Boldly Committed to Truth Telling in the False Face of Fakery

Corporate Income Tax Revenue, Do We Need It?

Publisher's Note: This post appears here courtesy of the John Locke Foundation. The author of this post is Paige Terryberry.

The Left insists government is better poised than you to spend more of your hard-earned money. Arguing against tax cuts, North Carolina Justice Center claims the tax cuts in the state's new budget "will permanently reduce revenue that the state has available to pay for every area of the budget."

In particular, some have argued that the government needs the money from the corporate income tax, one of the most detrimental taxes to economic growth, to "support the public schools, public health, and other public goods." Even without a massive surplus, significant pork spending, and unprecedented federal stimulus, this argument is invalid.

Yes, the government uses our tax revenue to function and to fund many programs. But the argument that the corporate income tax revenue is needed for government functions is flawed.

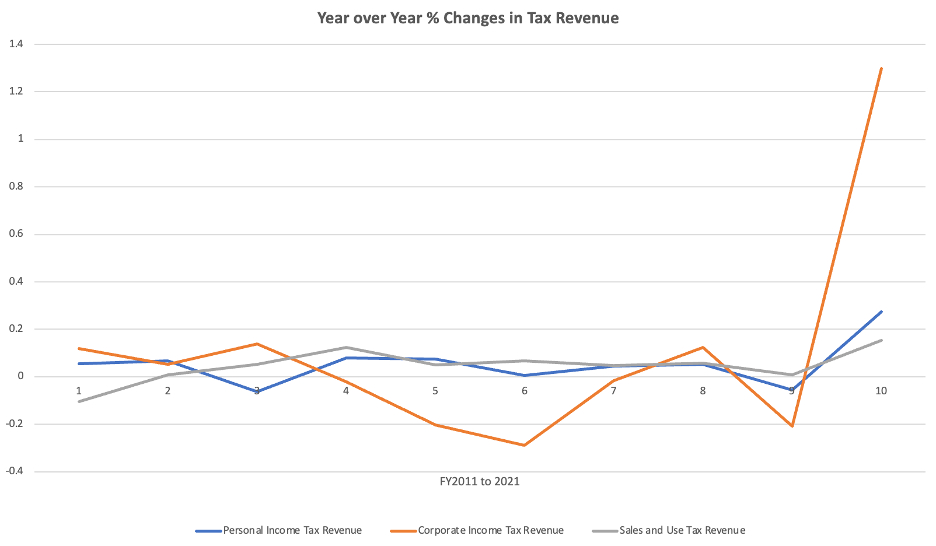

Separate from the fact that the corporate income tax penalizes workers, the revenue from this tax is tiny and volatile.

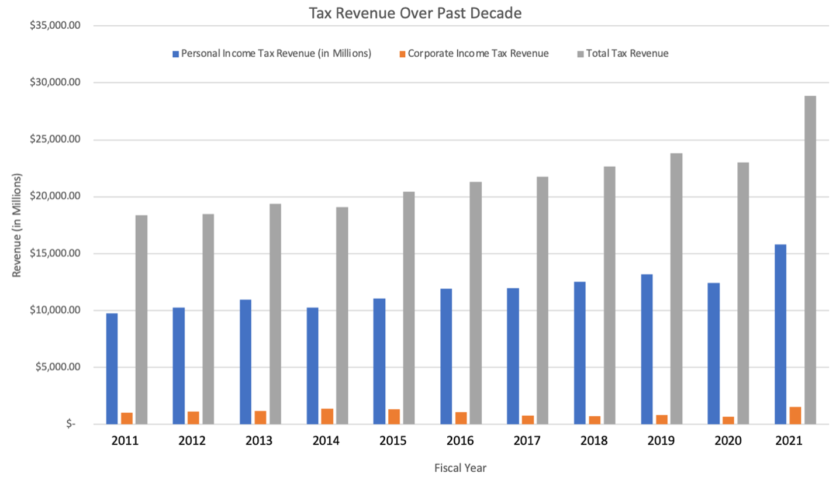

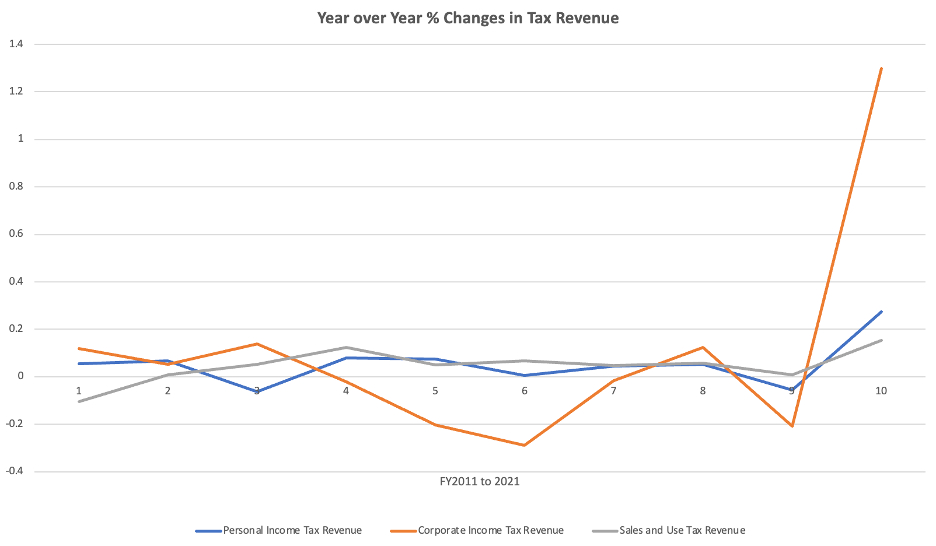

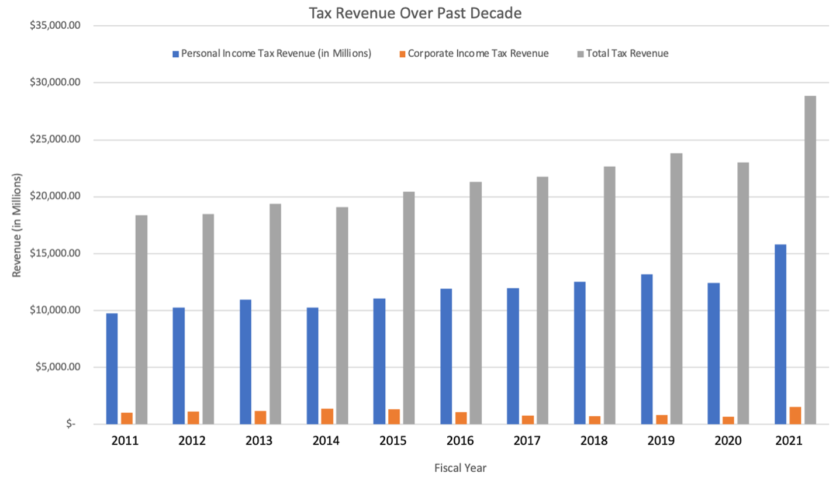

See the below graphs. Even before the tumult brought by Covid, the state corporate income tax revenue is minuscule, making up less than 3.5% of total tax revenue in each of the four years prior to the Covid-lockdown riddled fiscal year of 2020-21.

Moreover, it is not a reliable source of revenue but is the most volatile source of tax revenue.

SOURCE: OSC.NC.GOV

And without a corporate income tax, legislators could end the practice of doling out hundreds of millions in corporate welfare, which would help offset a portion of lost revenue.

Additionally, the corporate income tax comes with heavy administrative costs to both businesses and the collecting agency. Overall compliance costs for businesses have increased.

The General Assembly's laudable efforts this year to phase out this tax will relieve businesses of burdensome compliance, liberate workers, and have a negligible effect on the workings of government.

Go Back

The Left insists government is better poised than you to spend more of your hard-earned money. Arguing against tax cuts, North Carolina Justice Center claims the tax cuts in the state's new budget "will permanently reduce revenue that the state has available to pay for every area of the budget."

In particular, some have argued that the government needs the money from the corporate income tax, one of the most detrimental taxes to economic growth, to "support the public schools, public health, and other public goods." Even without a massive surplus, significant pork spending, and unprecedented federal stimulus, this argument is invalid.

Yes, the government uses our tax revenue to function and to fund many programs. But the argument that the corporate income tax revenue is needed for government functions is flawed.

Separate from the fact that the corporate income tax penalizes workers, the revenue from this tax is tiny and volatile.

See the below graphs. Even before the tumult brought by Covid, the state corporate income tax revenue is minuscule, making up less than 3.5% of total tax revenue in each of the four years prior to the Covid-lockdown riddled fiscal year of 2020-21.

Moreover, it is not a reliable source of revenue but is the most volatile source of tax revenue.

SOURCE: OSC.NC.GOV

And without a corporate income tax, legislators could end the practice of doling out hundreds of millions in corporate welfare, which would help offset a portion of lost revenue.

Additionally, the corporate income tax comes with heavy administrative costs to both businesses and the collecting agency. Overall compliance costs for businesses have increased.

The General Assembly's laudable efforts this year to phase out this tax will relieve businesses of burdensome compliance, liberate workers, and have a negligible effect on the workings of government.

| Building a Conservative Vision for Education | John Locke Foundation Guest Editorial, Editorials, Op-Ed & Politics | What is Gene Nichol Hiding About Poverty in NC? |

Latest Op-Ed & Politics

|

this is the propagandist mindset of MSM today

Published: Wednesday, April 17th, 2024 @ 3:04 pm

By: John Steed

|

|

Police in the nation’s capital are not stopping illegal aliens who are driving around without license plates, according to a new report.

Published: Wednesday, April 17th, 2024 @ 8:59 am

By: Daily Wire

|

|

same insanity that created Covid

Published: Wednesday, April 17th, 2024 @ 8:58 am

By: John Steed

|

|

Davidaon County student suspended for using correct legal term for those in country illegally

Published: Wednesday, April 17th, 2024 @ 7:23 am

By: John Steed

|

|

given to illegals in Mexico before they even get to US: NGOs connected to Mayorkas

Published: Tuesday, April 16th, 2024 @ 11:36 am

By: John Steed

|

|

committee gets enough valid signatures to force vote on removing Oakland, CA's Soros DA

Published: Tuesday, April 16th, 2024 @ 10:32 am

By: John Steed

|

|

other pro-terrorist protests in Chicago shout "Death to America" in Farsi

Published: Monday, April 15th, 2024 @ 9:13 pm

By: John Steed

|

|

claim is needed "to meet climate targets

Published: Monday, April 15th, 2024 @ 2:07 pm

By: John Steed

|

|

Only two of the so-called “three Johns” will be competing to replace Sen. Mitch McConnell (R-KY) as leader of the Senate GOP.

Published: Monday, April 15th, 2024 @ 12:50 pm

By: Daily Wire

|

|

particularly true on economic matters

Published: Sunday, April 14th, 2024 @ 8:58 pm

By: John Steed

|

|

House Judiciary Chair Jim Jordan (R-OH) is looking into whether GoFundMe and Eventbrite cooperated with federal law enforcement during their investigation into the financial transactions of supporters of former President Donald Trump.

Published: Sunday, April 14th, 2024 @ 6:56 pm

By: Daily Wire

|