Publisher's Note: This memorandum, from Rebecca Troutman of the NCACC, is such a concise explanation of the position of the North Carolina Association of County Commissioners on how they see the entire North Carolina fiscal budget, in its final ratification by the General Assembly, that I felt compelled to publish it. There really is some good information here.

News Release From: Rebecca Troutman, Intergovernmental Relations Director - North Carolina Association of County Commissioners (NCACC)

Memorandum To: County Managers, Finance Officers, Budget Directors

Subject: County Analysis of Adopted 2012-13 State Budget, H950, Modify 2011 Appropriations Act

State budget maintains lottery funding at $100M, makes changes to State-County Special Assistance Program, appropriates more funding to expand community and state psych beds.

The Senate and House completed work on the 2012-13 state budget on Thursday, June 21, by adopting the joint conference report that makes changes to the second year of the state's biennial budget. All signs point to the 2012 Short Session adjourning no later than 10 days thereafter, awaiting a possible gubernatorial veto with a responding override by July 1.

With two very different proposals going into conference, the conference report to H950 (Modify 2011 Appropriations Act) reflects components from both the House and Senate. Recommending $20.2 billion in general fund expenditures, or roughly $230 million higher than the 2012-13 certified budget, the conference budget relies on 2011-12 over-collections, special fund balances and agency reversions to increase spending and sets aside $146 million for rainy day and repairs and renovations.

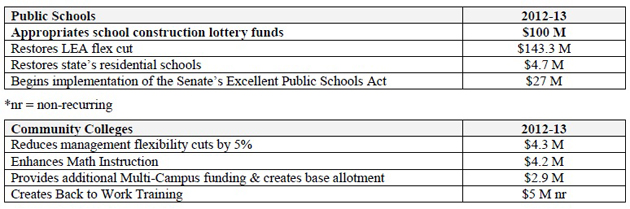

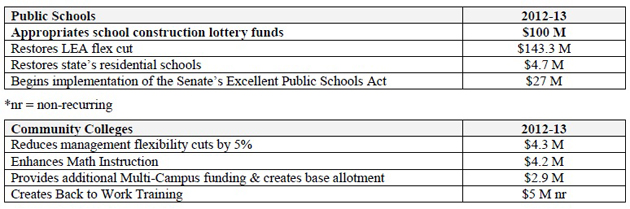

County lottery funds remain at $100 million for 2012-13 and continue to be allocated on a per pupil basis (Section 5.3). No special provision was included to alter the statutory allocation of excess lottery dollars for 2012-13; per statute, if lottery receipts exceed the appropriations ($441.4 million for 2012-13), 50 percent is directed to school construction and 50 percent is directed to higher ed scholarships.

While the $100 million is less than the 40 percent statutory set aside of net lottery receipts for school construction, this appropriations "floor" of school construction lottery dollars is very much needed to cover the required debt service commitments for public school capital projects. The Association has attempted to get counties the full share of the lottery funds due counties for school construction throughout the 2011-13 biennium. However, House and Senate appropriations chairs have stated consistently that given the status of the state's budget, full funding for 2012-13 would not be possible. Legislators promised to keep school construction dollars at the $100 million level and guaranteed to not shift operational costs for education to the counties. Legislators have kept these commitments.

An additional $143.2 million was made available to k-12, with $16.4 coming from budgeted lottery revenues in excess of 2011-12 appropriations. The budget also sets aside $85 million for a 1.2 percent salary increase for state-funded public school employees. An earlier Senate proposal to allow LEAs the flexibility to use these funds for compensation other than salary increases was not included.

With regards to post-secondary educational funding, the budget eliminates the additional flexibility cuts budgeted for next year for the universities and restores 5 percent of the community college flexibility cut. The budget includes $5 million for the "NC Back to Work Program" to retrain long-term unemployed via the community college system (Section 8.10A).

State employees would receive a 1.2 percent salary increase, and universities and community colleges may use their salary increase dollars to offset flexibility cuts or for other compensation initiatives. State retirees would receive a 1 percent COLA. All new university employees could choose the optional retirement program, which is akin to a defined contribution retirement option (Section 25.12).

Many state agencies are subject to the 2 percent management flexibility reduction in order to "pay for unbudgeted overpayments, penalties, and unachieved reductions in the Medicaid program."

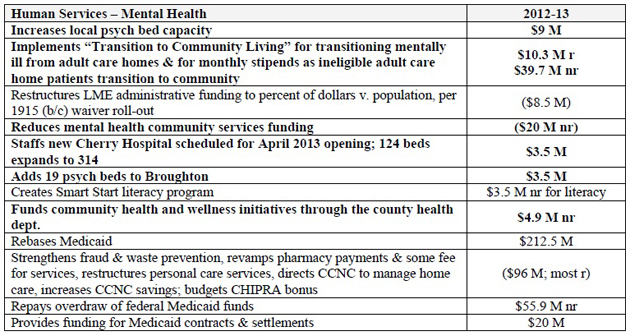

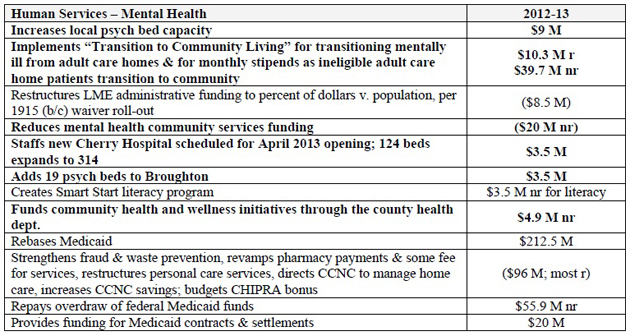

The budget appropriates an additional $9 million for greater investment in local in-patient psych beds and adds additional slots to the state's psychiatric hospitals. A non-recurring cut of $20 million in community mental health is budgeted.

To manage the expected loss of adult-care home placements, the budget does require significant changes in the State/County Special Assistance program as proposed in the initial Senate budget recommendation (Section 10.23). All counties would be required to participate in the in-home SA program (was voluntary with nine counties choosing not to participate). Counties with SA in-home slots without participants in those slots would be required to fill all slots; those with filled slots would be required to maintain the number of filled slots at that level. Counties would be required to appropriate SA funds at 2011-12 levels, to fund adult-care placement, in-home costs, and rental assistance. SA in-home payments would be equalized with adult-care home payments (now at 75 percent). These changes to the SA in-home program largely occur on Feb. 15, 2013. NCACC has been assured that changes in the SA program will not result in increased county SA payment costs.

The budget includes the House's recommendations, in part, to require that non-emergency Medicaid transportation be considered for a statewide brokering system. Prior to issuing an RFP, NC-DHHS must conduct an analysis of the impacts of adopting a statewide system. Included in the analysis is an assessment of the current coordination of human services transportation systems and how a broker system might impact transit system funding and operations (Section 10.7).

NCACC Intergovernmental Relations Director Rebecca Troutman explains to the North Carolina Caucus at the 2012 Legislative Caucus at the NACo legislation that will effect counties: Above. photo by Stan Deatherage

NCACC Intergovernmental Relations Director Rebecca Troutman explains to the North Carolina Caucus at the 2012 Legislative Caucus at the NACo legislation that will effect counties: Above. photo by Stan Deatherage

The budget does not fund eugenics compensation, nor does it include the State Board of Elections HAVA funds. The state budget does not continue redirecting the grants funds for scrap tire and white goods to the general fund, leaving these additional dollars available to offset county cost overruns.

The following highlights those expansion and reduction items of interest to counties. Direct county impacts are set out in bold text.

Education

As noted earlier, the budget restores $143.3 million of the $503 million in school discretionary funding cuts enacted over the past two biennia. Budgeted student enrollment growth is lowered by about 2100 students to 1,492,793. Geographically isolated schools would continue to receive one-half of the special allotment for the fiscal year following school closure to assist in student transition (Section 7.16).

The adopted budget begins implementation of some of the Senate's "Excellent Public Schools Act" components, with $27 million made available for the first year (Section 7A). Included is a concentrated reading and literacy program to ensure students read at or above grade level by the end of third grade. Kindergarten students will receive a developmental screening test to assess literacy and math skills, and children through grade three will be assessed in reading proficiency.

The State Board of Education must require that a student be retained in the third grade if that student does not demonstrate reading proficiency, with some exemptions. Prior to being retained, students will be enrolled in a summer reading camp to bring that student to proficiency. Schools must publish annually required statistics on reading proficiency and students being retained. Likewise, each school must publish newly required grades of A-F for school performance in its annual report card. The act also establishes the North Carolina Teacher Corps (in lieu of restoring the Teaching Fellows Program) to recruit and place recent college graduates or mid-career professionals in high needs public schools after they attend an intensive summer training institute. Each local board of education may develop a performance pay plan. The budget does not include the initial proposals to change teacher tenure.

After several years of rapid enrollment growth, community colleges are expected to need less funding to support their student population. The budget largely adopts the House's proposals for community college funding, including the five percent reduction in management flexibility cuts and the creation of the "Back to Work" program for the long-term unemployed.

The budget restores the university management flexibility cut for 2012-13 and largely accepts the Senate's proposals for university funding. It rejects the House's proposal to eliminate the state subsidy to UNC hospitals and the House's plans to eliminate in-state tuition for out-of-state students who have full academic scholarships. The budget restores partial state funding for the public television system on a recurring basis.

Human Services

Human Services

As noted above, the budget includes $9 million in additional funding for expanded community in-patient psych beds, and more dollars to expand Broughton and Cherry Hospitals. It does cut community mental health by $20 million on a non-recurring basis. The budget includes the House's proposal to direct the Joint Legislative Oversight Committee on Health and Human Services to appoint a subcommittee to examine the state's delivery of mental health services, including an assessment of the state's reforms, its capacity for community-based supports, and appropriate psych hospital catchment areas (Section 10.11).

To prevent a further Medicaid deficit, the budget rebases Medicaid to include $212.5 million more in state funds, with an additional $43 million above the Senate and House proposals. Special provisions direct the State Auditor to conduct a performance audit of the Division of Medical Assistance (Section 10.9A) and the General Assembly's Program Evaluation and Fiscal Research Divisions to jointly study the feasibility of creating a separate Medicaid department (Section 10.9B). The budget adopts the House's plans for DHHS to initiate a Medicaid smart card pilot (Section 10.9).

The adopted budget includes the "Transitions to Community Living Fund" to address two issues requiring a federal plan of corrective action - Medicaid personal care services and mentally ill in adult-care homes. The budget creates a blue ribbon commission on transitions to community living and sets aside a $50 million reserve fund to implement the commission's recommendations. A county representative will be appointed to serve on the commission. DHHS can use $39.7 million to temporarily backfill the loss of personal care dollars for adult-care home placements (Section 10.23A).

The budget changes the personal care services eligibility criteria in order to correct federal perceptions of institutional bias. All in-home and adult-care home PCS recipients must demonstrate the need for three activities of daily living or two with extensive assistance (Section 10.9F). It is thought that a number of current residents of adult-care homes receiving PCS services will not meet these qualifications. The 1915 I waiver would move forward for special care and memory units alone (Section 10.9E). The budget partially accepts the House's proposal to eliminate the 15 percent caseload restriction on in-home state/county special assistance slots by allowing NC-DHHS to waive the limitation. As noted above, substantial changes would be implemented in the in-home State/County Special Assistance program, with a delayed Feb. 15, 2013, implementation date.

County DSS departments will be required to include on childcare eligibility forms whether the family is receiving either NC Pre-K or Head Start (Section 10.2). Local Smart Start partnership cash-matching requirements will increase from 7 to 10 percent. The budget includes the House's "Read NC" early literacy initiative of $3.5 million within the Smart Start program and allocates some of these funds to rural partnerships (Section 10.4). The budget includes some of the House's proposals for additional funds for county health departments for wellness initiatives and inserts a non-supplant clause to ensure expanded funds (Section 10.14).

Many of these new funding streams, including the psych bed expansions, cannot be allocated prior to Jan. 1, 2013, and only after OSBM can certify that Medicaid funding is adequate. The budget does direct DHHS to use 2011-12 data sources and methodology for calculating county childcare subsidy allocations (Section 10.2A). Use of annual census survey information in lieu of 2000 census data had significantly changed county

allocations.

Also as noted above, the budget modifies the House's proposal to require NC-DHHS to develop and issue an RFP for managing nonemergency Medicaid transportation by calling for a feasibility study prior to RFP implementation. A proposal offered by NC-DHHS last summer to move forward with a statewide broker of these services was met with resistance by county transportation programs, driven by concerns of removing the Medicaid funding stream from the broader county human services transportation network.

The budget redirects state family planning dollars to local health departments, which are prohibited from using these funds for outside contracts (Section 10.12). The budget maximizes the decreasing federal block grants for county programs and services and funds the Work First electing counties' program.

Justice and Public Safety

Justice and Public Safety

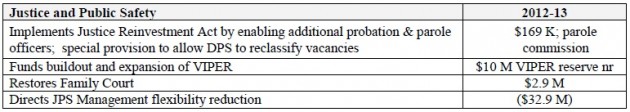

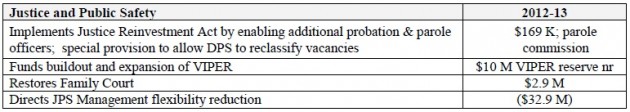

While the budget does not increase probation officer spending to manage increased caseloads for community supervision stemming from the Justice Reinvestment Act, it does authorize the Department of Public Safety to reclassify vacant positions to meet increased workload needs (Section 14.2A). The Parole Commission is expanded to handle its increased workload as a result of JRA. As a part of the 2 percent management flexibility reduction overall, DPS is cut $26.3 million.

The budget uses $5 million from the Statewide Misdemeanant Confinement Fund to offset one-time costs of the Treatment for Effective Community Supervision Program (the successor of CJPP). The budget adopts the House's proposal to direct Public Safety to study the feasibility of creating a technical violation center to house probationers serving 90 days for technical violations (Section 14.3). The budget also directs AoC to study magistrate schedules (Section 16.1).

The budget establishes a Human Trafficking Commission (Section 15.3). To spur construction of new VIPER towers and to migrate to P25 technology, the budget creates a $10 million VIPER reserve, with a corresponding special provision to limit state resources for VIPER to this amount (Section 6.3).

Natural and Economic Resources

Natural and Economic Resources

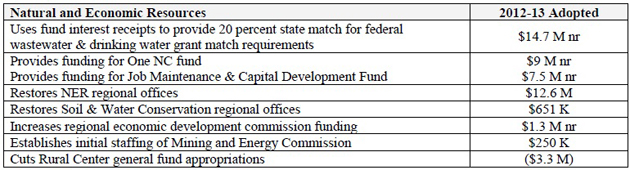

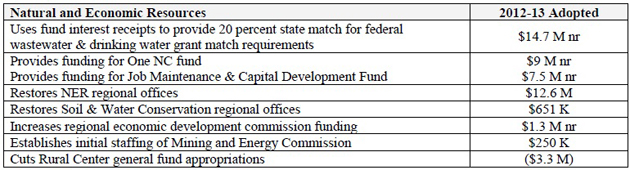

The budgets includes three new positions to staff the Mining and Energy Commission, to staff the fossil fuel oversight body; a special provision enables DENR to reclassify vacancies to support this effort (Section 12.1).

The budget moves the geodetic survey section from DENR to the Department of Public Safety's Division of Emergency Management. It makes the Clean Water Management Trust Fund monies non-recurring and reduces funding by $500,000.

The budget adopts the House's special revenue fund to capture Agriculture research station receipts for station improvements (Section 11.4). It instructs DENR to expand and centralize its oversight of its regional offices (Section 12.2).

The One NC Fund is restructured and becomes a cash flow reserve, such that annual appropriations are to cover anticipated cash requirements. Excess prior appropriations are directed at general fund expenses. The Legislative Research Commission is authorized to study the funding and member county alignment of regional economic development commissions to determine whether member needs are being met and need for service improvement (Section 13.15).

General Government and Transportation

General Government and Transportation

The budget does not include SBOE funds to draw down federal HAVA funds. A special provision prohibits counties and the SBOE from entering into vendor contracts for software license and maintenance agreements unless the vendor agrees to operate a training program for county personnel to become certified technicians and honors existing warranties if qualified county personnel maintain the voting system. No state funds may be used for these contracts (Section 23.3). Cultural Resources is directed to develop a five-year plan for certain historic sites (Section 18.3).

The budget does not restore the recurring reductions to the Volunteer Safety Workers' Compensation Fund, but does direct the Department of Insurance to review this fund for self-sufficiency, claims trends and premiumlevel recommendations (Section 20.4). DoI is also directed to study the fire protection grant fund to determine whether its compensation reflects local fire protection costs (Section 20.1).

The budget caps the gas tax at 37.5 cents for one year. Ferry tolls are not delayed, but those routes exempted last year would continue their exemption. The Cherry Branch/Minnesott Beach Ferry toll increase would not be effective until after 2012-13 (Section 24.18). The budget directs DoT to prioritize paving unpaved roads (Section 24.15) and subjects MPOs and RPOs to the State Ethics Act (Section 24.16). The budget appropriates personnel funding to complete the combined vehicle property tax collections with vehicle registration system and includes a special provision to direct the NC-DoT and NC-DoR to report by May 1, 2013, on the recurring system costs upon implementation and the fees needed to support these administrative costs (Section 24.10). Finally, the budget directs DoT to study the economic impacts of tolling I-95 and prohibits such tolling until July 1, 2014 (Section 24.21).