If you have insurance, you are invested in the stock market.

Insurance

Insurance companies are like any other business in the world. They have to make a profit to stay in business. There are two basic ways this can be accomplished. They can earn underwriting income, investment income, or both. Insurers have a unique way to earn massive amounts of additional profit. Unlike many other types of businesses, insurance companies collect huge sums of cash throughout the year and may not have to pay on claims on those policies for many years. This unique situation allows insurance companies to invest that money while it's not being used. Huge profits can be reaped, or lost, as a result.

This is exactly why Warren Buffet formed the Berkshire Hathaway Insurance Company...so he could generate capital to invest in the stock market.(1)

The third rail in the insurance business is that their guarantee is sacrosanct. For over a century these guarantees and promises were taken seriously and treated with respect by the insurance companies. During the Great Depression of the 1930s, not one policyholder lost one dollar held by an insurance company. So sacred has this promise been that when one company was in danger of failing on its guarantee, other companies would step in to make good on the promise.

AS LONG AS YOU CONTINUED TO PAY YOUR PRIEMUMS.

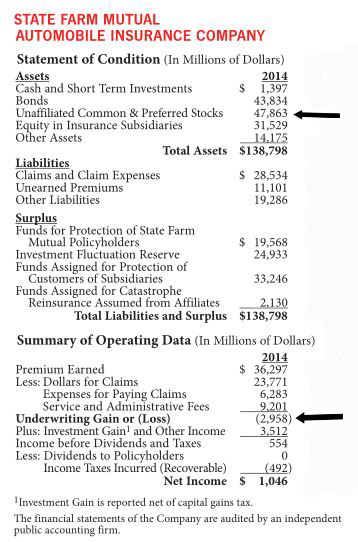

Here is an example from the State Farm balance sheet for 2014 (numbers are in thousands).

Notice that they hold $47,863 In common and preferred stocks but lost $2958 in 2014 before adding the investment income.

Gambling

Gambling works as follows. You pay some money to the "house". Then a random event is observed; it may be the roll of some dice, the draw of some cards, or the drop of some balls. Or it may not be a completely random event: it could be a horse race or a ball game; the important thing is that neither you nor the house controls or influences the outcome. Before the event, you and the house have agreed that if the event turns out one way, the house keeps the money you paid, and if the event turns out the other way, the house pays you according to an agreed formula.!

Now suppose the "house" is an insurance company. The money you pay is called a "premium". The event which neither you nor the insurance company controls is that a fire will damage your home during the next year. If there's no fire, the insurance company keeps your premium. If there is a fire, the insurance company pays you the amount of the damage. This fits the gambling scenario exactly. Buying insurance is a form of gambling.(2)

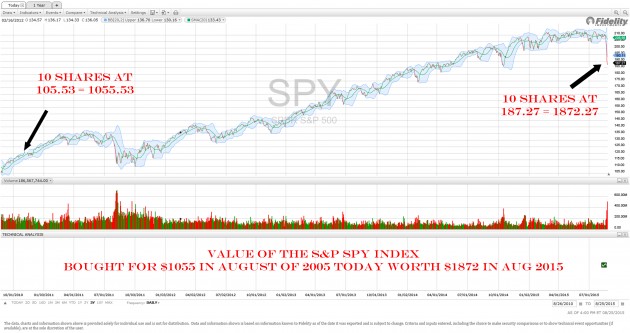

The chart below shows the value of $1055 invested in the S&P ETF in August of 2005 would be worth $1872 as of August 2015. It involves No trading, no options, no shorts, no longs, no hedging required. Just buy and hold, The Buffett way.

The italic text above if from various sources available upon request.

That does not mean I am against buying insurance, it means that a broad based investment strategy with diversification is the best way to earn as well as protect your money. Do not get confused between investing and gambling. If Ned Ryerson (Groundhog Day) trys to tell you the stock market is a gamble, remember he is most likely working for a company that has substantial exposure to the stock market. It could be worse though, his company may have most of their money in government bonds.

I am not an investment advisor nor am I advocating any course of action in investments. I am just trying to point out that most things in the financial world and life are interconnected and scapegoating a market segment for all our problems is dangerous. Beware of oversimplified clichés.

My best investment decisions were both made many years ago and it was simple. In 1966 when I was working in a warehouse, we would cash our checks at the local bank. I would ask for five silver dollars for the Christmas Fund. They were 90% silver in those days. Since we were paid twice a week, I had 130 silver dollars at the end of the year. I took the silver dollars back to the bank and exchanged them for dollars. Had I just put the silver dollars in a drawer they would be worth $1430 today and the silver market is in the dumper. In 1980 those 130 silver dollars would have been worth $6500.

Conclusion: Don't take advice from someone dumb enough to make that mistake and then tell about it. Do your own homework.

TED McD HAS A MUCH MORE AMUSING POST HERE