Publisher's note: The author of this post is Katherine Restrepo, who is Health and Human Services Policy Analyst for the John Locke Foundation.

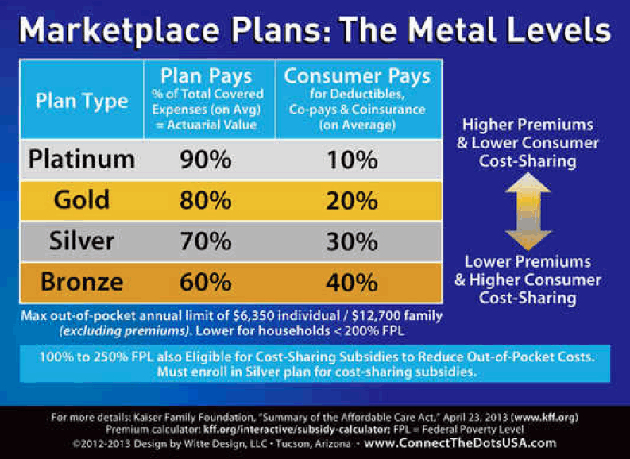

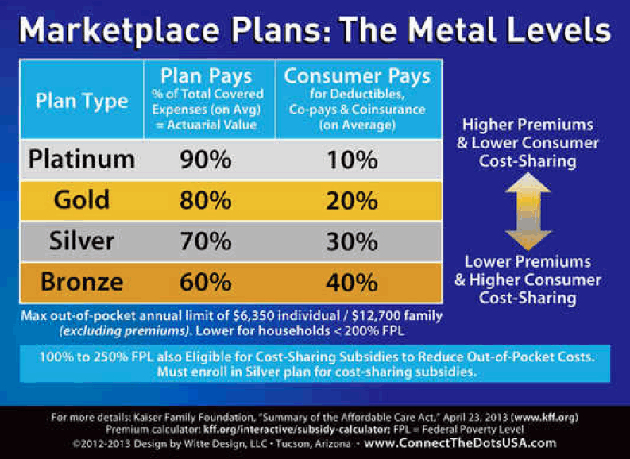

RALEIGH - Obamacare's health insurance exchanges offer four "

metallic" levels of plans: bronze, silver, gold, and platinum. Bronze plans cover 60 percent of benefits, meaning consumers will be responsible for higher

out-of-pocket expenses such as co-pays, co-insurance, and deductibles. Meanwhile, platinum plans come with the most expensive premiums but cover 90 percent of benefits.

Along with the metallic coverage levels, catastrophic plans still exist despite Obamacare's bloated health plan obsession. Catastrophic plans, however, are

for the most part available only to consumers under age 30. Subsidies are not offered to eligible individuals wishing to purchase these these bare-bones plans, nor does the Obama administration really discuss this option.

Keeping mum avoids a potential disruption of the exchange's necessary balanced risk pool among subsidized metallic plans. A recent

Politico article explains:

The catastrophic plans are treated as an insurance risk pool that's separate from the rest of the new Obamacare marketplace, according to Massachusetts Institute of Technology health economist Jon Gruber.

The administration wants as many people as possible to sign up in that marketplace - especially young, healthy ones - so pushing too many toward the catastrophic option undercuts that goal.

For the exchanges to remain financially afloat, a significant chunk of their consumers need to be young and healthy individuals ages 18-34. The White House projects that, of its anticipated 7 million exchange consumers by March 2014,

40 percent must be young invincibles.

This population most likely will be drawn to the most inexpensive plans - either catastrophic or bronze. It sure would help the administration if they ditched the catastrophic plans. Will they go for the bronze?

It can be argued that cost does not differ much when comparing bronze plans to catastrophic plans. Bronze plans do provide the benefit of subsidies to eligible individuals, but will they still be affordable without subsidies? If not, will catastrophic plans even be affordable? Is bronze the new catastrophic?

Comparisons in Wake County

In North Carolina, both Blue Cross Blue Shield and Coventry Health Care offer Obamacare exchange plans to individual policyholders. Since Blue Cross

dominates with 85 percent of the individual market and is the only insurer offering plans in all 100 counties of the state, let's focus on the cost of its catastrophic and bronze plans for a 27-year old.

Here in Wake County, Blue Cross Blue Shield offers two catastrophic plans. The cheapest catastrophic monthly premium for a 27-year old starts at $148, with a $6,350 deductible. If this consumer prefers a larger provider network, the monthly premium will cost around $163.

In some cases, bronze premiums are actually less expensive than catastrophic. If a 27-year old in Wake County earns $25,000 a year, he will qualify for an estimated $80 subsidy and end up paying about $110 a month with a $5,500 deductible through the cheapest bronze plan offered.

However, subsidies greatly tail off after a young individual's income exceeds $25,000. A 27-year old making $30,000 a year qualifies for a whopping $12 subsidy, and monthly premiums start at $176.

Best of luck to young individuals making more than $35,000, as they won't be seeing any subsidies with their monthly $190 bronze premium.

Defining affordable

The Obama administration's

definition of affordable coverage is that one's annual health insurance premium does not exceed 8 percent of pre-tax income. According to this definition, the aforementioned plans are technically affordable - but not really. Premiums may be below the 8 percent threshold, but premiums do not count toward one's deductible.

The law does enforce consumer protections starting in 2015, featuring out-of-pocket

limits of $6,350 for individuals and $12,700 for families (including co-pays and deductibles). However, the cheapest 2014 exchange rates offered for the very population that is needed to balance the risk pool don't look too affordable.