Publisher's Note: This post appears here courtesy of the

John Locke Foundation. The author of this post is

Paige Terryberry.

- During the Covid pandemic, government concocted many costly, "temporary" policies

- Many of those have lingered well past their originally promised dates and expanded beyond their stated intentions, such as progressives trying to turn the student loan payment "pause" into total debt exoneration

- These policies grew government and stoked perverse incentives, harming working families most

It has been over two years since the pandemic began. Announcements on extending the student loan repayment pause, dropping mask rules on planes, or prolonging Obamacare subsidies have me wondering: what stage of

"pandemic relief" is this? What programs and policies are still lurking around in the name of Covid?

While purportedly initiated with good intentions, several of the government's Covid response policies created perverse incentives and generated a new set of problems, with inflation being a primary example.

Here are four examples:

1. Eviction Moratoriums

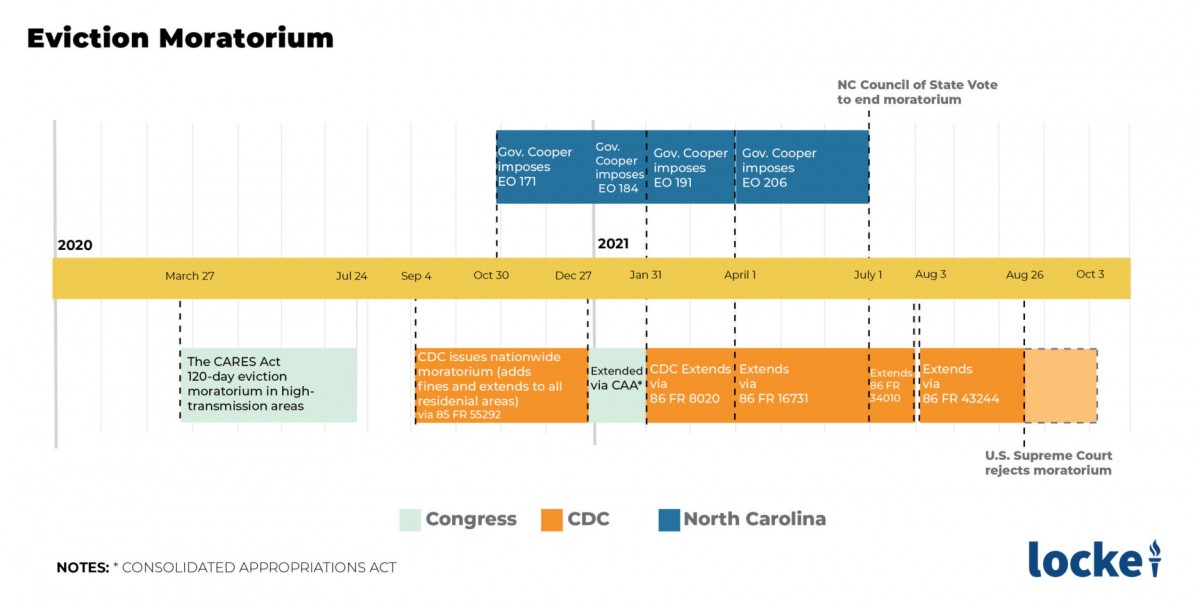

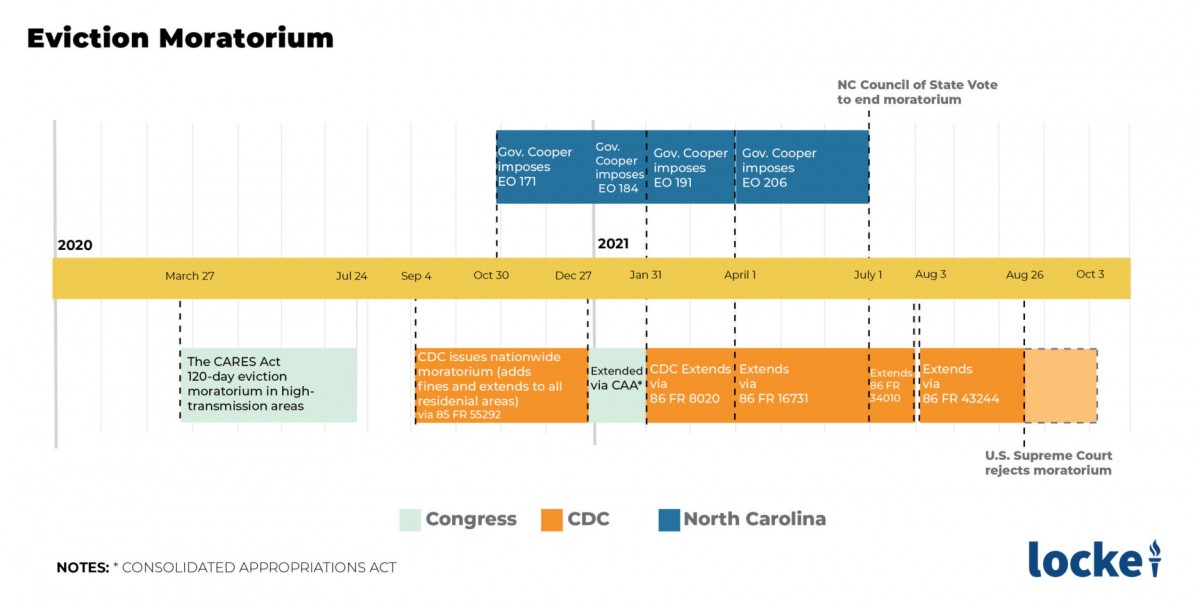

Eviction moratoriums were authorized by Congress, the Centers for Disease Control and Prevention (CDC), and the states. In North Carolina, Gov. Roy Cooper's Executive Orders were generally in step with the CDC's action.

The above timeline shows the chaotic process of Covid-related eviction moratorium declarations. The original order from the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020 was just a 120-day moratorium. Congress did not renew this moratorium when it expired, prompting the CDC to take action. The CDC based its authority on a dated statute that had never before been used to justify an eviction moratorium. In striking it down, the Supreme Court stated that the CDC's

"new, administratively imposed moratorium went further than its statutory predecessor, covering all residential properties nationwide and imposing criminal penalties on violators."

The eviction moratorium lasted close to 500 days nationally, costing landlords billions in debt. After the SCOTUS ruling struck down the moratorium, some states issued their own eviction moratoriums. North Carolina did not.

Paying rent when one has lost a job is a serious issue. But shifting the burden to landlords does not make sense. If the government wants to put this burden on landlords, where then is the line? For how long is this appropriate?

No one has the right to the labor and property of another, including landlords to whom one used to pay rent.

The National Apartment Association wrote:

"Any extension of the eviction moratorium equates to an unfunded government mandate that forces housing providers to deliver a costly service without compensation and saddles renters with insurmountable debt."

Today's landlords likely will fear a future loss of their property rights, discouraging investment in private land ownership.

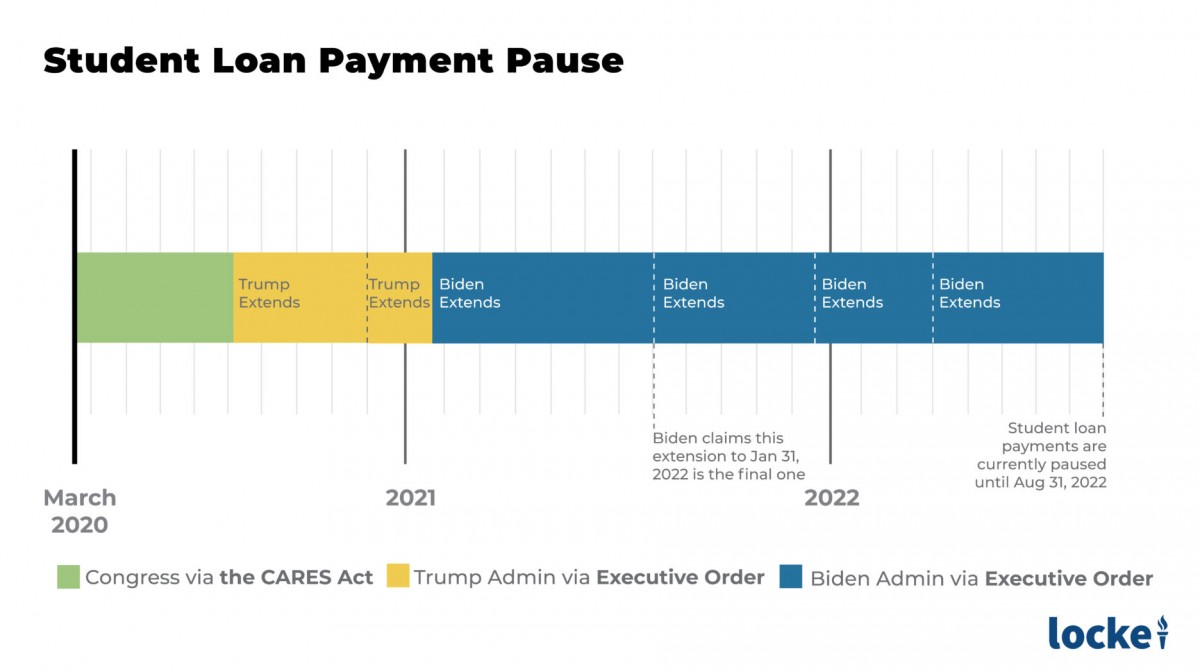

2. Student Loan Payment Pause

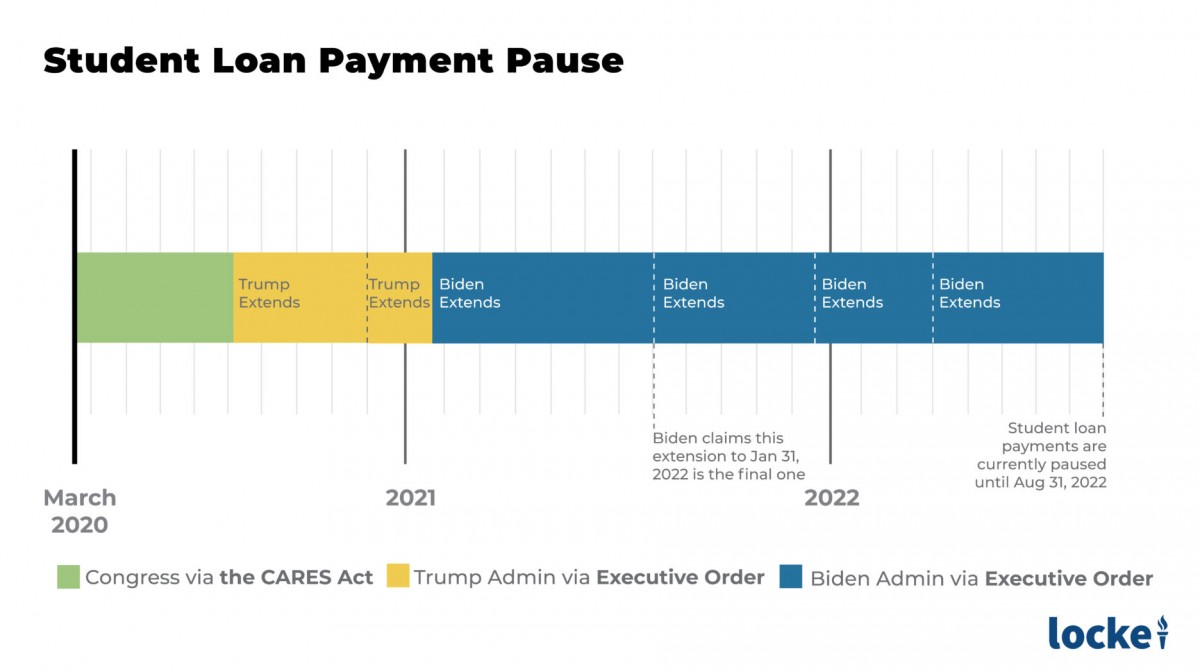

The pause on student loan payments began in March 2020 with The CARES Act. When the Trump Administration extended the pause via presidential memorandum rationalizing that it was

"appropriate to extend this policy until such time that the economy has stabilized, schools have re-opened, and the crisis brought on by the COVID-19 pandemic has subsided." The Trump Administration made clear that borrowers were in control and could choose for themselves whether or not to continue to pay during the pause.

After four extensions by the Biden Administration, progressives insist it is not enough. Senator Chuck Schumer (D-NY) stated:

"This pause isn't going to stay forever and the canceling of student debt is the way to go."

But the $1.6 trillion in federal student loan debt wouldn't be

"canceled," it would be shifted - from those who took out the loans onto the backs of taxpayers.

Two-thirds of American adults do not have loans or did not even go to college and would be unjustly forced to subsidize the others.

Furthermore, most do not need the relief. The unemployment rate for college graduates is under 2%. And, according to National Review, nearly 40% of student loan debt is held by students who earned advanced degrees, while less than 10% is held by the bottom third of earners.

Washington is out of touch. The pause extensions alone cost taxpayers $5 billion a month.

3. Unemployment Insurance

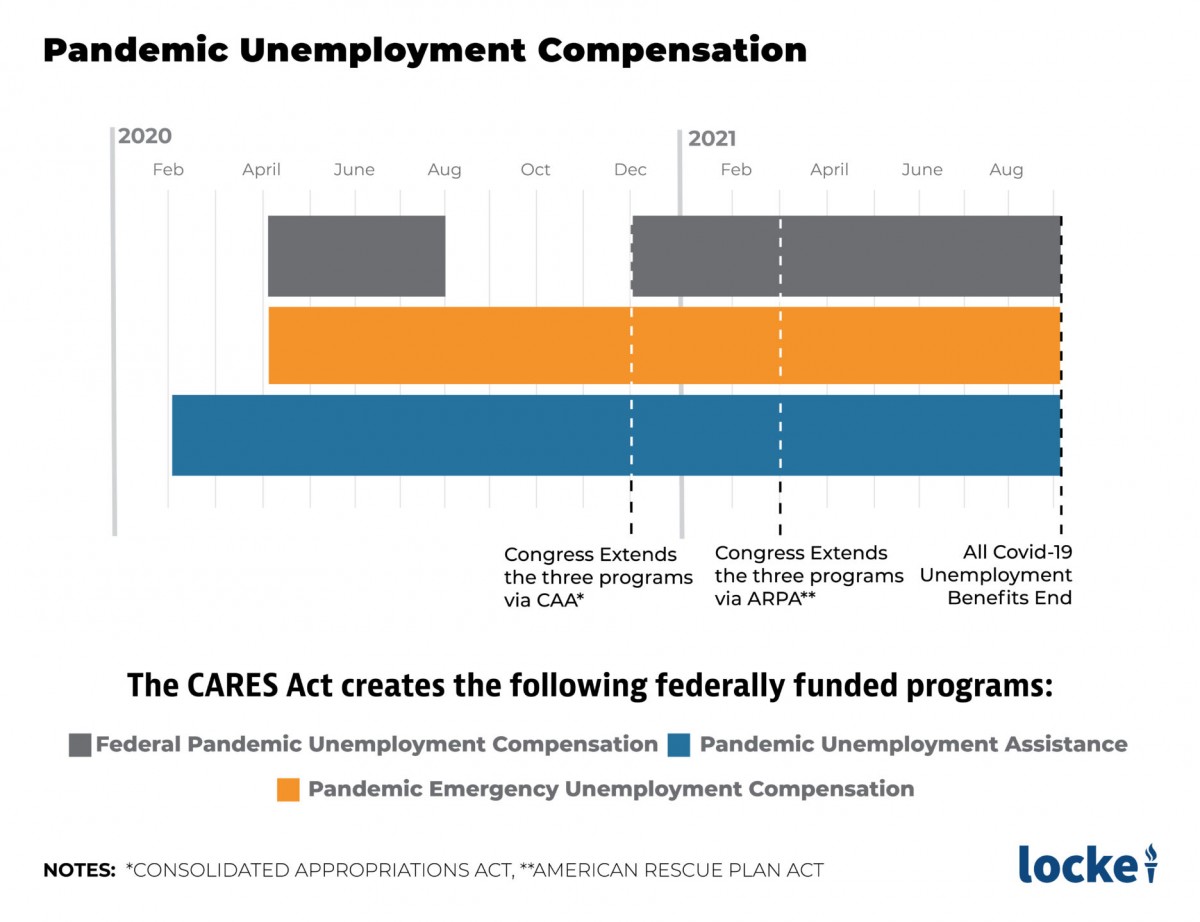

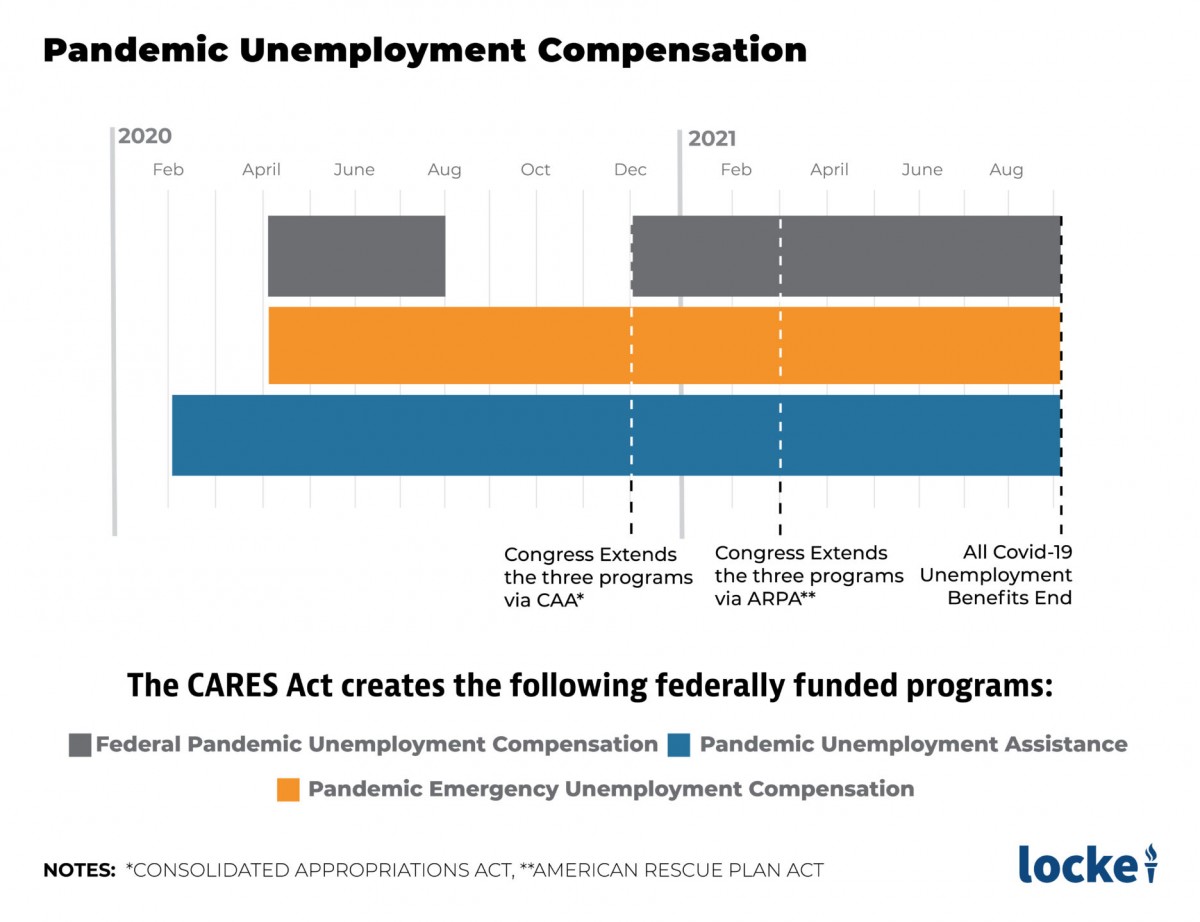

The CARES Act created three new, federally funded unemployment insurance (UI) programs: Federal Pandemic Unemployment Compensation (FPUC), Pandemic Unemployment Assistance (PUA), and Pandemic Emergency Unemployment Compensation (PEUC).

FPUC increased UI benefits for those on UI by $600 per week for 14 weeks.

PEUC expanded state UI by allowing claimants to receive benefits after exhausting their state UI benefits and eased the work search requirement by expanding eligibility to include Covid-related reasons.

PUA was created for workers who do not traditionally fit into UI: self-employed or gig economy workers, for example.

In the first few weeks of the pandemic, unemployment insurance claims rose by an unprecedented 3,000% between March 7 and April 4, 2020, according to the St. Louis Federal Reserve.

The generosity of the benefits, however, created the wrong incentives. University of Chicago researchers found that at the programs' height, unemployment benefits were higher than what they had been earning for two-thirds of those who had lost their jobs.

Paying people more not to work contributes significantly to a worker shortage.

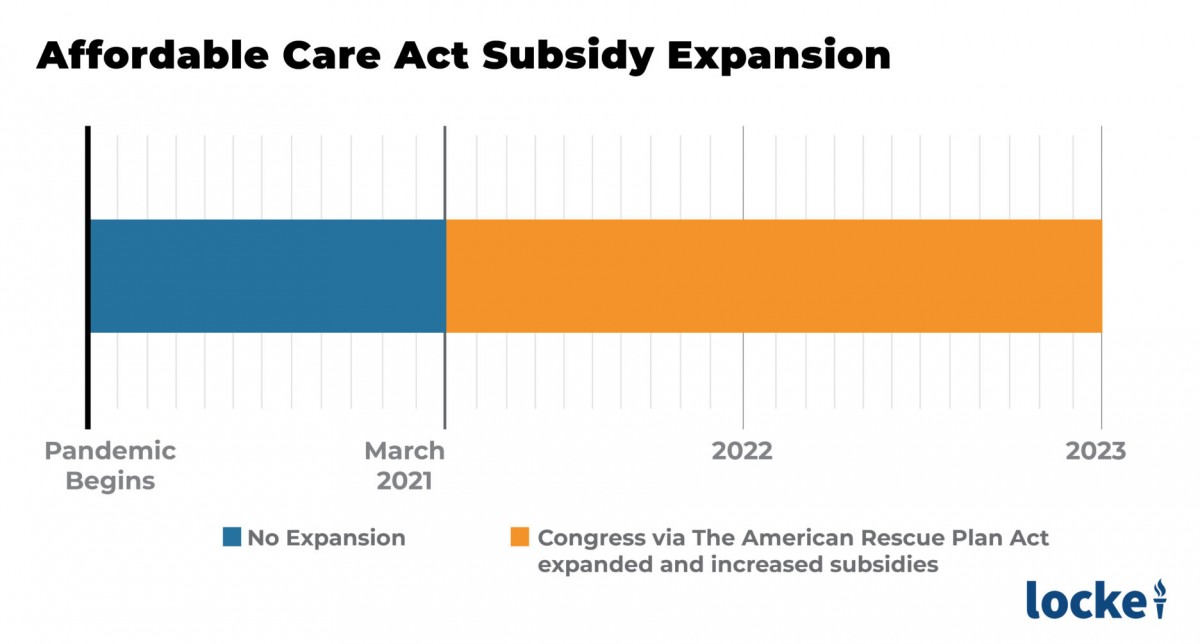

4. Affordable Care Act Subsidies

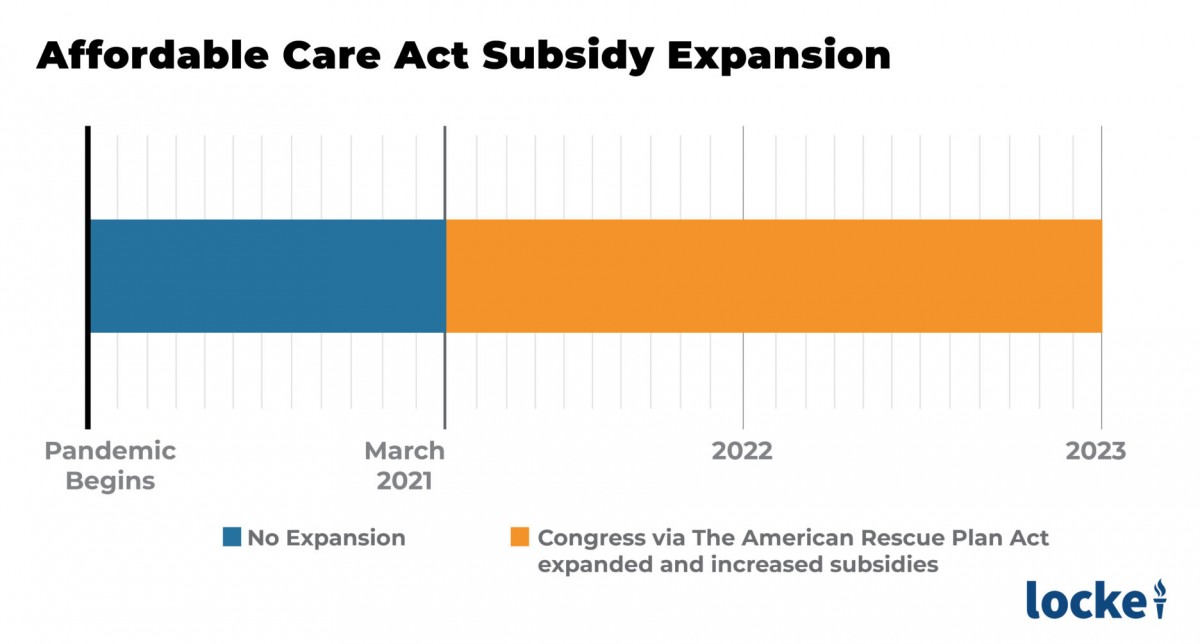

A year into the pandemic, the Biden Administration hugely expanded Obamacare subsidies, spending roughly $90 billion that will benefit high-income earners while enticing employers to drop their existing coverage.

With the ACA expansion, the federal government, via taxpayer dollars and debt, pays more to insurance companies on behalf of those who are already covered as well as to add coverage to families at a higher income levels. Before the American Rescue Plan Act (ARPA), Obamacare provided subsidies only to those with incomes between 100% and 400% of the federal poverty level. With ARPA, individuals with incomes over the 400% level are eligible, benefitting wealthier individuals.

Moreover, the premise that families would lose their coverage indefinitely due to Covid was incorrect: An analysis by Heritage Foundation experts found that 5.7 million more people had coverage in December 2020 than in December 2019.

For employers who offer private health insurance, their employees do not qualify for Obamacare under the ACA. This fact encourages employers to drop their coverage. Expansion of government healthcare will tempt employers to drop their superior coverage with the knowledge that their employees can find subsidized options in the Obamacare exchange. Perverse incentives abound.

Conclusion

The government stood between workers and work when some states mandated the shutdown of entire sectors of the economy. In those instances, the government should be held responsible for those workers who were handcuffed by government policy. But addicting groups to government aid is harmful. Throughout Covid and still today, government leaders instilled fear in citizens and created stigmas toward those who sought to

"go back to normal."

These policies are just four examples of pandemic-related government overreach. Washington justifies spending in the name of Covid, but these policies are a blatant misuse of present and future taxpayer dollars during a time when bureaucrats should be most cautious.