Boldly Committed to Truth Telling in the False Face of Fakery

North Carolina's New Ranking On Tax Foundation's State Business Tax Climate Index

Publisher's note: The author of this post is Sarah Curry, who is Director of Fiscal Policy Studies for the John Locke Foundation.

Every year the Tax Foundation publishes the State Business Tax Climate Index, which allows taxpayers, businesses, and policy makers an easy comparison of how their states' tax systems relate. This ranking of the states is based on tax policy has been very important in North Carolina over the last few years. During the 2013 legislative session, North Carolina lawmakers looked at the State Business Tax Climate Index very carefully and framed their tax reform legislation to make North Carolina more competitive relative to its neighbors.

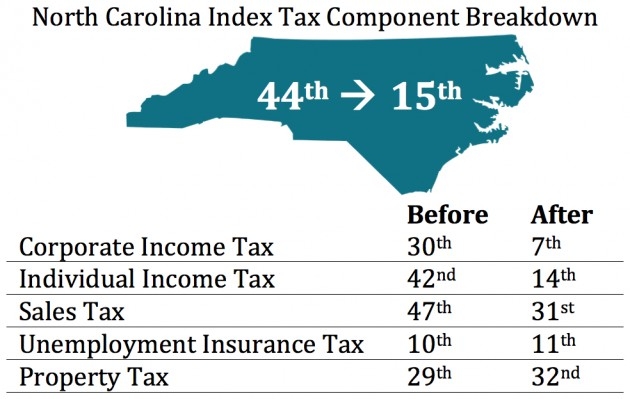

Before 2013, North Carolina had a surprisingly high tax burden when compared to its southern neighbors. The index ranked North Carolina 44th in the country — meaning only six states were less competitive than North Carolina. The tax rates in North Carolina had narrow bases and high rates for many of the taxes included in the index.

After the tax reform legislation in 2013, the legislature continued to build on those successes in 2014 and 2015 by furthering the state's competitiveness through the tax code. The change in the index was achieved by reforms to various forms of taxation:

North Carolina can expect to see a drop in the unemployment tax ranking in upcoming years thanks to recent news that is not included in this year's index. Earlier this month, Gov. Pat McCrory announced that the state's unemployment reserve fund has ballooned to $1 billion, meaning that businesses across North Carolina will see the surcharges on their state unemployment taxes drop in January, resulting in more than a half-billion dollars in tax relief.

The Tax Foundation estimates once all reforms are fully phased in,North Carolina's overall ranking will be 13th best in the country. According to the most recent index that was released today, here is where North Carolina already stands thanks to comprehensive tax reform.

So what do the top ten states have that North Carolina doesn't? Property taxes and unemployment insurance taxes are levied in every state, but there are several states that score the highest that do without one or more of the major taxes. Wyoming (#1), South Dakota (#2), Nevada (#5), and Texas (#10) have no corporate or individual income tax; Alaska (#3) has no individual income or state-level sales tax; Florida(#4) has no individual income tax; and Montana (#6) and New Hampshire (#7) have no sales tax.

That doesn't mean that North Carolina must get rid of one of these taxes to make the top 10, although that would help. For example, Indiana (#8) and Utah (#9) both levy all of the major tax types, but do so with low rates on broad bases.

The state on the bottom of the list is New Jersey. New Jersey ranks 50th because it has some of the highest property tax burdens in the country, is one of just two states to levy both an inheritance tax and an estate tax, and maintains some of the worst structured individual income taxes in the country.

North Carolina is on the right path to becoming a top ten state thanks to the tax reform legislation passed in recent years. If we continue down the same path, hopefully North Carolina will be atop 10 state in the State Business Tax Climate Index before too long.

If you want to read more about the Tax Foundation's State Business Tax Climate Index, visit www.taxfoundation.org.

Go Back

Every year the Tax Foundation publishes the State Business Tax Climate Index, which allows taxpayers, businesses, and policy makers an easy comparison of how their states' tax systems relate. This ranking of the states is based on tax policy has been very important in North Carolina over the last few years. During the 2013 legislative session, North Carolina lawmakers looked at the State Business Tax Climate Index very carefully and framed their tax reform legislation to make North Carolina more competitive relative to its neighbors.

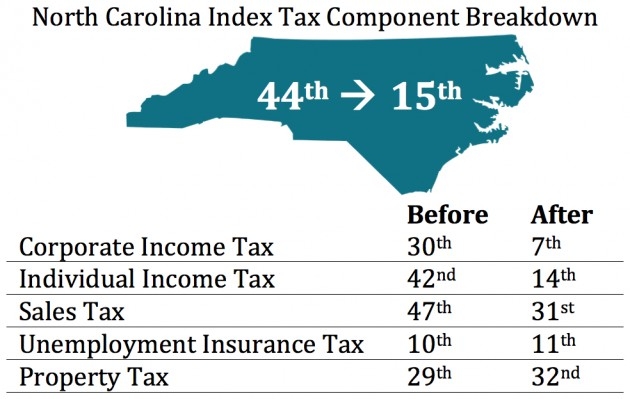

Before 2013, North Carolina had a surprisingly high tax burden when compared to its southern neighbors. The index ranked North Carolina 44th in the country — meaning only six states were less competitive than North Carolina. The tax rates in North Carolina had narrow bases and high rates for many of the taxes included in the index.

After the tax reform legislation in 2013, the legislature continued to build on those successes in 2014 and 2015 by furthering the state's competitiveness through the tax code. The change in the index was achieved by reforms to various forms of taxation:

(1) Individual Income

- Replaced graduated rates with one flat rate

- Lowered the individual income tax rate over several years

- Broadened the tax base by closing or limiting many income tax credits and deductions

- Expanded the Child Tax Credit and Standard deduction

- Repealed the state estate tax

(2) Business Taxes

- Lowered the corporate income tax rate over three years with a further deduction subject to a revenue trigger

- Broadened the tax base by allowing many credits to expire

- Eliminated local business privilege taxes

- Phased in single sales factor apportionment which determines the percentage of a multi-state operation's total profits that are taxable, based on the percentage of sales made in the state

(3) Sales Taxes

- Modestly broadened the sales tax base to include certain service contracts and repair/maintenance services associated with the purchase of tangible personal property

- Eliminated the state sales tax holidays

- Eliminated special sales tax rates for electricity, piped natural gas, amusements, and entertainment

North Carolina can expect to see a drop in the unemployment tax ranking in upcoming years thanks to recent news that is not included in this year's index. Earlier this month, Gov. Pat McCrory announced that the state's unemployment reserve fund has ballooned to $1 billion, meaning that businesses across North Carolina will see the surcharges on their state unemployment taxes drop in January, resulting in more than a half-billion dollars in tax relief.

The Tax Foundation estimates once all reforms are fully phased in,North Carolina's overall ranking will be 13th best in the country. According to the most recent index that was released today, here is where North Carolina already stands thanks to comprehensive tax reform.

So what do the top ten states have that North Carolina doesn't? Property taxes and unemployment insurance taxes are levied in every state, but there are several states that score the highest that do without one or more of the major taxes. Wyoming (#1), South Dakota (#2), Nevada (#5), and Texas (#10) have no corporate or individual income tax; Alaska (#3) has no individual income or state-level sales tax; Florida(#4) has no individual income tax; and Montana (#6) and New Hampshire (#7) have no sales tax.

That doesn't mean that North Carolina must get rid of one of these taxes to make the top 10, although that would help. For example, Indiana (#8) and Utah (#9) both levy all of the major tax types, but do so with low rates on broad bases.

The state on the bottom of the list is New Jersey. New Jersey ranks 50th because it has some of the highest property tax burdens in the country, is one of just two states to levy both an inheritance tax and an estate tax, and maintains some of the worst structured individual income taxes in the country.

North Carolina is on the right path to becoming a top ten state thanks to the tax reform legislation passed in recent years. If we continue down the same path, hopefully North Carolina will be atop 10 state in the State Business Tax Climate Index before too long.

If you want to read more about the Tax Foundation's State Business Tax Climate Index, visit www.taxfoundation.org.

| The North Atlantic Treaty, The Constitution, And The War Against ISIS | John Locke Foundation Guest Editorial, Editorials, Op-Ed & Politics | Introduction Letter - NC Overcriminaization Task Force |

Latest Op-Ed & Politics

|

how many of these will come to North Carolina?

Published: Tuesday, April 23rd, 2024 @ 1:32 pm

By: John Steed

|

|

Barr had previously said he would jump off a bridge before supporting Trump

Published: Tuesday, April 23rd, 2024 @ 11:37 am

By: John Steed

|

|

Babis is leader of opposition in Czech parliament

Published: Tuesday, April 23rd, 2024 @ 10:28 am

By: John Steed

|

|

illegal alien "asylum seeker" migrants are a crime wave on both sides of the Atlantic

Published: Tuesday, April 23rd, 2024 @ 9:44 am

By: John Steed

|

|

only one holdout against acquital

Published: Tuesday, April 23rd, 2024 @ 9:01 am

By: John Steed

|

|

DEI now includes criminals?

Published: Monday, April 22nd, 2024 @ 8:33 pm

By: John Steed

|

|

Biden regime intends to force public school compliance as well as colleges

Published: Monday, April 22nd, 2024 @ 1:55 pm

By: John Steed

|

|

clamps down on oil drilling in Alaska

Published: Monday, April 22nd, 2024 @ 9:09 am

By: John Steed

|

|

plan put in place by Eric Holder

Published: Monday, April 22nd, 2024 @ 7:38 am

By: John Steed

|

|

prosecutors appeal acquittal of member of parliament in lower court for posting Bible verse

Published: Sunday, April 21st, 2024 @ 9:14 am

By: John Steed

|

|

Biden abuses power to turn statute on its head; womens groups to sue

Published: Friday, April 19th, 2024 @ 8:28 pm

By: John Steed

|