Your Basic Needs: Food, Shelter and The TRUTH

FY 2016-17 State Budget Limits Spending Growth, Cuts Taxes, Raises Teacher Pay

Publisher's note: This post, by Brian Balfour, was originally published in the Recent Articles section of Civitas's online edition.

North Carolina's 2016-17 state budget responsibly limited the growth rate of state spending, wisely padded the state's Rainy Day Fund, cut taxes further and continued one of the most aggressive trends of teacher pay increases in the nation.

Totaling $22.34 billion, the state budget signed by Gov. Pat McCrory on July 14 held year-over-year spending growth to 2.8 percent, a rate lower than the combined rate of population plus inflation growth by most accounts.

In dollar terms, that marks a $600 million increase from last year, and a $1.2 billion hike over the past two years.

Moreover, recent tax cuts are still being vindicated as North Carolina continues to see robust economic growth - and revenue surpluses.

Critics of the recently passed budget often make misleading comparisons between this year's budget and the pre-recession spending level of 2008. The aim of such criticism is to advance the narrative that North Carolina's state budget is "cut to the bone" and woefully "underfunded."

Such criticism, however, misses the mark for several reasons:

Recent budget figures and economic indicators point toward the conclusion that the 2013 tax reforms, and subsequent tax cuts, are working.

The 2016 state budget provides public school teachers with an average 4.7 percent pay raise. This is the fourth pay raise for teachers in the last five years, in contrast to three straight years of average teacher salary decline during the final years in which Democrats controlled the legislature. Including this boost, average teacher pay is up almost $10,000 - more than 20 percent - since the 2013-14 school year. This ranks North Carolina's teacher pay increases among the highest such raises in the country during this time.

In other noteworthy education news:

Budget writers wisely kept long-term fiscal solvency as a priority by setting aside another $475 million into the state's Rainy Day Fund - bringing the total to nearly $1.6 billion, or roughly 7.5 percent of the budget.

With the cyclical nature of our economy, and most observers suggesting that the next recession is not too far in the future, this move makes sense. Some critics are claiming that the state doesn't need such a robust savings reserve, but recent history tells us otherwise.

Two-thirds (roughly 66 percent) of General Fund spending is devoted to state worker salaries, benefits and retiree pensions and benefits. The total cost in this year's budget comes to more than $14.5 billion.

Thanks to rapidly growing pension and benefit obligations mandated by overly generous promises made by previous legislatures, the amount of taxpayer funds needed to finance such benefits is crowding out other budgetary priorities, even salary increases.

Go Back

North Carolina's 2016-17 state budget responsibly limited the growth rate of state spending, wisely padded the state's Rainy Day Fund, cut taxes further and continued one of the most aggressive trends of teacher pay increases in the nation.

Totaling $22.34 billion, the state budget signed by Gov. Pat McCrory on July 14 held year-over-year spending growth to 2.8 percent, a rate lower than the combined rate of population plus inflation growth by most accounts.

In dollar terms, that marks a $600 million increase from last year, and a $1.2 billion hike over the past two years.

Moreover, recent tax cuts are still being vindicated as North Carolina continues to see robust economic growth - and revenue surpluses.

Slowing the Rate of Spending Growth Was Long Overdue

Critics of the recently passed budget often make misleading comparisons between this year's budget and the pre-recession spending level of 2008. The aim of such criticism is to advance the narrative that North Carolina's state budget is "cut to the bone" and woefully "underfunded."

Such criticism, however, misses the mark for several reasons:

- 2008 is a high-water mark, the culmination of a 30-year spending binge. The recession revealed this out-of-control growth as unsustainable. To compare current spending levels to 2008 is to desire a return to skyrocketing budget growth - and also a corresponding massive budget hole, as happened when the Great Recession struck.

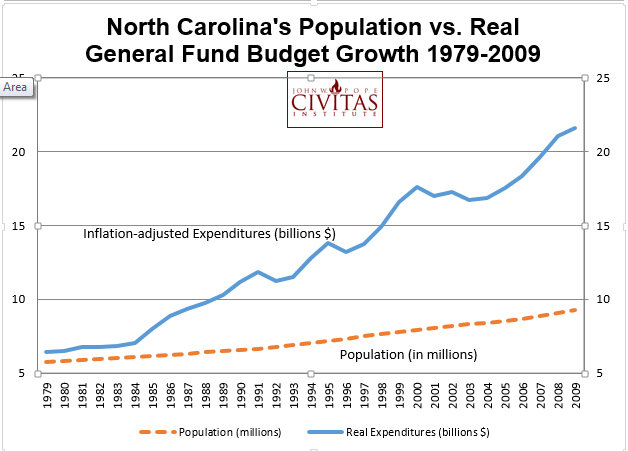

- As shown in the above chart, state spending from 1979 to 2009 skyrocketed at a rate three times the rate of population growth, even after adjusting spending for inflation.

- Inflation-adjusted, per person spending in the 2016 budget will total roughly $2,100. By comparison, the average per capita, inflation-adjusted state spending during the 1980s in North Carolina was only $1,300. In other words, the current budget spends about two-thirds more money per person than the average during the 1980s, even after adjusting for inflation.

- And this ignores the influx of federal funds flowing to the state - which has increased by three and a half times in the last 20 years.

- The bottom line: Long-term spending trends were out of control, and the recent slowdown of spending increases is just smoothing the trend-line a little bit.

Tax Cuts Are Working

Recent budget figures and economic indicators point toward the conclusion that the 2013 tax reforms, and subsequent tax cuts, are working.

- Contrary to the critics, the tax cuts have not "starved" the state government of revenue. Indeed, the most recent estimates conclude that the state will reap a revenue surplus of $425 million for the fiscal year that ended June 30.

- Analysts attribute the revenue surplus in large part to tax revenues coming in higher than anticipated, due to strong economic and job growth.

- As measured by the broadest employment statistical data, North Carolina has enjoyed the largest job market improvement in the Southeast, and the eighth largest in the nation from mid- 2013 to mid-2016.

- Also since mid-2013, North Carolina's economy has grown at one of the fastest rates in the country, and our average personal income growth has exceeded both the national and regional averages.

- Since 2010, state government spending as a share of the state's GDP has dropped steadily, which is good news indicating that less of the state's resources are controlled by politicians. This data also further demonstrates the healthy rate of the state's economic growth - as the economy's growth is outpacing the growth of the state budget.

- Buoyed by this good news, budget writers increased the standard deduction for all tax filers:

- Married filers will see their standard deduction increased by $2,000 by 2018; single-filers will see an increase of $1,000.

- This move is estimated to amount to a $145 million cut this year, $205 million next year.

Teacher Raises Among Highest in Nation Over Last Three Years

The 2016 state budget provides public school teachers with an average 4.7 percent pay raise. This is the fourth pay raise for teachers in the last five years, in contrast to three straight years of average teacher salary decline during the final years in which Democrats controlled the legislature. Including this boost, average teacher pay is up almost $10,000 - more than 20 percent - since the 2013-14 school year. This ranks North Carolina's teacher pay increases among the highest such raises in the country during this time.

In other noteworthy education news:

- Overall education spending in the 2016 state budget is up $513 million over last year, marking a 4.2 percent increase.

- $314 million of this increase is devoted to K-12 education spending.

- K-12 education spending has increased by $1.1 billion over the last six years - even after adjusting for inflation.

- Per student state support has risen by about $530 in the last six years, also adjusted for inflation.

- The budget lowers class sizes in early grades, adding nearly 450 first- grade teachers.

- The 2016 budget also included several incentive-based programs to further enhance teacher's earnings:

- Top 25 percent of third grade reading teachers whose students excel on reading tests can earn up to $6,500 in bonuses.

- (Pilot Program) Pay teachers $50 bonus - up to $2,000 a year - for each student who takes either an Advanced Placement or International Baccalaureate course and gets a certain grade on the exam.

- (Pilot Program) Bonus of $25 or $50 for each student - up to $2,500 per year - for every class taught by a teacher who provides instruction in a course that led to the attainment of an industry certification or credential.

- NC families will benefit from expanded school choice, as the 2016 budget develops a Reserve Fund of $34.8 million for the Opportunity Scholarship Program, in order to meet the demand of families on the growing waiting list.

- Taking money from public schools? Voucher programs comprise one-half of one percent of K-12 funding.

- No accountability? Voucher students must take national assessment exam once a year. The voucher may be subject to a financial audit. Voucher schools are subject to the same health, discrimination and safety laws as the traditional schools. Voucher schools are accountable to parents. A different form of accountability does not mean inferior.

- The budget bill also expands the Scholarships for Special Needs Students to $4,000 per semester.

- Community Colleges receive $30 million more in the 2016 budget.

- The UNC System receives one of the largest year-over-year increases of any major agency in the state budget at 6.2 percent.

Rainy Day Fund Contributions Demonstrate Fiscal Prudence

Budget writers wisely kept long-term fiscal solvency as a priority by setting aside another $475 million into the state's Rainy Day Fund - bringing the total to nearly $1.6 billion, or roughly 7.5 percent of the budget.

With the cyclical nature of our economy, and most observers suggesting that the next recession is not too far in the future, this move makes sense. Some critics are claiming that the state doesn't need such a robust savings reserve, but recent history tells us otherwise.

- These very same critics pointed out in 2009 that the onset of the Great Recession caused an estimated $4.6 billion "budget gap" heading into the FY 2009-10 budget year.

- Such a sizeable hole sent state legislators into a panic.

- The state relied on billions of federal stimulus funds to help plug the holes, but major, disruptive budget-cutting was necessary, along with ill-advised tax hikes that prolonged the misery for North Carolina's economy.

- If anything, state lawmakers need to continue to set aside more funds in the Rainy Day Fund in order for North Carolina to weather the next recession without going into panic mode.

- Neglecting rainy day savings is short-sighted and the type of mindset that the federal government has used to amass a national debt greater than $18 trillion, with unfunded liabilities exceeding another $80 trillion.

Unfunded Liabilities Accumulated by Previous Legislatures Crowd Out Funding for Higher Salary Increases

Two-thirds (roughly 66 percent) of General Fund spending is devoted to state worker salaries, benefits and retiree pensions and benefits. The total cost in this year's budget comes to more than $14.5 billion.

Thanks to rapidly growing pension and benefit obligations mandated by overly generous promises made by previous legislatures, the amount of taxpayer funds needed to finance such benefits is crowding out other budgetary priorities, even salary increases.

- Health benefits for retirees has amassed nearly $27 billion in unfunded liabilities - up a whopping $3.5 billion in two years.

- Unfunded liabilities for the state pension plan are estimated to be at least $3.7 billion - and most experts believe the true figure is much higher.

- The cost of the State Health Plan for current workers has reached $1.4 billion annually.

- The total annual cost to cover pension plan payouts is roughly $1.2 billion.

- The yearly cost to pay for retiree health benefits has grown to $662 million, marking a stunning 28 percent increase in just four years.

- In spite of these mounting fiscal pressures, the 2016 budget still provided a 1.5 percent across-the-board raise for state workers (other than teachers), along with a one-time bonus worth 0.5 percent of their salary. State retirees were also provided with a 1.6 percent increase in their pension payments.

| Civitas Action Unveils 2016 State Legislative Rankings | Civitas Institute, Editorials, Op-Ed & Politics | FY 2016-17 State Budget Limits Spending Growth, Cuts Taxes, Raises Teacher Pay |