Publisher's note: The James G. Martin Center for Academic Renewal is a nonprofit institute dedicated to improving higher education in North Carolina and the nation. Located in Raleigh, North Carolina, it has been an independent 501(c)(3) organization since 2003. It was known as the John W. Pope Center for Higher Education Policy until early January 2017.

The author of this post is Madeline Baker.

When students are late making a monthly payment on their federal student loans, the loan

becomes delinquent. And if they don't make any payments for 270 days, most types of federal student loans go into default.

The Department of Education

provides data on cohort default rates by institution, which informs the public of how many students who borrowed for college cannot repay. The cohort default rate is the percentage of a school's borrowers who defaulted on their loans within a fiscal year.

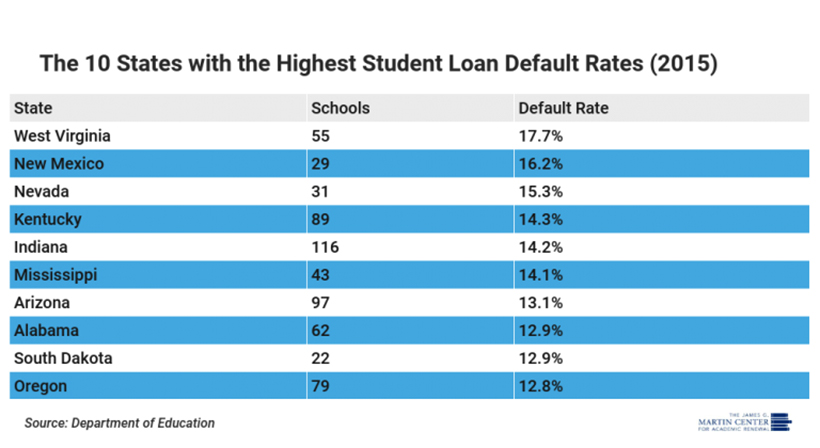

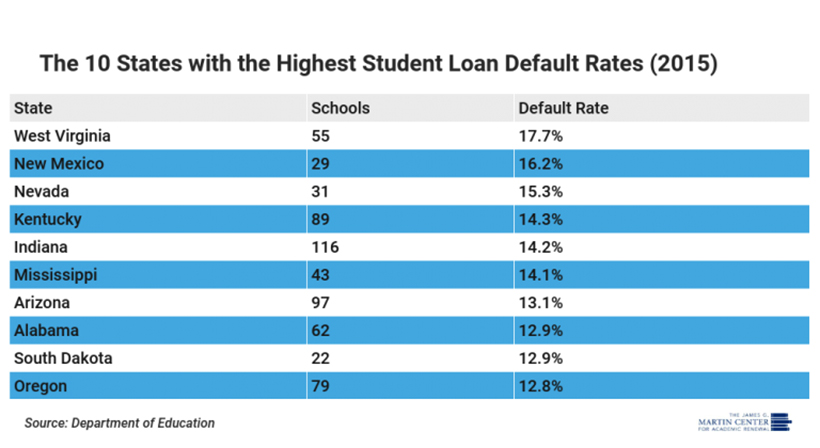

At the state level, student loan default rates indicate how well students can repay their loans after leaving college. Low or high default rates can indicate a number of things, such as the quality of education in the state or the value of a college degree in the state's job market.

The latest data from the Department of Education found a national default rate of

10.8 percent in 2015, below the 2014 rate of

11.5 percent. That 10.8 percent represents

531,653 borrowers from 6,155 schools who defaulted between October 2014 and September 2017. The report shows, however, that default rates from for-profit schools have increased, from 15.5 percent in 2014 to 15.6 percent in 2015.

Despite the overall decrease, some states still have extremely high default rates. While West Virginia lowered its default rate from 18.3 percent in 2014 to 17.7 percent in 2015, close to one of every five student loan borrowers in the state cannot reliably pay off their debt. New Mexico saw a larger improvement, down 2 percent from its 2014 rate, but still shows the cost of the federal government providing easy-to-get loans.

More than 10 other states have default rates over 10 percent, including large states such as Ohio, Michigan, Florida, and Georgia. Still, a decrease in the national cohort default rate is an improvement, and hopefully marks the beginning of an ongoing downward trend.

Madeline Baker was a Martin Center intern in summer 2019. She is pursuing a bachelor of science in International Economics and Finance with a minor in Spanish at the Catholic University of America in Washington, D.C.