Publisher's note: Agenda 2012 is the John Locke Foundation's charge to make known their wise political agenda to voters, and most especially candidates, with our fourth installment being the "State Tax Reform -- Sales Tax," found in the Budget, Taxation, and the Economy section, and written by Dr. Roy Cordato, Vice President for Research and Resident Scholar at the John Locke Foundation. The first installment was the "Introduction" published here.

North Carolina's tax on retail sales needs reforming. At the present time, there exists a hodgepodge of taxes on consumption and sales that show very little consistency or forethought. There are economic principles of taxation that should guide the formation of our sales tax system and that, if followed, would make the system more conducive to economic growth and prosperity. Unfortunately, they tend to be ignored. Some purchases that are part of the retail-sales tax base should not be, such as transactions between businesses, while other kinds of purchases that should be included are not, such as services sold to retail consumers. Also, special sales or excise taxes of different kinds are used apart from the main body of the sales tax to punish and reward consumption choices. In addition to being bad economics, this is inconsistent with the role of taxation in a society that respects individual liberty.

Key Facts

• In reforming North Carolina's sales tax, the focus should be on whether the tax base is what economists call neutral and whether the tax conforms with the principles of justice rooted in a respect for liberty and freedom of choice.

• Over the past several years, the focus of most discussions about reforming North Carolina's sales tax have been almost exclusively on whether to expand the base to include services.

• There has been almost no discussion about which services are appropriate to tax and which are not. In fact, basic principles of taxation have rarely entered into the conversation.

Sound principles of taxation argue that both goods and services be taxed but taxed only once and in a manner obvious to the taxpayer.

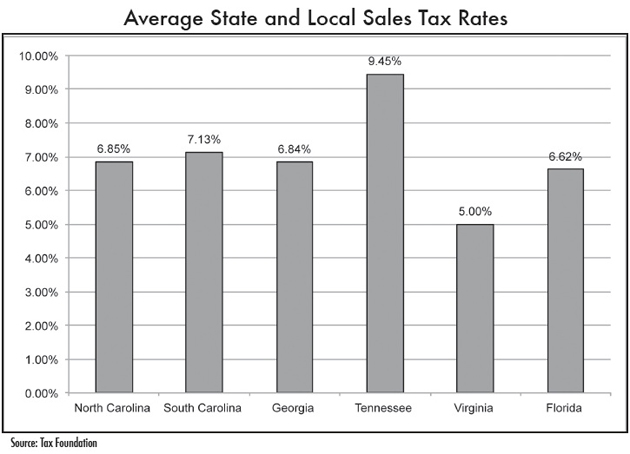

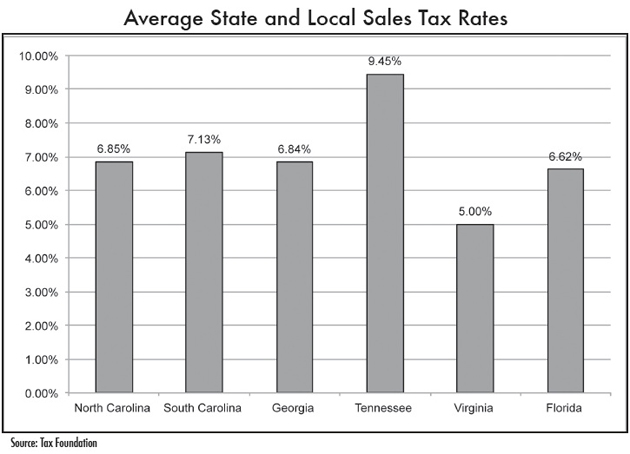

• North Carolina's combined average state and local rate is 6.85 percent. This rate is slightly above the middle of the pack for the nation (23rd highest) and in the middle among our neighboring states. It should be noted that Tennessee and Florida have no income tax and that North Carolina has the highest top income tax rate in the South. In its latest analysis, the Tax Foundation ranked North Carolina's sales tax as 4th worst in the country because of the many biases and distortions contained within it.

• Some goods and services in NC are taxed at extraordinary rates. While the sales tax rate in North Carolina (not including local sales taxes) is 4.75%, alcoholic beverages, tobacco products, and rental cars are all taxed at higher rates. In a free society, the tax system should not be used to punish activities that are disfavored by politicians or to reward activities that politicians consider virtuous. It also shouldn't be used to extract disproportional amounts from some consumers just because they lack political power or reside elsewhere, i.e., rental car customers.

Recommendations

1.

The tax base should be broadened to include services sold to final consumers but only to final consumers. This would include everything from haircuts and lawn services to accountants and lawyers.

2.

Sales taxes on all business-to-business sales should therefore be abolished. In other words, while expanding the tax base to services, many goods currently being taxed should be removed from the base. To tax business-to-business sales and the sales of final products represents double taxation because the former tax will be incorporated in the price of the final product, which is also taxed.

3.

These same principles of tax reform should also be applied to products that are singled out for special penalties such as those mentioned above. These goods and services should be taxed at no greater rate than other products subject to the sales tax. This disproportionate tax treatment is inconsistent with freedom and represents an unwarranted interference with private decision-making.

4.

In the process of broadening the base to include consumer purchased services, the rate should be commensurately lowered so as to keep the amount of revenue brought in by the tax constant, i.e., the reform should be revenue neutral.

Analyst: Dr. Roy Cordato

Vice President for Research and Resident Scholar

(919) 828-3876 •

rcordato@johnlocke.org