Publisher's note: The author of this post is Katherine Restrepo, who is the Health and Human Services Policy Analyst for the John Locke Foundation.

This Halloween, Blue Cross and Blue Shield of North Carolina (BCBSNC) customers were

spooked by skyrocketing premiums when opening their 2015 rate notification letters for their non-group health plans. While it turns out that the mailings provided incorrect information for an estimated 38,000 policyholders with grandfathered plans – those that have not changed since the Affordable Care Act passed in March 2010 – the real increases may still be scary. Corrected notification letters are to be delivered next week.

The insurer announced last week during a media briefing that individual policyholders may still be burdened with

double-digit premium increases next year. Round two of the federal health law's insurance enrollment period begins November 15.

According to BCBSNC's Vice President and Chief Actuary, premiums for health plans sold on the state's federally run exchange will increase on average by 13 percent. The same amount applies to grandfathered plans as well. Moreover, 240,000 individuals eligible to keep their grandmother plans – plans that are not compliant with the law's standards but were extended at the White House's urgent request last November – may face increases of an average 19 percent. It's important to note that, although this percentage increase surpasses those pertaining to the other two pools, Obamacare plans will likely remain the most expensive.

Is this news all that surprising? Many are aware that insurers are mandated to sell health plans with a minimum standard of 10 essential health benefits. They can no longer risk-adjust individuals based on health status, nor can they deny those with pre-existing health conditions. And, within the past year, BCBSNC has observed increasingly expensive medical trends driven by new specialty drugs, orthopedic surgery, heart disease treatment, and maternity services – just to name a few. Accounting for these factors and for risk pools skewing older and sicker due to many low-risk customers opting to hold onto their old plans means passing higher rates onto consumers.

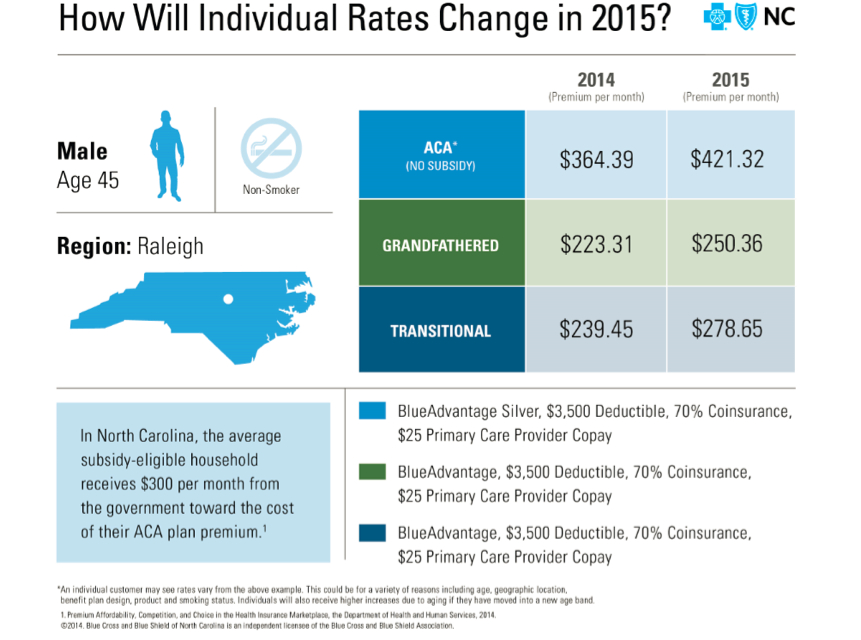

The chart below provided by Blue Cross and Blue Shield outlines the rising costs for the insurer's most popular silver plan sold on the exchanges:

Of course, these figures represent the underlying costs of health insurance premiums. Depending on one's household income,

subsidies may significantly offset monthly payments at the taxpayer's expense. 91 percent of Blue Cross and Blue Shield's exchange enrollees qualified for subsidized private coverage. The chart also mentions that the average subsidy-eligible household premium is discounted by $300 per month.

Meanwhile, this graph compares the carrier's anticipated enrollment and actual enrollment for 2014 after Obamacare's initial six-month enrollment period that began last October.

Things will only get more interesting, and maybe more frightening, as Obamacare continues to unfold. Over the next few months, the media will make noise about the state's enrollment projections, the cost of federally qualified plans sold on and off the heath insurance exchanges, and how subsidized private coverage makes health care cost a lot more for some and less for others. Over the next few years, however, the conversation will focus on loads of policy cancellations for "subpar" health plans that have been reinstated for up to two years and

possibly for

Obamacare compliant plans as well.