Publisher's Note: This article originally appeared in the Beaufort Observer.

To listen to Governor Perdue and other Democrats you'd think the mean ole Republicans have slashed the budget so much that horrible things are happening to good people. The truth, however, is something very different.

As the Beaufort County Commissioners begin their budget workshops tonight (5-14-12) and as the General Assembly heads to Raleigh for the "short session" on the budget the truth should be known. Here it is.

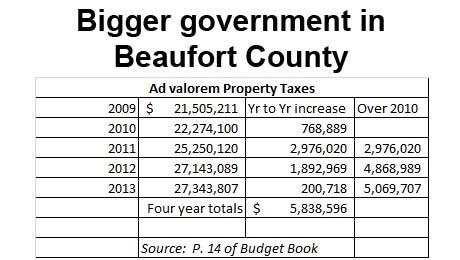

First, in Beaufort County the County Manager, who obviously has taken his cues from the Gang of Five, has presented a budget that continues the spending resulting from two tax increases for most people in the last two years. Here are the numbers (See Page 14 of Budget Book). In 2010 the ad valorem property tax rate was $.60. It collected $22,274,100 dollars from the taxpayers. With revaluation, in 2011 the rate was dropped to $.50 and $25,250,120 was collected. (Remember all that talk about "revenue neutral?" Well, revaluation resulted in a tax INCREASE OF $2,976,020, a 13.4% increase.)

Then in 2012 they raised

Here is the record of higher taxes passed by the Gang of Five (5-2) over the last four years

the rate to $.53 cents and that brought in $27,143,089. That is $4,868,989 more than was taken from the taxpayers in 2010. Do the math and you find that we have had a 22% increase in property taxes since 2010.

The 2013 recommended budget is based on a $.53 rate that is projected to produce $27,343,807. If that budget is not reduced we will suffer a $5,069,707 increase over 2010. In four years ad valorem taxes have increased cumulatively by $5,838,596. Thus, another way of saying it is that the proposed budget proposes to spend nearly six million more than was spent in 2009.

One can look at Beaufort County's budget in several different ways, but the numbers above tell a story you seldom hear from the officials. The simple fact is that Beaufort County is collecting much more in taxes than it used to. And in the 2013 budget it proposes to spend it all.

Here's the problem, as we see it. When revaluation takes place, or tax rates go up, in a given year they don't go up just that one time. They come back to bite the taxpayer EVERY year thereafter. It is the cumulative effect of raising taxes that hurts a county's economy. For example, the six million that has been taken out of the private economy in Beaufort County over the last four years is worth at least $48 million in lost productivity by businesses in Beaufort County (using the Economic Development Commission's oft used "multiplier effect.") That's a lot of jobs. That's a lot of commerce that did NOT happen because taxes increased the cost of doing business in Beaufort County.

Now think about that the next time you hear a politician claim to be for "jobs" or economic development. When you hear a politician say they favor "economic development incentives" what they are really saying is they favor raising taxes and then them deciding which of their chosen buddies will get subsidies. Ask them why we would not be better off reducing the cost of doing business by lower taxes.

We have also heard about how the mean ole Republicans have cut state spending so that horrible things have been happening. But the John Locke Foundation has just published a new study that shows:

• Total state spending per capita is at its highest level ever in the 2012 fiscal year and has more than tripled since 1970--from $1,701 to an authorized $5,247.

• Over the past four decades, state spending has grown much faster than personal income, rising as a percentage from 10.9 in 1970 to 14.4 in 2012.

• A simple cap on state spending at inflation and population growth since 2000 would have restrained spending to $38.5 billion, 75 percent of the current $51.5 billion.

• In real, per capita terms, spending on all reported categories has more than doubled since the mid-1970s. That includes education, corrections, health and human services, transportation, and debt servicing.

• General fund spending per capita has declined by 16 percent since 2009, but per capita spending outside of the general fund increased by 26 percent and more than compensated for the general fund's decline.

• General fund spending comprises 38 percent of total state spending in 2012, down from 53 percent in 1970 and 59 percent in 2000.

• Federal aid continues to comprise an ever-larger portion of the state budget. In 2012, 36 percent of state revenue is from federal aid, up from 21 percent in 1975 and 24 percent in 2000.

• North Carolina's cash-basis accounting conceals spending and is generating unfunded liabilities--obligations to pay without sufficient funds set aside. The state's largest is for employee retirement health benefits, unfunded by at least $34.2 billion at the end of 2010. The $4.4 billion growth of this specific liability over 2009 and 2010, constituted 4.8 percent of total state spending for that period.

Click here to go to a page that will allow you to download the full report.

Commentary

The above numbers are staggering. What they show pure and simply is the enormous growth of government at the county and state levels. Most people don't look at tax increases as cumulative. But that is the real story here. Once taxes are raised they never come down. They have a cumulative effect year after year after year.

The problem with government taking so much from people in taxes is that it leaves that much less money to be used in the productive economy. Just the tax increases (not the total taxes, just the increases) over the last four years has taken more money out of the economy than all the efforts at economic development we have ever put into "creating jobs." In other words, taxes are killing the goose that lays the golden eggs. The six million in cumulative increases would have turned over in the county's economy at least eight times. That is $48 million in just four years that would have been increased production in Beaufort County. Everyone would have benefitted from that commerce. But it is gone.

To be sure, some of the tax money got re-invested in the local economy. But the chances are that money did not produce as much as if it had been left with businesses who would have increased economic productivity. That increased productively would have generated more taxes.

So why can't the five county commissioners (Cayton, Langley, McRoy, Klemm and Booth) see the harm they are doing to everybody in Beaufort County by continuing to spend more and raise taxes more, every year on top of what they've done in years past? Perhaps that's a question we should all be asking those who are running for election this year.

When you boil all this down to its essentials what you have is a "transformation" of government in America from Washington to the county level. That transformation is from free enterprise to socialism. Socialism is government control of the means of production and distribution of economic activity. Free enterprise is the market making those decisions. Confiscatory taxation is the mechanism we are using in America to impose socialism on what was once the most productive economic system in human history. Socialism has never work anywhere it has been tried, except in the family where the decision makers care more about their loved ones than themselves. But out in the Real World it has never, ever worked. So why are we doing this?