The Board of Commissioners will hold their required public hearing on the budget Monday (6-7-12) night.

We are now at that time of the year when your elected county commissioners will decide how much of your money they will take using the police power of the State. Counties are political subdivisions of the State of North Carolina. The State has empowered the county to run the local government and take the money from you in the form of sales and property taxes. If you don't pay your property taxes they can confiscate your property and sell it. Yes, that is correct, county commissioners can sell your property if you refuse to pay your taxes. Many county commissioners start to twist in their seats when some of us talk about this police power, They do not want to see themselves as the local representative of the sovereign (just say king), but that is the way it is. Some actually see themselves as doing good when they vote to take your hard earned money and give it to others.

But consider the arrogance of such an act. The Gang of Five sit at a table and decide which special interests will get your money. How can they justify deciding this for each of us? If a special interest, no matter how worthy of support, needs money then we should leave it up to each of us to decide what we will give them. But we've got elected officials who think they know better how our money should be doled out.

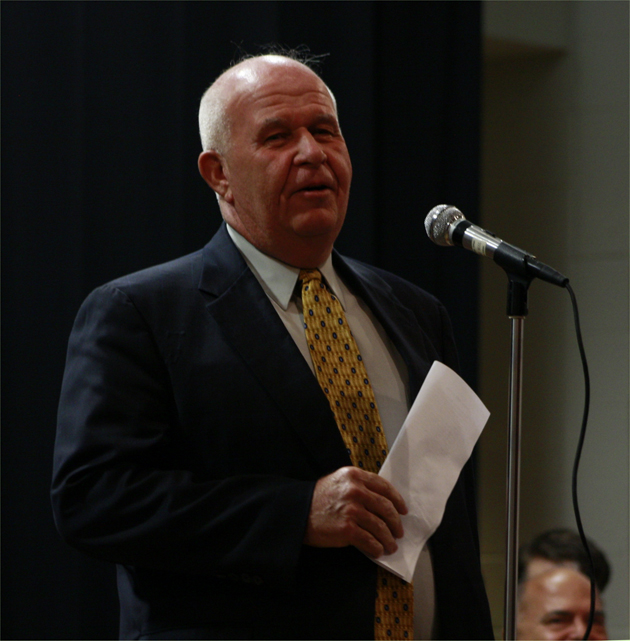

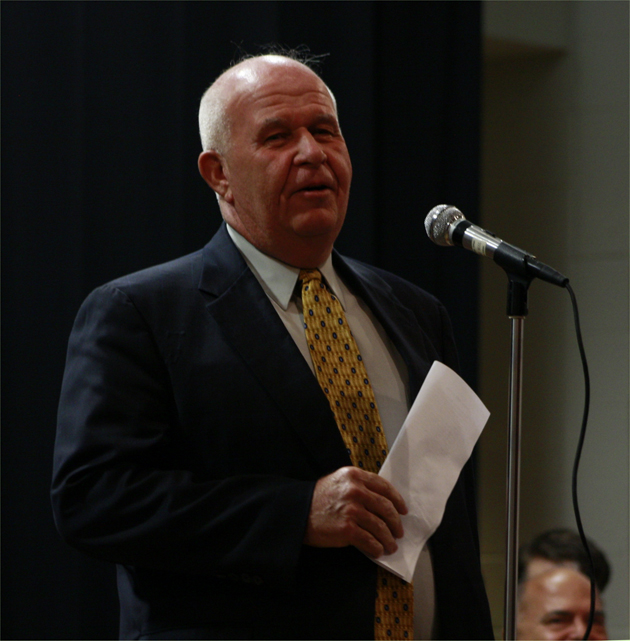

Beaufort County Commissioner Hood Richardson speaking to many of his constituents at the Candidates Forum, help on April 2, 2012 at Beaufort CountyCommunity College: Above. photo by Stan Deatherage

Beaufort County Commissioner Hood Richardson speaking to many of his constituents at the Candidates Forum, help on April 2, 2012 at Beaufort CountyCommunity College: Above. photo by Stan Deatherage

The single most important thing County Commissioners do is to decide the amount of money to be spent each year and what the money will be spent on (and those are really two separate decisions). The simple explanation for how the tax rate is set is that once they decide how much they will spend the number crunchers just determine mathematically what the rate have to be to raise the amount of money they have decided to spend. It is the spending that determines the tax rate and therefore the amount of tax you will pay. The then just send out the tax bills to the property owners of the County. If Commissioners do not spend money, the public does not have higher taxes to pay.. The tax rate for the year is required to be set by July 1 of each year.

Things are pretty simple up to this point. Deciding what the public needs are can be broken down into two broad categories. There are certain prescribed services, such as protection of the public from criminals, paying for elections, public health, education etc.. The other category is everything that any person or interest group can convince the majority of the board commissioners to appropriate money for. Admittedly, there are some gray areas such as welfare, animal control, and emergency management. There are many more areas such as sports, the arts, building inspections, economic development, child support enforcement, solid waste, veterans services etc. that are not necessary to provide for the mandated general welfare of the public. Some would argue that these are just as important as law enforcement. Many of these border line services can be provided by private companies. In other instances, such a utilities (water), the users should pay for the service they receive and therefore the user decides how much of a service they will consume.

The budget should be built by first deciding which services or functions are necessary and which are discretionary. Then, in each category we should decide the minimum basic level of service that is necessary, mandated or sufficient and how much it costs to provide the basic level of service. Then we decide how much we are willing to pay to go beyond the basic level of service and what we get for the additional expenditure beyond the basic. In other words: "What will we get in addition to the minimum for the extra amount of spending?" Finally, we then do the same thing with the discretionary services, such as providing donations to special interest groups, economic development etc. That is not to say that all discretionary spending is not good. But whether a service is good or not is not the issue. The issue is whether the County should be providing that service and again, what do we get for the expenditure? But the reality is, we don't do it that way. We use the continuation approach. That is: "how much did we spend last year (in each line item) and how much more are we going to spend next year?"

Very few counties prepare a "zero based budget." This budget begins at zero and examines every expenditure in every department adding justified expenditures line item by line item. This kind of budget requires a lot of work by Commissioners. Almost every county budget in North Carolina is prepared by making adjustments to last years budget. Both revenues and expenses are examined for change during the coming year and simply inked in. This kind of budget can lead to surprises when an alert citizen asks why we are still buying buggy whips. Things go real fast with the annually adjusted budget. And for the most part no one is the wiser about inefficiencies.

Now is the time of the year to start bending your commissioner's ear about what you want or do not want to pay for. Notice that people who own real estate and personal property and buy goods pay the taxes for running county governments. Even those who rent pay real estate taxes in their rent. It is easy for any citizen or special interest group to decide they want the tax payer to pay for their special interest item. Currently there are dozens of special interest items in county budget. Because of this, property and sales taxes are now burdensome. Added to the cost of government is the special interest taxes that some people desire limousine service when walking will do just as well.and tax rates can become oppressive. One test that quickly determines whether an expenditure is special or for the general welfare is whether of not the service will be used by all or just a few. Those services that apply to only a few are not mandated in the Constitution of the United States or the State of North Carolina. But to paraphrase Everett Dirksen: "a little here, and a little there, pretty soon you're talking big money."

Now is the time to contact all of your county commissioners and let them know you expect lower spending. The special interests call them to demand more spending. Do not sit this one out. A friendly call will be very effective.