During the June 4th Beaufort County Commissioners meeting Commissioner Jay McRoy made some astounding statements about the honesty of a company that finds unlisted tax property for a one time payment of a percentage of the taxes owed. This means Beaufort County pays nothing unless the company finds something. This is an extraordinary good deal for the taxpayers.

The property that is not listed, whether by accident or deliberately, is almost all personal property. The majority of it is owned by businesses. Individuals usually do not have large amounts of high valued personal property. Real estate and mobile homes are fairly easy to track because of fixed locations and the requirement for building and septic tank permits. Business property is another matter. Large expensive items like heavy equipment and utility equipment such as switch gear do no require permits nor have registered titles like automobiles. Equipment could be purchased in another state and moved to North Carolina without being listed for taxes. Utilities tend to issue purchase orders for large quantities of transmission lines, towers, transformers and switches and then install these items in several states. Let us face it, the main interest of most of us is not to be first in line to pay taxes, we are too busy trying to make the money to survive in this economy.

Normally, in a larger company the accounting department is charged with keeping a list of large (capital) items and depreciation schedules. Small companies usually have their CPA or tax accountant keep the depreciation schedule. There may be as many as three schedules. The Feds have their schedule of allowable depreciation, the State may or may not have a different schedule and the county has a different schedule. Each item has a different allowable rate or number of years it may be written off or expensed. Recently there have been some special tax breaks that let some things be written off or expensed in the same year purchased, so those items may not find their way on to a depreciation schedule. Large companies may not know an item was moved out of state much less into another county. Keep in mind these companies and individuals first priority is not to pay taxes but to make money.

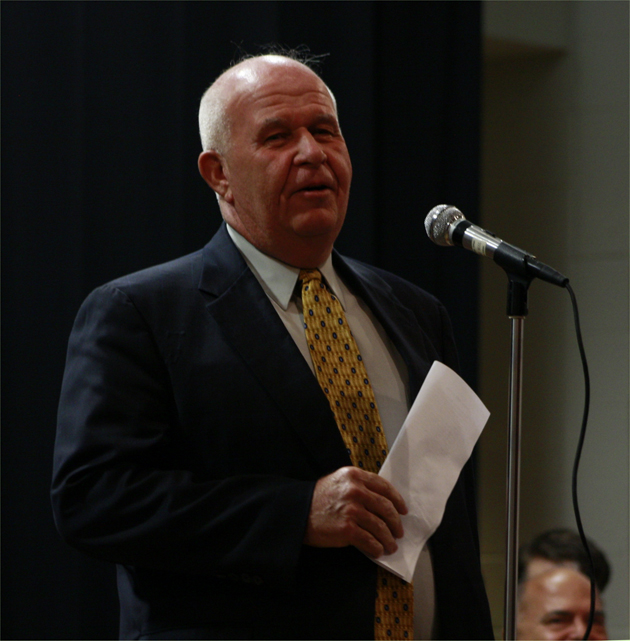

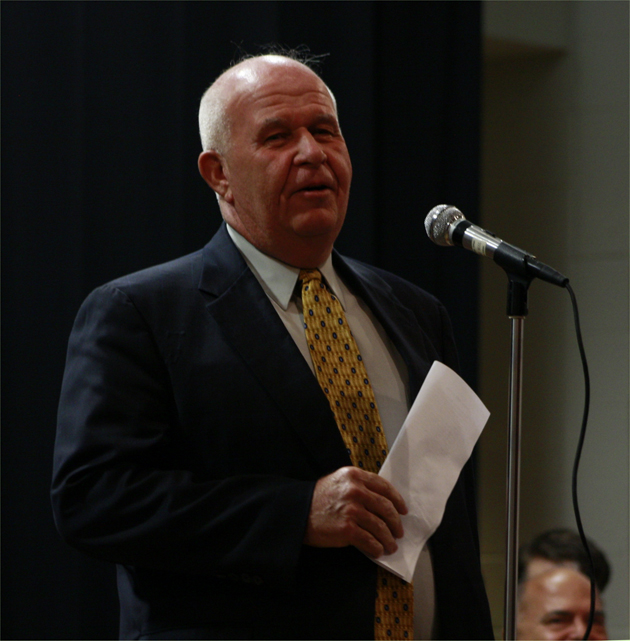

Beaufort County Commissioner Hood Richardson making himself perfectly clear: Above. photo by Stan Deatherage

Beaufort County Commissioner Hood Richardson making himself perfectly clear: Above. photo by Stan Deatherage

Within this complex system of keeping track of equipment, and depreciation schedules there is ample opportunity to accidentally loose track of the location and tax status of multi million dollar pieces of equipment. There is also opportunity to deliberately not report everything to the county tax assessor.

So, here come the bounty hunters. These are companies who have large computer systems and who know all the places to look for personal (not attached to the ground) property that may or may not have been reported to the county tax assessor. They have search systems, computer systems and programs that individual counties could not afford and they are confident enough in what they do to work for nothing unless they find something. There is a lot of personal property that is not reported for taxation or these people would not be able to stay in business. Bear in mind that it is not a matter of just identifying the property. After being identified the property must be located and proof of ownership established. The bounty hunter cannot get paid until all of this is done. On some occasions there are law suits. Owners of some property deliberately list in low tax States and then use it in North Carolina.

Guess what? The special interests have bills up in the North Carolina Legislature to make it illegal for anyone to pay anyone a fee based on value for finding property that is not listed for taxes. It is House Bill 462. Guess who that helps? All of the people described above. If they do not pay their taxes, you will have to pay it. It is somewhat like shop lifting. The stores simply add the loss of the price of the merchandise and the buyer pays. So the tax payer will pay.

McRoy tried a cheap trick to make himself look good. You can decide who he is trying to appeal to. He made a motion to remove the cost of using these companies from the budget. The cost in the budget is zero. The cost of these companies is not in the budget because we get more than the cost of their services when they find unlisted property. What McRoy was doing was trying to shut down our discovery of unlisted property. Beaufort County makes money on this and it promotes fairness to those who are paying their fair share. So, McRoy actually made a motion to reduce Beaufort County tax revenue. This means some people would own property and not be taxed.

CPA's, and McRoy is a CPA, prepare these tax (depreciation) schedules for their clients. These schedules can be made available for tax audit to be sure they are complete and accurate. Why would someone who has a fiduciary responsibility to the taxpayers of Beaufort County want to eliminate a part of the tax collection system?