Boldly Committed to Truth Telling in the False Face of Fakery

Don't Forget About the Other Taxes in Obamacare

Publisher's note: This post, by Brian Balfour, was originally published in the Budget & Taxes, Healthcare section of Civitas's online edition.

The big debate about whether Obamacare imposes a "penalty" or a "tax" for not buying health insurance shouldn't blind us to a much more expensive problem: the half-a-trillion dollars Americans will be paying with 19 new or higher taxes in the health care takeover.

Much was made about last month's U.S. Supreme Court decision declaring Obamacare to be constitutional, under the guise that the penalty for those not purchasing health insurance is a "tax."

According to Chief Justice John Roberts in the majority opinion, "Such legislation is within Congress's power to tax," adding, "The federal government does not have the power to order people to buy health insurance. ... The federal government does have the power to impose a tax on those without health insurance."

Estimates based on a projected share of individuals and employers choosing to pay the tax suggest the total amount collected will be roughly $65 billion in the first ten years of its implementation.

But add in the other new or higher taxes included in the health care overhaul, and total new taxes are estimated to exceed $500 billion over the next decade.

If you haven't already done so, click here to sign Civitas' petition to Repeal Obamacare Now!

Americans for Tax Reform has the details on the new taxes, based on estimates in the most recent Congressional Budget Office report. Below is a listing of the new taxes taken from the ATR website, arranged by estimated amount over the next ten years, along with its effective date:

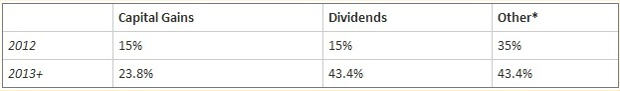

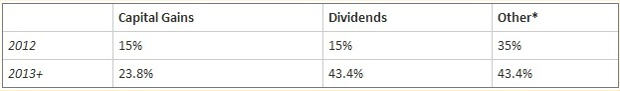

$123 Billion: Surtax on Investment Income (Takes effect Jan. 2013): A new, 3.8 percent surtax on investment income earned in households making at least $250,000 ($200,000 single). The tax applies to gains realized on investments including stocks, bonds, dividends, and the sale of your home or business. This would result in the following top tax rates on investment income:

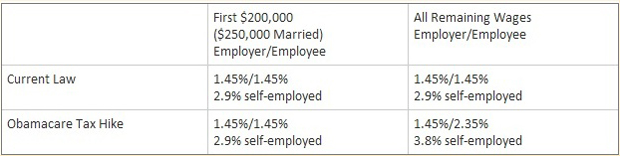

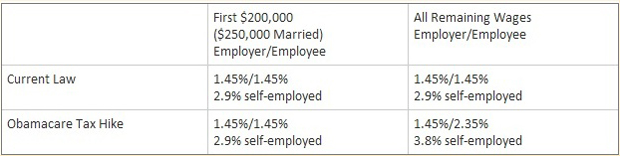

$86 Billion: Hike in Medicare Payroll Tax (Takes effect Jan. 2013): Current law and changes:

$65 Billion: Individual Mandate Excise Tax and Employer Mandate Tax (Both taxes take effect Jan. 2014):

Individual: Anyone not buying "qualifying" health insurance as defined by Obama-appointed HHS bureaucrats must pay an income surtax according to the higher of the following

Exemptions for religious objectors, undocumented immigrants, prisoners, those earning less than the poverty line, members of Indian tribes, and hardship cases (determined by HHS). Bill: PPACA; Page: 317-337

Employer: If an employer does not offer health coverage, and at least one employee qualifies for a health tax credit, the employer must pay an additional non-deductible tax of $2,000 for all full-time employees. Applies to all employers with 50 or more employees. If any employee actually receives coverage through the exchange, the penalty on the employer for that employee rises to $3,000. If the employer requires a waiting period to enroll in coverage of 30-60 days, there is a $400 tax per employee ($600 if the period is 60 days or longer). Bill: PPACA; Page: 345-346

(Combined score of individual and employer mandate tax penalty: $65 billion)

$60.1 Billion: Tax on Health Insurers (Takes effect Jan. 2014): Annual tax on the industry imposed relative to health insurance premiums collected that year. Phases in gradually until 2018. Fully-imposed on firms with $50 million in profits.

$32 Billion: Excise Tax on Comprehensive Health Insurance Plans (Takes effect Jan. 2018): Starting in 2018, new 40 percent excise tax on "Cadillac" health insurance plans ($10,200 single/$27,500 family). Higher threshold ($11,500 single/$29,450 family) for early retirees and high-risk professions. CPI +1 percentage point indexed.

$23.6 Billion: "Black liquor" tax hike (Took effect in 2010) This is a tax increase on a type of bio-fuel.

$22.2 Billion: Tax on Innovator Drug Companies (Took effect in 2010): $2.3 billion annual tax on the industry imposed relative to share of sales made that year.

$20 Billion: Tax on Medical Device Manufacturers (Takes effect Jan. 2013): Medical device manufacturers employ 360,000 people in 6,000 plants across the country. This law imposes a new 2.3% excise tax. Exempts items retailing for <$100.

$15.2 Billion: High Medical Bills Tax (Takes effect Jan 1. 2013): Currently, those facing high medical expenses are allowed a deduction for medical expenses to the extent that those expenses exceed 7.5 percent of adjusted gross income (AGI). The new provision imposes a threshold of 10 percent of AGI, meaning the government will take more. Waived for age 65+ taxpayers in 2013-2016 only.

$13.2 Billion: Flexible Spending Account Cap - aka "Special Needs Kids Tax" (Takes effect Jan. 2013): Imposes cap on FSAs of $2,500 (now unlimited). Indexed to inflation after 2013. There is one group of FSA owners for whom this new cap will be particularly cruel and onerous: parents of special needs children. There are thousands of families with special needs children in the United States, and many of them use FSAs to pay for special needs education. Tuition rates at one leading school that teaches special needs children in Washington, D.C. (National Child Research Center) can easily exceed $14,000 per year. Under current tax rules, FSA dollars can be used to pay for this type of special needs education, so many families with such children will be especially hard hit when the rules change.

$5 Billion: Medicine Cabinet Tax (Took effect Jan. 2011): Americans no longer able to use health savings account (HSA), flexible spending account (FSA), or health reimbursement (HRA) pre-tax dollars to purchase non-prescription, over-the-counter medicines (except insulin).

$4.5 Billion: Elimination of tax deduction for employer-provided retirement Rx drug coverage in coordination with Medicare Part D (Takes effect Jan. 2013)

$4.5 Billion: Codification of the "economic substance doctrine" (Took effect in 2010): This provision allows the IRS to disallow completely-legal tax deductions and other legal tax-minimizing plans just because the IRS deems that the action lacks "substance" and is merely intended to reduce taxes owed.

$2.7 Billion: Tax on Indoor Tanning Services (Took effect July 1, 2010): New 10 percent excise tax on Americans using indoor tanning salons.

$1.4 Billion: HSA Withdrawal Tax Hike (Took effect Jan. 2011): Increases additional tax on non-medical early withdrawals from an HSA from 10 to 20 percent, disadvantaging them relative to IRAs and other tax-advantaged accounts, which remain at 10 percent.

$0.6 Billion: $500,000 Annual Executive Compensation Limit for Health Insurance Executives (Takes effect Jan. 2013)

$0.4 Billion: Blue Cross/Blue Shield Tax Hike (Took effect in 2010): The special tax deduction in current law for Blue Cross/Blue Shield companies would only be allowed if 85 percent or more of premium revenues are spent on clinical services.

$ Negligible: Excise Tax on Charitable Hospitals (Took effect in 2010): $50,000 per hospital if they fail to meet new "community health assessment needs," "financial assistance," and "billing and collection" rules set by HHS.

$ Negligible: Employer Reporting of Insurance on W-2 (Took effect in Jan. 2012): Preamble to taxing health benefits on individual tax returns.

Go Back

The big debate about whether Obamacare imposes a "penalty" or a "tax" for not buying health insurance shouldn't blind us to a much more expensive problem: the half-a-trillion dollars Americans will be paying with 19 new or higher taxes in the health care takeover.

Much was made about last month's U.S. Supreme Court decision declaring Obamacare to be constitutional, under the guise that the penalty for those not purchasing health insurance is a "tax."

According to Chief Justice John Roberts in the majority opinion, "Such legislation is within Congress's power to tax," adding, "The federal government does not have the power to order people to buy health insurance. ... The federal government does have the power to impose a tax on those without health insurance."

Estimates based on a projected share of individuals and employers choosing to pay the tax suggest the total amount collected will be roughly $65 billion in the first ten years of its implementation.

But add in the other new or higher taxes included in the health care overhaul, and total new taxes are estimated to exceed $500 billion over the next decade.

If you haven't already done so, click here to sign Civitas' petition to Repeal Obamacare Now!

Americans for Tax Reform has the details on the new taxes, based on estimates in the most recent Congressional Budget Office report. Below is a listing of the new taxes taken from the ATR website, arranged by estimated amount over the next ten years, along with its effective date:

$123 Billion: Surtax on Investment Income (Takes effect Jan. 2013): A new, 3.8 percent surtax on investment income earned in households making at least $250,000 ($200,000 single). The tax applies to gains realized on investments including stocks, bonds, dividends, and the sale of your home or business. This would result in the following top tax rates on investment income:

$86 Billion: Hike in Medicare Payroll Tax (Takes effect Jan. 2013): Current law and changes:

$65 Billion: Individual Mandate Excise Tax and Employer Mandate Tax (Both taxes take effect Jan. 2014):

Individual: Anyone not buying "qualifying" health insurance as defined by Obama-appointed HHS bureaucrats must pay an income surtax according to the higher of the following

Exemptions for religious objectors, undocumented immigrants, prisoners, those earning less than the poverty line, members of Indian tribes, and hardship cases (determined by HHS). Bill: PPACA; Page: 317-337

Employer: If an employer does not offer health coverage, and at least one employee qualifies for a health tax credit, the employer must pay an additional non-deductible tax of $2,000 for all full-time employees. Applies to all employers with 50 or more employees. If any employee actually receives coverage through the exchange, the penalty on the employer for that employee rises to $3,000. If the employer requires a waiting period to enroll in coverage of 30-60 days, there is a $400 tax per employee ($600 if the period is 60 days or longer). Bill: PPACA; Page: 345-346

$60.1 Billion: Tax on Health Insurers (Takes effect Jan. 2014): Annual tax on the industry imposed relative to health insurance premiums collected that year. Phases in gradually until 2018. Fully-imposed on firms with $50 million in profits.

$32 Billion: Excise Tax on Comprehensive Health Insurance Plans (Takes effect Jan. 2018): Starting in 2018, new 40 percent excise tax on "Cadillac" health insurance plans ($10,200 single/$27,500 family). Higher threshold ($11,500 single/$29,450 family) for early retirees and high-risk professions. CPI +1 percentage point indexed.

$23.6 Billion: "Black liquor" tax hike (Took effect in 2010) This is a tax increase on a type of bio-fuel.

$22.2 Billion: Tax on Innovator Drug Companies (Took effect in 2010): $2.3 billion annual tax on the industry imposed relative to share of sales made that year.

$20 Billion: Tax on Medical Device Manufacturers (Takes effect Jan. 2013): Medical device manufacturers employ 360,000 people in 6,000 plants across the country. This law imposes a new 2.3% excise tax. Exempts items retailing for <$100.

$15.2 Billion: High Medical Bills Tax (Takes effect Jan 1. 2013): Currently, those facing high medical expenses are allowed a deduction for medical expenses to the extent that those expenses exceed 7.5 percent of adjusted gross income (AGI). The new provision imposes a threshold of 10 percent of AGI, meaning the government will take more. Waived for age 65+ taxpayers in 2013-2016 only.

$13.2 Billion: Flexible Spending Account Cap - aka "Special Needs Kids Tax" (Takes effect Jan. 2013): Imposes cap on FSAs of $2,500 (now unlimited). Indexed to inflation after 2013. There is one group of FSA owners for whom this new cap will be particularly cruel and onerous: parents of special needs children. There are thousands of families with special needs children in the United States, and many of them use FSAs to pay for special needs education. Tuition rates at one leading school that teaches special needs children in Washington, D.C. (National Child Research Center) can easily exceed $14,000 per year. Under current tax rules, FSA dollars can be used to pay for this type of special needs education, so many families with such children will be especially hard hit when the rules change.

$5 Billion: Medicine Cabinet Tax (Took effect Jan. 2011): Americans no longer able to use health savings account (HSA), flexible spending account (FSA), or health reimbursement (HRA) pre-tax dollars to purchase non-prescription, over-the-counter medicines (except insulin).

$4.5 Billion: Elimination of tax deduction for employer-provided retirement Rx drug coverage in coordination with Medicare Part D (Takes effect Jan. 2013)

$4.5 Billion: Codification of the "economic substance doctrine" (Took effect in 2010): This provision allows the IRS to disallow completely-legal tax deductions and other legal tax-minimizing plans just because the IRS deems that the action lacks "substance" and is merely intended to reduce taxes owed.

$2.7 Billion: Tax on Indoor Tanning Services (Took effect July 1, 2010): New 10 percent excise tax on Americans using indoor tanning salons.

$1.4 Billion: HSA Withdrawal Tax Hike (Took effect Jan. 2011): Increases additional tax on non-medical early withdrawals from an HSA from 10 to 20 percent, disadvantaging them relative to IRAs and other tax-advantaged accounts, which remain at 10 percent.

$0.6 Billion: $500,000 Annual Executive Compensation Limit for Health Insurance Executives (Takes effect Jan. 2013)

$0.4 Billion: Blue Cross/Blue Shield Tax Hike (Took effect in 2010): The special tax deduction in current law for Blue Cross/Blue Shield companies would only be allowed if 85 percent or more of premium revenues are spent on clinical services.

$ Negligible: Excise Tax on Charitable Hospitals (Took effect in 2010): $50,000 per hospital if they fail to meet new "community health assessment needs," "financial assistance," and "billing and collection" rules set by HHS.

$ Negligible: Employer Reporting of Insurance on W-2 (Took effect in Jan. 2012): Preamble to taxing health benefits on individual tax returns.

| NC Needs a Reality Check | Business, Your Economy | N.C.'s Film Tax Incentives: Good Old-Fashioned Corporate Welfare |