Should I sell, should I buy, or should I just put a gun to my head and relieve the misery? If these questions have not yet crossed your mind in the last week - you're in a pretty good place. This means you are probably not investing in the United States equities markets, or you are a "high frequency trader," and you're loving the volatility; however, for the vast majority of us, who struggle to invest in this most uncertain environment, we just know the high anxiety of certain risk.

And certain risk is about all we can be certain of.

Yes, "these are the times that try Men's souls." Regardless of your position in the markets, it certainly has been a roller coaster ride as we navigate the dilemma of risk versus reward. It has been a historic week for investors: The Dow Jones Average had its most volatile week since March of 2009 - enduring 4 straight days of point swings of 400 or more points, which is a new record. The takeaway for me: If you can't stand the roller coaster, don't go to the theme park. My opinion: The ride will continue, unabated, over the next coming weeks, but the big drop, or two, or three ... has already occurred, and the lower register of the market's undulation is just around the next coaster curve. My ever optimistic summation: You better hang on, because there is a better than even chance you might be smiling when the ride is over; however, as a longterm investor, I truly don't believe that you will be lining up for a second ride.

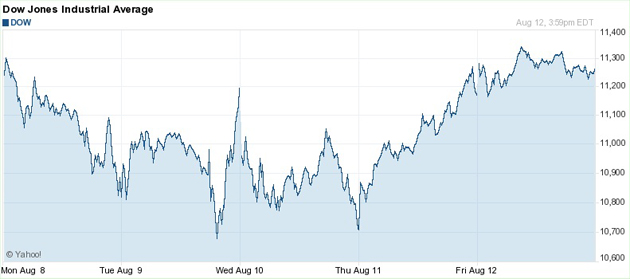

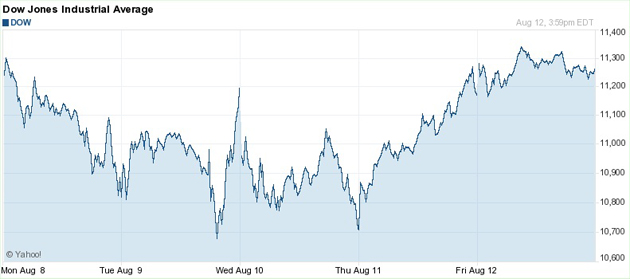

The precipitous of the last few weeks of the last three months ending August 12, 2011: Above. The Week from Hell ending August 12, 2011: Below. If Steve Cortes is right: Could a double bottom already be in?

The precipitous of the last few weeks of the last three months ending August 12, 2011: Above. The Week from Hell ending August 12, 2011: Below. If Steve Cortes is right: Could a double bottom already be in?

The investing philosophy: "Buy when others are fearful, sell when others are joyous" is often attributed to Warren Buffet. Regardless of who coined the standard, or if you even know the nature of the Master Investor, one must admit that in most cases adversity breeds opportunity.

Steve Cortes, of

CNBC's Fast Money fame, recently stated, "Just today (in reference to the infamous August 8 week of market volatility), I distinctly believe I saw grown men crying in front of the CME (Chicago Mercantile Exchange), and when they're cry'n, I'm buy'n."

This is the nature of the contrarian investor, and the contrarian investor is certainly not always right. Currently there is the near certainty of sovereign default in Greece, and now the possibility of Italy, and rumors that France will also be downgraded to AA+, just as the United States was

downgraded by Standard and Poor's on August 6, 2011. Also, there is the consensus that the United States of America has a better than one in three chance that it will traipse back into recession.

What does the investor do?

The good news: While it is uncertain, the recent bottom in the equities markets may have been constructed in this last trying week; however, do not be committed to a V shaped recovery in the markets just yet.

The signs:

Contrarian sentiment: Not only Steve Cortes, but other knowledgeable investors are heartened by the fact that most polls put bullish sentiment at less than 25% of most investors. Capitulation (the liquidation of shares with impunity) occurred possibly two times last week, and once the week before, with trading volumes the highest since March of 2009 - the bottom of the last Bear Market, within the Great Recession. The volatility index (known as the VIX) is the highest, around 49, since March, 2009, with the October futures in the high 20's, suggesting that the market expects the volatility to abate. Oversold conditions are at the highest levels, also, since 2009, but is there a reason for this? First, we should check the fundamentals.

Market fundamentals: S&P future earnings, without a recession, are predicted to have a PE ratio (profits to earnings ratio) of 12, which is historically low (low equates to good). Corporations have cleaned up their balance sheets and have record amounts of cash, about three trillion dollars. Banks, who are certainly reluctant to lend, are well capitalized - the best since 1934 - and will not be a financial drag as they were in 2008 / 2009. Insider buying (officers of corporations) is also at the highest levels since March, 2009. Plus, an accommodative Federal Reserve is committed to keeping rates low, which will diminish the profits of banks, but will encourage investing by corporations and individuals. It remains to be seen how the "Fed's" actions may encourage inflation in the future.

What should you do?

I ask this question a second time, because I truly have no answers.

This I do know. Famed investors Dougie Kass of Seabreeze Partners and Bob Doll of BlackRock Advisors are encouraged by the signs, and are buying. And more importantly the historic averages suggest: If you bet against the USA, the odds are that you will lose.

My advice to investors: "Stick to your knitting" and be heartened. "This too shall pass."