Agenda 2012: State Tax Reform -- Income Tax | Eastern North Carolina Now

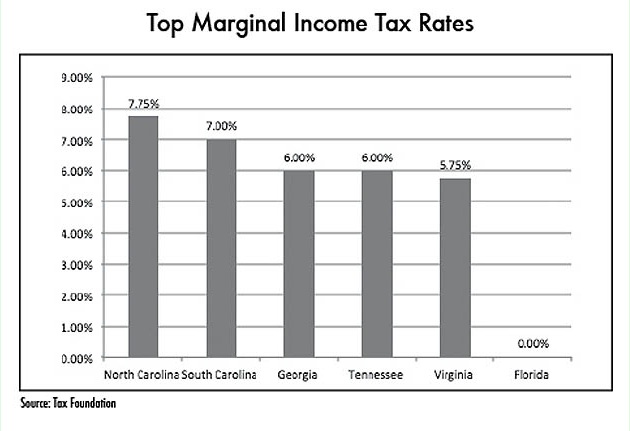

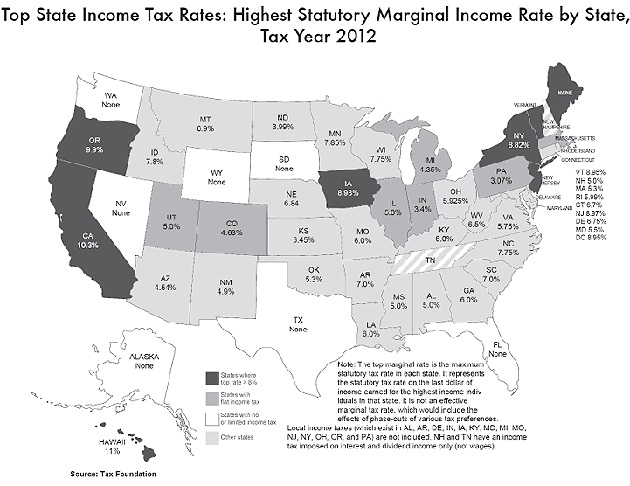

North Carolina's state income tax penalizes people's income-generating activities by reducing the rewards to work, saving, investment, and entrepreneurship.

| Where is the Outrage? | John Locke Foundation Guest Editorial, Editorials, Op-Ed & Politics, Bloodless Warfare: Politics | Is a Republican governor REALLY all that necessary? |

|

(RALEIGH) Today Governor Josh Stein announced the following judicial appointment:

Published: Tuesday, September 9th, 2025 @ 10:30 pm

By: Governor's Office

|

|

President Donald J. Trump slammed failed Governor Roy Cooper's soft-on-crime agenda that led to the tragic murder of Ukrainian refugee, Iryna Zarutska, by a career criminal in North Carolina.

Published: Tuesday, September 9th, 2025 @ 2:43 pm

By: Eastern NC NOW Staff

|

|

WASHINGTON, D.C. — Soft-on-crime Democrat Roy Cooper stayed silent this weekend after police released the footage of a repeat offender brutally murdering an innocent passenger on the Charlotte Light Rail.

Published: Tuesday, September 9th, 2025 @ 10:01 am

By: Eastern NC NOW Staff

|

|

Today Governor Josh Stein announced appointments to boards and commissions.

Published: Tuesday, September 2nd, 2025 @ 12:32 pm

By: Governor's Office

|

|

Today Governor Josh Stein signed Executive Order 23, establishing the North Carolina Energy Policy Task Force to strengthen the state’s electricity infrastructure and energy affordability as demand increases.

Published: Thursday, August 28th, 2025 @ 7:26 am

By: Governor's Office

|

|

I am honored to announce my candidacy for City Council.

Published: Sunday, August 10th, 2025 @ 6:50 pm

By: Nick Fritz

|

|

The N.C. Department of Environmental Quality’s Division of Coastal Management announced nearly $6 million in Resilient Coastal Communities Program (RCCP) grants, with nearly $1.2 million of that going to support communities in District 3.

Published: Monday, July 28th, 2025 @ 6:05 pm

By: Eastern NC NOW Staff

|

|

National Republican Senatorial Committee (NRSC) Chairman Tim Scott released the following statement commenting on President Trump's "complete and total endorsement" of Michael Whatley for the North Carolina U.S. Senate race in a Truth Social post earlier this evening:

Published: Sunday, July 27th, 2025 @ 8:17 am

By: Eastern NC NOW Staff

|

|

(RALEIGH) Today, Governor Josh Stein announced that the Department of Natural and Cultural Resources has awarded more than $2.6 million to trail development and restoration projects in eastern North Carolina.

Published: Friday, July 25th, 2025 @ 8:23 am

By: Governor's Office

|