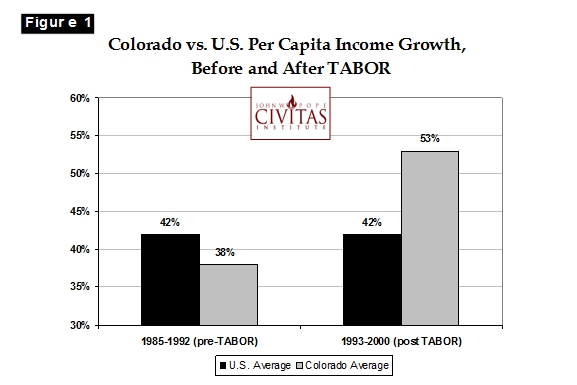

Nothing could be further from the truth. As shown in Figure 1, Colorado's per capita income growth greatly exceeded the national average after the passage of its TABOR. Prior to passage of its TABOR, however, Colorado's per capita income growth lagged the national average.[2]

Moreover, Colorado's private sector job growth rose dramatically after passage of TABOR:[3]

"TABOR's impact on Colorado's public structures led to business community leaders from across the political spectrum coming together to call for the suspension of TABOR in 2005."

"TABOR would not eliminate budget shortfalls during recessions.... By 2003, the National Conference of State Legislators ranked Colorado's budget shortfall as second-worst in the country."

"TABOR forced Colorado to continue cutting state services even as the state's economy recovered (from the early 2000's recession)."

A TABOR is a "highly restrictive formula ensur(ing) that funding for public services will be perpetually insufficient."

"Nearly two decades of TABOR weakened Colorado's public structures." These include public and higher education, health insurance and roads.

It is way beyond time for North Carolina to implement a sensible, constitutional limitation on the growth rate of state spending. North Carolina lawmakers have proven over the last several decades to be incapable of imposing any self-restraint when it comes to spending taxpayer dollars.

House Bill 188 deserves serious consideration. Opponents of sensible measures to protect taxpayers against out-of-control government growth, however, have already began reciting irresponsible and grossly misleading talking points about Colorado's experience with its Taxpayer Bill of Rights.

Colorado's legislation differed from HB 188 in several significant ways, and thus using recycled talking points from Colorado is ill-advised to begin with. But it remains important to set the record straight and learn the facts behind the misleading rhetoric in order to engage in an honest debate about HB 188.

Go Back

NOTE: This week the NC Senate approved a Taxpayer Protection Act that would enact restraints on the annual growth rate of the state budget. Although different from Colorado's Taxpayer Bill of Rights (TABOR) in many important regards, much of the discussion over North Carolina's measure will focus on Colorado's experience with its TABOR. Given the timely nature of the issue, we are re-posting this 2011 article that thoroughly debunks the left's primary claims about Colorado's TABOR experience.

Likely North Carolina voters overwhelmingly favor a measure to restrain the growth rate of state spending. According to the April 2011 Civitas Institute poll, 67 percent of respondents support the ideas contained in HB 188 — which would limit the growth rate of the state budget to a formula based on recent changes in state population and inflation. Support for such a measure outweighs opposition by more than a 3.5 to 1 margin.[1]

Big-government advocates, special interest groups and others interested in unfettered expansion of the size and scope of North Carolina government, however, have already began to mount baseless attacks on this fiscally sensible measure. Most of the opposition to HB 188 Taxpayer Bill of Rights is based on misleading and false claims about Colorado's experience with a TABOR.

This fact sheet examines these claims and provides the truth to counter the well- coordinated but desperately misleading attacks on a measure intended to merely slow the rate of state spending growth.

Claim

Colorado's TABOR crippled their economy.

Fact

Nothing could be further from the truth. As shown in Figure 1, Colorado's per capita income growth greatly exceeded the national average after the passage of its TABOR. Prior to passage of its TABOR, however, Colorado's per capita income growth lagged the national average.[2]

Moreover, Colorado's private sector job growth rose dramatically after passage of TABOR:[3]

- For the decade preceding TABOR, Colorado's private sector employment grew by 17.5 percent.

- For the decade following TABOR, Colorado's private sector rate of jobs growth more than doubled, growing at a rate of 37.7 percent.

Claim

"TABOR's impact on Colorado's public structures led to business community leaders from across the political spectrum coming together to call for the suspension of TABOR in 2005."

Fact

- This "coalition" actually — and unsurprisingly — consisted of special interest groups that benefit from government largesse. Examining the finances behind the movement to suspend TABOR in 2005 reveals[4]:

- The top contributor to this movement was public sector unions.

- Another major contributor was the Denver area Chamber of Commerce, a group seeking to benefit from greater government spending on "economic development."

- Also among top donors was the construction industry — seeking to maintain high levels of state contracts.

- Wealthy liberal philanthropists and well-funded liberal policy groups also contributed significantly.

- The $8 million spent in 2005 by special interests seeking to suspend TABOR was two and a half times the amount spent by groups opposing TABOR's suspension.[5]

- In spite of this massive spending advantage, TABOR's suspension was approved by only a 52 to 48 margin.[6]

Claim

"TABOR would not eliminate budget shortfalls during recessions.... By 2003, the National Conference of State Legislators ranked Colorado's budget shortfall as second-worst in the country."

Fact

- Like the entire nation, Colorado's revenues were impacted by the recession in the early 2000's. Colorado was hit especially hard, experiencing a 13% drop in revenue from fiscal year 2001 to 2003.[7]

- Colorado's TABOR proved to work as predicted, however, limiting the budget deficit when recession hit.

- The NCSL ranking of Colorado's 2003 budget shortfall is grossly misleading:

- The NCSL estimate was published in Nov. 2002, and used revenue projections available at that time.[8]

- The alleged "shortfall" actually only reflects terribly unrealistic revenue projections.

- Revenue estimates by Colorado's Legislative Council in March 2002 projected an 8.7% increase of year-over-year revenue for the state budget in 2003.[9]

- Colorado based the second year of their biennial budget on this unrealistically rosy revenue projection.

- Naturally, actual revenue fell far short of the inexplicitly optimistic revenue projections — the true cause of the reported budget shortfall

- Colorado's TABOR had nothing to do with this "shortfall."

- Indeed, the spending restraint imposed by TABOR prevented the actual shortfall from being much larger than it otherwise would have been by limiting the spending growth of prior budget years.

- If North Carolina had implemented HB 188 just in FY 2004, the state budget would have easily survived the recession of the last few years.

- Without any restraint, the state saw a budget deficit of roughly $2 billion in FY 2009, the first year the recession had a substantial impact on revenue.

- With HB 188 spending restraints in place, however, even the lowered level of $19.6 billion in actual revenue in 2009 would have been enough to cover budget appropriations, with more than $1 billion to spare.[10]

Claim

"TABOR forced Colorado to continue cutting state services even as the state's economy recovered (from the early 2000's recession)."

Fact

- Colorado's general fund appropriations increased by 12% from FY 2000-01 to FY 2004-05.[11]

- Similarly, North Carolina's state budget — without any spending restrictions in place — grew by 13% during that time.[12]

Claim

A TABOR is a "highly restrictive formula ensur(ing) that funding for public services will be perpetually insufficient."

Fact

- A TABOR still allows for state spending to grow, it just allows for more sensible and smoother growth patterns.

- During the first ten years under TABOR (FY 1993 to FY 2003), Colorado's general fund appropriations more than doubled — increasing by 112%.[13]

- In fact, Colorado's spending growth under this "highly restrictive formula" far outpaced North Carolina's spending growth during that time.

- North Carolina’s state budget increased by 75% from FY 1993 to FY 2003,[14] well below Colorado’s budget growth of 112%.

Claim

"Nearly two decades of TABOR weakened Colorado's public structures." These include public and higher education, health insurance and roads.

- "From 1992 to 2001, Colorado's per pupil funding in K-12 education as a share of personal income declined from 35th to 49th in the nation."

- "From 1992 to 2004, Colorado's colleges and university funding as a share of personal income declined from 35th to 48th in the nation."

- "The share of low-income children without health insurance doubled in Colorado between the passage of TABOR and its suspension in 2005."

- Funding for public health initiatives declined significantly, with Colorado falling to 48th in the nation in pregnant women's access to prenatal care and to 50th in the nation for the share of children receiving full vaccinations."

- Thanks to TABOR, Colorado faces a future of "crumbling roads and bridges."

Facts

- Measuring K-12 education spending "as a share of personal income" is designed to mislead. This is more a reflection of Colorado's personal income growing at a much faster rate than the national average in the decade following the passage of TABOR (see Figure 1).

- Actual total spending per pupil in Colorado improved from 29th in the nation in 1992-93 to 28th in the nation after 11 years of TABOR.[15]

- Colorado ranked 22nd in average teacher salary in 2003, with the highest average instructional salary of any state in the Rocky Mountain region in 2003-04.[16]

- In 2005-06, average teacher salaries in Colorado were slightly higher than in North Carolina ($44,454 to $43,940). Further, average starting salaries for teachers in Colorado far outpaced those in North Carolina ($34, 952 to $28,905).[17]

- Graduation rates have improved under TABOR. Colorado ranked second in the percentage increase in high school graduates from 1992-93 to 2002-03.[18]

- The measure of funding as a measure of personal income once again misleads on college and university support.

- As of 2005, Colorado ranked second in the nation in total higher-ed instructional staff per 10,000 population.[19]

- University tuition for residents declined steadily for the decade after 1991-92, the year before TABOR passed.[20]

- From 1992 to 2006, North Carolina's "affordability" measure (share of income needed to pay for tuition) for 4-year public university rose much more sharply than Colorado during that time (37% increase vs. 23%).[21]

- The share of low-income children without health insurance may have doubled from 1992 to 2005 as the claim indicates, but this can be attributed to a number of factors. TABOR spending restraints is not one of them. Indeed, even during the tightest budget crunch of the TABOR era, budget years 2001 to 2005, Colorado's Health Policy and Financing (home to its Medicaid program) spending still increased by a robust 24 percent — the largest increase of any major budget area.[22]

- Colorado's ranking of 50th in the nation for children's vaccinations refers to its 2002 ranking provided by the National Immunization Survey (NIS). Specifically targeting this one year is designed to mislead. The NIS itself explicitly states that their survey data, due to small sample size, is often prone to significant error and should be "interpreted with caution." In fact, when looking at other years, the 2002 measure appears to be a statistical anomaly. The 2002 rate of 67.5% stands out it stark contrast to the 2001 rate of 75.4%, 2004 rate of 77.1%, and 2005 rate of 83.4%.[23] To follow these numbers closely could also suggest that Colorado's TABOR helped increase immunization rates by nearly 20 percentage points in just three years.

- The prenatal care data-point is yet another isolated statistic cherry-picked from one specific year. The source is the United Health Foundation's 2004 state health survey. [24] For that same year, Colorado received an overall ranking of 9th healthiest state. And in spite of the alleged low access to prenatal care, Colorado also ranked 16th best for infant mortality rate, compared to North Carolina's lowly 39th ranking in 2004.

Conclusion

It is way beyond time for North Carolina to implement a sensible, constitutional limitation on the growth rate of state spending. North Carolina lawmakers have proven over the last several decades to be incapable of imposing any self-restraint when it comes to spending taxpayer dollars.

House Bill 188 deserves serious consideration. Opponents of sensible measures to protect taxpayers against out-of-control government growth, however, have already began reciting irresponsible and grossly misleading talking points about Colorado's experience with its Taxpayer Bill of Rights.

Colorado's legislation differed from HB 188 in several significant ways, and thus using recycled talking points from Colorado is ill-advised to begin with. But it remains important to set the record straight and learn the facts behind the misleading rhetoric in order to engage in an honest debate about HB 188.

[1] To see full version of question, see press release for this question at: http://www.nccivitas.org/2011/civitas-poll-nc-voters-want-taxpayer-bill-of-rights-to-limit-state-spending/

[2] U.S. Department of Commerce, Bureau of Economic Analysis, Regional Economic Accounts. Available at http://www.bea.gov/regional/spi/default.cfm?selTable=SA04&selSeries=ancillary

[3] Fred Holden, "A Decade of TABOR," Independence Institute Issue Paper # 8-2003. June 2003. Available online at: http://www.heartland.org/custom/semod_policybot/pdf/17298.pdf

[4] http://www.followthemoney.org/database/StateGlance/committee.phtml?c=1676

[5] http://www.followthemoney.org/database/StateGlance/ballot.phtml?m=272

[6] http://ballotpedia.org/wiki/index.php/Colorado_State_Spending_Act,_Referendum_C_(2005)

[7] Michael J. New and Stephen Slivinski, "Dispelling the Myths: The Truth About TABOR and Referendum C," Cato Institute, Oct. 2005. Available at: http://www.cato.org/pubs/bp/bp95.pdf

[8] http://www.pbs.org/now/politics/budgetmap.html

"Budget figures for 2003 come from the recent survey by the National Conference of State Legislatures, published in November 2002. They reflect the revenue and expenditure situation through the early months of FY 2003 - which included budget reductions already made to meet shortfalls."

[9] State of Colorado Joint Budget Committee, FY 2002-03 Appropriations Report. Available at: http://www.state.co.us/gov_dir/leg_dir/jbc/FY02-03apprept.pdf

[10] Brian Balfour, Civitas Institute, "House Bill 188 Introduces Much Needed Spending Reform." March 2011. Available online at: http://www.nccivitas.org/2011/house-bill-188-introduces-much-needed-spending-reform/

[11] Colorado Legislative Council, "Overview of the State Budget Situation," Appendix C. Available online at: http://www.colorado.gov/cs/Satellite?blobcol=urldata&blobheader=application%2Fpdf&blobkey=id&blobtable=MungoBlobs&blobwhere=1251606115881&ssbinary=true

[12] North Carolina General Assembly, Fiscal Research Division, "Fiscal and Budgetary Actions, 2009 Regular Session." Available online at: http://www.ncleg.net/FiscalResearch/highlights/highlights_pdfs/WEB_Highlights_2009_Final_FRD.pdf

[13] Colorado General Assembly, Joint Budget Committee, "2003-04 Appropriations Report" http://www.state.co.us/gov_dir/leg_dir/jbc/FY02-03apprept.pdf

[14] See Fiscal Research Division, Ibid.

[15] Linda Gorman and Ben DeGrow, "Exposing TABOR Data Games: A Second Reply to CBPP." Independence Institute. Available at: http://old.i2i.org/files/misc/CBPP2.doc

[16] See Adkins

[17] American Federation of Teachers, "2007 Teacher Salary Survey: State-by-State Fact Sheets" Available at: http://www.aft.org/yourwork/teachers/reports/salarybystate07.cfm

[18] See Adkins, Ibid.

[19] See Adkins, Ibid.

[20] University of Colorado Chancellor, "Question and Answer about the Quality for Colorado Plan" Available at: http://www.colorado.edu/chancellor/quality4colo/quality4coloQA.html

[21] Measuring Up 2006, National Center for Public Policy and Higher Education. Available at: http://measuringup.highereducation.org/reports/

[22] State of Colorado Legislative Council, "Overview of the State Budget Situation" pg. 10. Feb. 2005. Available online at: http://www.colorado.gov/cs/Satellite?blobcol=urldata&blobheader=application%2Fpdf&blobkey=id&blobtable=MungoBlobs&blobwhere=1251606115881&ssbinary=true

[23] National Immunization Survey: http://www.cdc.gov/vaccines/stats-surv/default.htm#nis

[24] http://statehealthstats.americashealthrankings.org/#/state/US/CO/2004

[2] U.S. Department of Commerce, Bureau of Economic Analysis, Regional Economic Accounts. Available at http://www.bea.gov/regional/spi/default.cfm?selTable=SA04&selSeries=ancillary

[3] Fred Holden, "A Decade of TABOR," Independence Institute Issue Paper # 8-2003. June 2003. Available online at: http://www.heartland.org/custom/semod_policybot/pdf/17298.pdf

[4] http://www.followthemoney.org/database/StateGlance/committee.phtml?c=1676

[5] http://www.followthemoney.org/database/StateGlance/ballot.phtml?m=272

[6] http://ballotpedia.org/wiki/index.php/Colorado_State_Spending_Act,_Referendum_C_(2005)

[7] Michael J. New and Stephen Slivinski, "Dispelling the Myths: The Truth About TABOR and Referendum C," Cato Institute, Oct. 2005. Available at: http://www.cato.org/pubs/bp/bp95.pdf

[8] http://www.pbs.org/now/politics/budgetmap.html

"Budget figures for 2003 come from the recent survey by the National Conference of State Legislatures, published in November 2002. They reflect the revenue and expenditure situation through the early months of FY 2003 - which included budget reductions already made to meet shortfalls."

[9] State of Colorado Joint Budget Committee, FY 2002-03 Appropriations Report. Available at: http://www.state.co.us/gov_dir/leg_dir/jbc/FY02-03apprept.pdf

[10] Brian Balfour, Civitas Institute, "House Bill 188 Introduces Much Needed Spending Reform." March 2011. Available online at: http://www.nccivitas.org/2011/house-bill-188-introduces-much-needed-spending-reform/

[11] Colorado Legislative Council, "Overview of the State Budget Situation," Appendix C. Available online at: http://www.colorado.gov/cs/Satellite?blobcol=urldata&blobheader=application%2Fpdf&blobkey=id&blobtable=

[12] North Carolina General Assembly, Fiscal Research Division, "Fiscal and Budgetary Actions, 2009 Regular Session." Available online at: http://www.ncleg.net/FiscalResearch/highlights/highlights_pdfs/WEB_Highlights_2009_Final_FRD.pdf

[13] Colorado General Assembly, Joint Budget Committee, "2003-04 Appropriations Report" http://www.state.co.us/gov_dir/leg_dir/jbc/FY02-03apprept.pdf

[14] See Fiscal Research Division, Ibid.

[15] Linda Gorman and Ben DeGrow, "Exposing TABOR Data Games: A Second Reply to CBPP." Independence Institute. Available at: http://old.i2i.org/files/misc/CBPP2.doc

[16] See Adkins

[17] American Federation of Teachers, "2007 Teacher Salary Survey: State-by-State Fact Sheets" Available at: http://www.aft.org/yourwork/teachers/reports/salarybystate07.cfm

[18] See Adkins, Ibid.

[19] See Adkins, Ibid.

[20] University of Colorado Chancellor, "Question and Answer about the Quality for Colorado Plan" Available at: http://www.colorado.edu/chancellor/quality4colo/quality4coloQA.html

[21] Measuring Up 2006, National Center for Public Policy and Higher Education. Available at: http://measuringup.highereducation.org/reports/

[22] State of Colorado Legislative Council, "Overview of the State Budget Situation" pg. 10. Feb. 2005. Available online at: http://www.colorado.gov/cs/Satellite?blobcol=urldata&blobheader=application%2Fpdf&blobkey=id&blobtable=

[23] National Immunization Survey: http://www.cdc.gov/vaccines/stats-surv/default.htm#nis

[24] http://statehealthstats.americashealthrankings.org/#/state/US/CO/2004

| Bobby Tony responds to Nuclear Nonproliferation Treaty Post | Civitas Institute, Editorials, Op-Ed & Politics | GDP Is Not Economic Growth |