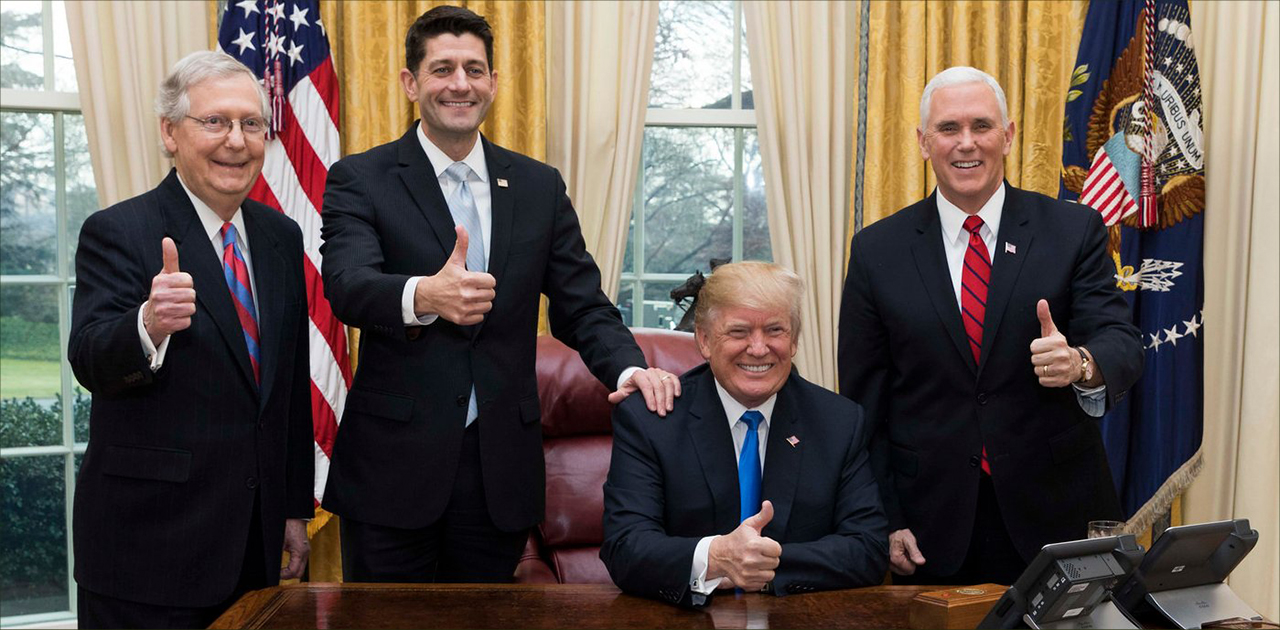

President Donald Trump Signs Tax Cuts and Jobs Act | Eastern North Carolina Now

The Tax Cuts Act provides $5.5 trillion in tax cuts, $3.2 trillion, or nearly 60 percent, of which go to families

| President Donald J. Trump Announces New National Security Strategy | News Services, Government, State and Federal | White House Statements on Saudi Arabia and Yemen for December 20-21, 2017 |

|

"Robert F. Kennedy Jr. is a foolish man, full of foolish and vapid ideas," former Governor Chris Christie complained.

Published: Monday, September 15th, 2025 @ 10:18 pm

By: Daily Wire

|

|

If a white person commits a crime against a black person, it is a national news story.

Published: Monday, September 15th, 2025 @ 5:21 pm

By: Daily Wire

|

|

"This highly provocative move was designed to interfere with our counter narco-terror operations."

Published: Sunday, September 14th, 2025 @ 5:43 pm

By: Daily Wire

|

|

Charlie Kirk, 31 years of age, who was renowned as one of the most important and influential college speakers /Leaders in many decades; founder of Turning Point USA, has been shot dead at Utah Valley University.

Published: Sunday, September 14th, 2025 @ 5:42 pm

By: Stan Deatherage

|

|

The Trump administration took actions against Harvard related to the anti-Israel protests that roiled its campus.

Published: Sunday, September 14th, 2025 @ 5:33 pm

By: Daily Wire

|

|

ďThis could happen to any American man or woman [who] goes to Heathrow."

Published: Sunday, September 14th, 2025 @ 5:31 pm

By: Daily Wire

|

|

"Up from 0.91% in 2023 and double the rate in 2020"

Published: Thursday, September 11th, 2025 @ 9:59 pm

By: Daily Wire

|

|

In addition, Sheikha Al-Thani has "taken to promoting Mamdaniís mayoral candidacy on social media, boosting news of favorable polling on Instagram"

Published: Tuesday, September 9th, 2025 @ 10:58 pm

By: Daily Wire

|

|

Raleigh, N.C. ó The State Board of Elections has reached a legal settlement with the United States Department of Justice in United States of America v. North Carolina State Board of Elections.

Published: Tuesday, September 9th, 2025 @ 1:45 pm

By: Eastern NC NOW Staff

|