Press Release:

Elizabeth City State University Posts First Enrollment Increase In Seven Years

The 2017 fall semester has seen the largest freshman class at Elizabeth City State University (ECSU) in five years, and now the overall enrollment numbers have exceeded the admissions goal. The total enrollment for ECSU's fall 2017 semester is 1,411 - and it's the first time in seven years that ECSU has seen an overall increase in enrollment. Under the leadership of Chancellor Thomas Conway - ECSU is headed in the right direction by demonstrating creative adjustments in order to improve the institution.

This fall's freshman class numbers, along with the increase in Transfer Students, combined with recent partnerships with regional community colleges such as Halifax and Roanoke Rapids Community Colleges, where local students are able to enroll into bachelor's degree programs on site and continue their education with ECSU while staying in their home communities, are important components of a foundation that is being laid for solid enrollment growth into the future.

This year's state budget appropriated an additional $4.8 million to Elizabeth City State University to stabilize enrollment. The revised net appropriation for Elizabeth City State University is $32 million in FY 2017-18. The budget also continues to lower college tuition at Elizabeth City State University, UNC Pembroke and Western Carolina University to $500 for in-state tuition per semester and $2,500 for out-of-state tuition per semester.

Additionally, Mr. Tracy L. Swain of Camden County has been reappointed by Senate Leader Phil Berger to the Elizabeth City State University Board of Trustees for a term ending on June 30, 2021.

North Carolina Education Budget

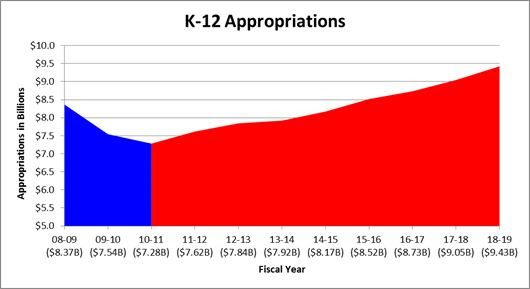

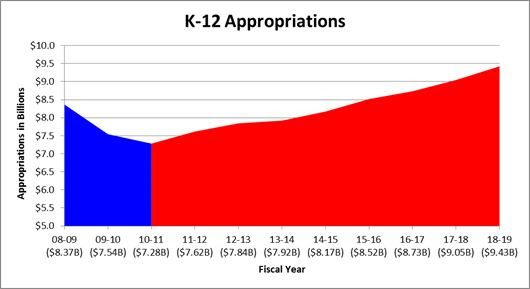

During the long session, we approved a state budget for the 2017-19 biennium that provides nearly $23 billion in general funds statewide for 2017-18 and $23.6 billion in 2018-19. Community colleges receive over $1.1 billion in each year of the biennium, with funds increasing 2.4 percent in 2017-18 and a further 1.8 percent in 2018-19. State universities receive nearly $2.9 billion in the first year of the biennium (up 1.5 percent). General funds for K-12 education through the Department of Public Instruction rise 3.6 percent in 2017-18 to $9 billion, and by 4.2 percent in 2018-19 to $9.4 billion. Funds directed to classroom instruction are up to nearly $6.8 billion in the first year of a biennium, a 3.6 percent increase.

Appropriations for K-12 education include funding to raise teacher pay by an average 10 percent over the biennium while assistant principals and principals will see average pay increases of 13 percent and 9 percent respectively. In addition, teachers with 25 or more years of experience will receive a $385 bonus in each year of the biennium, while non-certified and central office staff will receive $1,000 raises. The budget also renames the Third Grade Reading Teacher Performance Pilot Program as the Third Grade Read to Achieve Teacher Bonus Program and allocates $5 million in each year of the biennium to provide bonuses of up to $3,500 to teachers whose student growth index score for third grade reading is in the top 25 percent in the state or the top 25 percent in their school districts.

The budget provides $6 million in each year to provide grants to nonprofit organizations, working independently or with school districts, to provide high-quality, evidence-based extended learning and student support programs to improve the academic outcomes of at-risk students. The provision also requires each school district to provide at least two work-based learning opportunities related to career and technical instruction, and establishes a B-3 Interagency Council to establish a vision and accountability model for a birth through grade three system of early education.

The budget establishes the North Carolina Personal Education Savings Accounts Program, which will provide up to $9,000 per year to each participating disabled student for education and therapeutic expenses, including private school tuition. We appropriate $3.4 million for the first year of the program (2018-19), which is administered through the North Carolina State Education Assistance Authority. We reorganized the ApprenticeshipNC program - which works with employers to develop apprenticeship agreements and programs - and we established the Board of Postsecondary Education Credentials. The board will make recommendations for the development of a statewide system to link industry and businesses with educators, government and community organizations to identify needed workforce skills and training and to ensure the availability of courses of study and vocational training to meet those needs.

Grants to Fight Crime, Aid Victims

Nearly $73 million in grant funding to address issues related to the opioid crisis, human trafficking, gangs, and safer communities and schools through programs administered by the Governor's Crime Commission (GCC) were recently announced. Among the numerous grants awarded across the state, the following local entities will receive grant funding:

- Beaufort County: Pitt/Beaufort/Martin/Washington SA 2017 - REAL Crisis Intervention, Inc. - $408,328.82

- Camden County: Camden County Sheriff's Office - Portable Radio Replacement - $21,600

- Dare County: Nags Head Police Department - Digital Evidence Storage System - $24,500

- Dare County: Kitty Hawk Police Department - Communications Improvement - $24,348

- Dare County: Dare County Sheriff's Office - P and E Storage and Officer Safety - $24,280

- Hyde County: Hyde Safe Shelter - Hyde County Hotline, Inc. - $50,211

- Pasquotank County: Sexual Assault Services - Albemarle Hopeline, Inc. - $21,751

- Pasquotank County: Elizabeth City Police Department - Local Law Enforcement Block Grant - $24,498

- Northeastern North Carolina: Kids First, Inc. - Child Advocacy Center - $463,419

- Northeastern North Carolina: Albemarle Hopeline, Inc. - Services to Victims of Domestic Violence -$416,091

Additionally, Ruth's House, a Beaufort County domestic violence not-for-profit organization and the Coastal Pregnancy Center, a not-for-profit organization offering help and hope to women and men in unplanned pregnancies - both received a special budget appropriation of $100,000.

Senate Bill 628 (Various Changes to the Revenue Laws)

Senate Bill 628 - now S.L. 2017-204 makes various substantive, technical, clarifying, and administrative changes to our state's revenue laws. The bill incorporated provisions from legislation that I filed in

SB 552 (Modify Sales Tax Remittance: Boat/Jet Repairs) and

SB 230 (Exempt Vacation Linen Rentals From Sales Tax).

The exact same language from Senate Bill 552 which ultimately passed in SB 628 simplifies the collection and remittance of use tax due and payable on the repair and maintenance of a boat or aircraft. Here in North Carolina - our state has a unique brand reputation for building high-quality, custom sport fishing vessels, tested in the rough waters of the world-famous sport fishing grounds off the Outer Banks. The boat building industry in North Carolina has grown rapidly since 1990. The total economic impact of the boat building industry among our eight Atlantic coastal counties is approximate $327 million, providing nearly a combined $30 million of local, state and federal taxes.

The final language included in SB 628 pertinent to the double taxation of linens was amended compared to what was originally filed in SB 230. Brief synopsis of the issue, the N.C. Dept. of Revenue (DOR) has been asking for a tax on linens for vacation rentals to be paid twice, once by the property management companies (PMC) when they rent the linens, which is already common practice, but then again by the actual vacationers when they rent the linens from the PMC. In essence, the consumers (vacationers) are therefore being double taxed for the same linens. Thus, SB 230 would exempt vacation linen rentals from the second charge of sales tax and would have codified the statute to only charge it once.

When a family books their vacation rental in the OBX they're already paying 12.75% of taxes - 6.75% (sales tax) and 6% (occupancy tax) - and the PMC's remit a sales tax of 6.75% to DOR for linens, towels, soap and other accessories. The homeowners and business owners of the PMC's also already pay property taxes, business license fees, trash collection fees and collect the sales tax for free. However, the compromise language included in SB 628 was to delay the enactment of the double taxation until January 2018 and to reduce any potential sales tax assessments by 90%. It's not perfect - but it's a start.

Agricultural Development and Farmland Preservation Trust Fund Grant for Hyde County

On Monday, the N.C. Agricultural Development and Farmland Preservation Trust Fund (ADFPTF) recently awarded $540,611 to the Hyde County Soil and Water Conservation District to assist in purchasing a perpetual conservation easement on 210 acres of cropland. This year, our state budget provided an additional $2 million of nonrecurring to the N.C. ADFPTF. Thus, the revised net appropriation to ADFPTF is $4.6 million.

Small Business Disaster Recovery & Resiliency KIT

As we have seen recently, devastating events such as Hurricanes Harvey and Irma are becoming more frequent. The Caroline Small Business Development Fund recently released a booklet going through all of the information and procedures a business owner would need to prepare for, endure, and recover from a disaster. It also details the specific action items for hurricanes, floods, and tornados.

Click here to view the small business disaster recovery & resiliency KIT.

North Carolina Attracts Record Visitor Spending in 2016

Despite the threats from outside sources, North Carolina tourism generated record visitor spending in 2016 with a total of $22.9 billion, a 4.3 percent increase over 2015 which outpaced the national average for growth last year of only 2.3 percent. Additionally, tourism industry-supported employment topped 218,000 jobs to set another record for the state. And according to the

N.C. Beach and Inlet Management Plan (BIMP), beach tourism by itself had a direct economic impact of $1.5 billion and produced over $400 million on consumer surplus value. Also, pursuant to the

BIMP, more people visited NC beaches than all state parks, national parks and historic sites in North Carolina combined. Six times more people visited NC for the beaches than for golf. Thus, this year in our state budget, we designated an additional $2.5 million over the biennium to the Economic Development Partnership of North Carolina (EDPNC) for tourism advertising and marketing. These funds are restricted to a research-based comprehensive marketing program directed toward consumers in key markets most likely to travel to North Carolina and shall not be used for ancillary activities, such as statewide branding and business development marketing. Below is a travel and tourism impact analysis of the eight counties that I represent comparing 2016 to 2015.

- Contact: Bill Cook

- bill.cook@ncleg.net