REAL News for REAL People

How Loans Are Shaping the Finance Industry

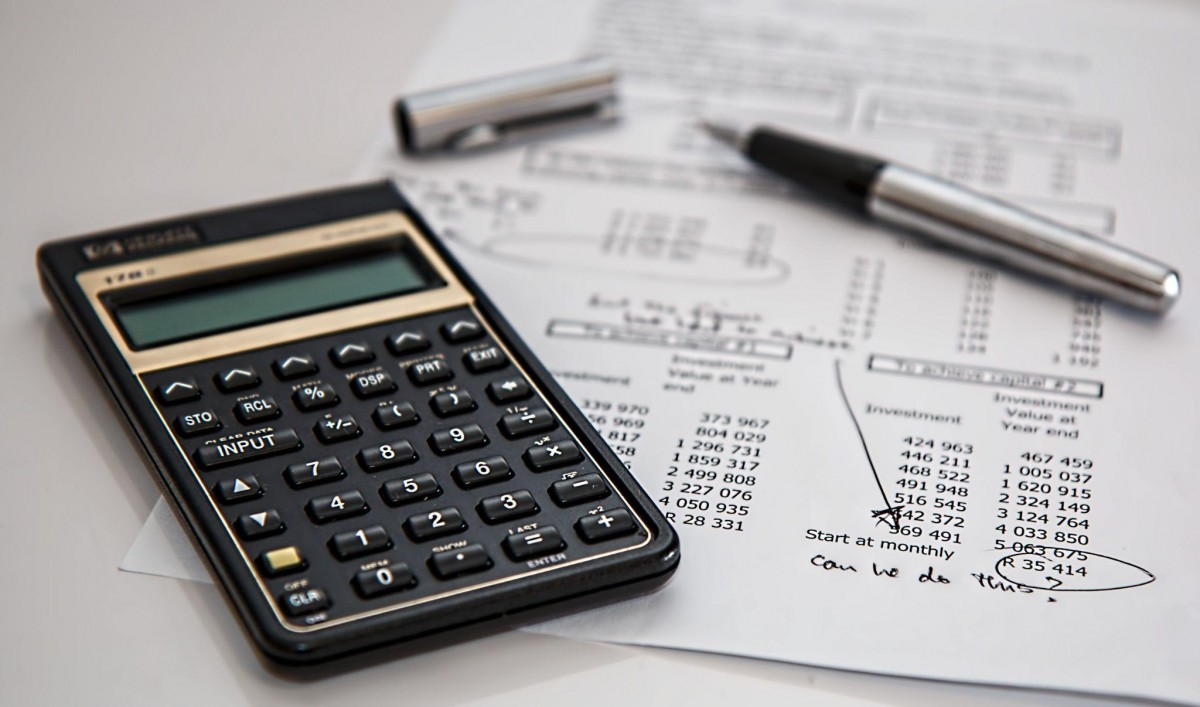

The financial services sector is facing an unprecedented time of transformation. The rapid digitization of the world and its growing online population, coupled with many new solutions, have created a perfect storm for the industry, forcing it to adapt to new market realities.

With so many changes taking place at once, it can be difficult to see where exactly the finance sector is headed. In this post, we'll take a closer look at how loans are shaping the future of the finance industry and why these changes are inevitable.

Change Is the Only Constant

When it comes to the world of finance, there are two things that are certain: uncertainty and change. With change being an ongoing part of the industry, it's important to identify how different factors are having an impact on how loans are shaping the future of the finance industry.Shifting demographics and evolving customer preferences are creating a new type of customer, one that is more informed, more discerning and more demanding. The convergence of technologies and their adoption is also creating new ways of doing business. When it comes to the future of finance, the industry has seen its share of disruption, transformation, and adaptation.

All of these changes have contributed to shaping the future of finance, especially with digital lending being one of the biggest drivers. Recently, some of the world's largest tech companies, including Facebook and Apple, have become lenders, threatening the dominance of traditional banking.

The Rise of Digital Lending

Digital lending, also known as online lending or online financing, is the practice of loaning money using online channels. The creation of digital lending has been influenced by the rapid growth of online spending, which has increased significantly over the last decade.The shift toward online retail is a huge opportunity for the finance industry, with online lenders and online banking growing at a much faster rate than their offline counterparts. As a consumer, there are many important facts to look out for. For example, is a payday loan variable or fixed rate? Payday loans are short-term loans that are typically granted by financial institutions or lenders.

These loans are also called cash advance loans, and they can be used in case of an emergency when you don't have enough cash to cover expenses such as car repairs, medical bills, home repair costs, or whatever else might come up unexpectedly.

Impact of Fintech in the Finance Industry

The inception of Fintech has resulted in significant changes to the finance industry and a lot of disruption in existing business models, especially in the banking sector. Fintech has been responsible for the decline in the use of cash and cheques and the growth of online payments.While cash is still the most commonly used payment method worldwide, the share of cash is decreasing in almost every region. Fintech has also increased the use of personal loans, mortgages, and other types of loans. Personal loans have been one of the fastest-growing loan types since the financial crisis.

Consumers Are Taking Control

With advancements in technology and the digitization of the financial services industry, consumers are increasingly empowered to take control of their finances. Online lending has allowed consumers to gain more control and make their lives easier, especially when it comes to finances.Many companies have allowed consumers to make payments, save money, and be in control of their finances 24/7, with the help of digital banking, online payments, and other digital solutions. Since the financial crisis of 2008, Fintech has become increasingly important, especially in the last few years. Nowadays, Fintech can be seen in almost every aspect of the industry and is shaping the future of finance.

Conclusion

While these technological advancements are expected to change the way banks operate, they will also have a significant impact on consumers' access to credit and the way they manage their finances. During this time of transformation, it is important to identify how different factors are having an impact on the future of finance.By understanding how the increase in digital lending, various companies, marketing and the growing adoption of new technologies are shaping the future of finance, we can be better prepared for what lies ahead.

| Four Reasons to Support Tax Cuts for North Carolina | Pointers of Interest, A Business Perspective, Business | Offshore Wind Facilities Would Wreck N.C.’s Coastal Fishing Industry and Marine Ecosystems |

Latest Business

|

A former Boeing employee who raised safety concerns related to the company’s aircraft production was found dead this week.

Published: Saturday, March 30th, 2024 @ 4:41 pm

By: Daily Wire

|

|

A national report card on hospital patient safety has ranked North Carolina in third place among hospitals in the U.S. that had mostly “A” ratings when it comes to patient safety, up from sixth place this past spring.

Published: Monday, March 25th, 2024 @ 5:22 pm

By: Carolina Journal

|

|

RALEIGH: Lynddahl Telecom America Inc. (LTA), a duct solutions company for fiber optics installations, will create 54 new jobs in Gaston County, Governor Cooper announced today.

Published: Sunday, March 24th, 2024 @ 9:32 am

By: Governor's Office

|

|

A unanimous three-judge panel of the state Court of Appeals has ruled in favor of the North Carolina Farm Bureau Federation, and against the Department of Environmental Quality, in a dispute over animal-waste permits.

Published: Thursday, March 21st, 2024 @ 5:23 pm

By: Carolina Journal

|

|

Trying to turn our oceans into sprawling, on-again/off-again electric stations is becoming even more prohibitively expensive.

Published: Wednesday, March 20th, 2024 @ 1:06 am

By: John Locke Foundation

|

|

Gateway to the World: North Carolina's ports see record traffic

Published: Monday, March 18th, 2024 @ 3:37 am

By: John Locke Foundation

|

|

Mercedes-Benz is scrapping its plans to only sell electric vehicles after 2030 as consumer demand for EVs remains lower than what automakers projected.

Published: Saturday, March 16th, 2024 @ 11:12 am

By: Daily Wire

|

|

A subsidiary of one of the largest health insurance agencies in the U.S. was hit by a cyberattack earlier this week from what it believes is a foreign “nation-state” actor, crippling many pharmacies’ ability to process prescriptions across the country.

Published: Tuesday, March 5th, 2024 @ 1:12 am

By: Daily Wire

|

|

The John Locke Foundation is supporting a New Bern eye surgeon's legal fight against North Carolina's certificate-of-need restrictions on healthcare providers.

Published: Monday, March 4th, 2024 @ 11:08 am

By: Carolina Journal

|

|

The cellular outage that crippled service for AT&T customers all over the U.S. on Thursday was likely the result of a software update gone wrong, the company said.

Published: Sunday, March 3rd, 2024 @ 8:51 pm

By: Daily Wire

|

|

North Carolina has climbed to rank 9th in the nation for its tax climate, according to the latest study conducted by the nonprofit Tax Foundation.

Published: Sunday, March 3rd, 2024 @ 3:17 pm

By: Carolina Journal

|

|

The Tax Foundation, a Washington D.C. based nonpartisan tax policy research organization, has released its 2024 State Business Tax Climate Index.

Published: Sunday, March 3rd, 2024 @ 12:49 pm

By: John Locke Foundation

|

|

Toyota, Kempower, and Epsilon Advanced Materials – all companies in clean energy industries – top the year’s $12.9 billion project list

Published: Sunday, March 3rd, 2024 @ 12:09 pm

By: Governor's Office

|