Agenda 2012: State Tax Reform -- Corporate Income Tax | Eastern North Carolina Now

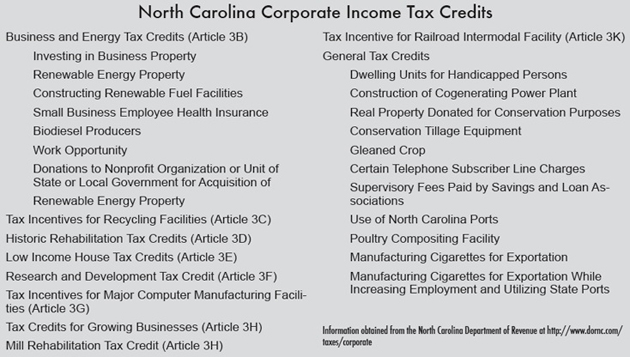

North Carolina's corporate income tax violates basic principles of sound economic policy and open government.

| Court Could Limit Appeal of Competitive Contracting | John Locke Foundation Guest Editorial, Editorials, Op-Ed & Politics | An Inescapable Fact about Poverty |

|

while right and center shun political violence

Published: Tuesday, September 16th, 2025 @ 8:25 am

By: John Steed

|

|

"Robert F. Kennedy Jr. is a foolish man, full of foolish and vapid ideas," former Governor Chris Christie complained.

Published: Monday, September 15th, 2025 @ 10:18 pm

By: Daily Wire

|

|

more transgender violence

Published: Monday, September 15th, 2025 @ 9:19 pm

By: John Steed

|

|

several far left Democrat incumbents need defeat

Published: Monday, September 15th, 2025 @ 8:28 pm

By: John Steed

|

|

If a white person commits a crime against a black person, it is a national news story.

Published: Monday, September 15th, 2025 @ 5:21 pm

By: Daily Wire

|

|

would allow civil lawsuit against judge if released criminal causes harm

Published: Monday, September 15th, 2025 @ 8:32 am

By: John Steed

|

|

good sign for next French election

Published: Sunday, September 14th, 2025 @ 9:17 pm

By: John Steed

|

|

By Rev. Mark Creech

Published: Sunday, September 14th, 2025 @ 5:43 pm

By: Countrygirl1411

|