Publisher's Note: This post appears here courtesy of the John Locke Foundation. The author of this post is Paige Terryberry.

- The North Carolina House, Senate, and governor have each released their budget proposals for the upcoming biennium

- The price tags, tax cuts, teacher pay increases, and savings from these budgets would have differing fiscal effects on North Carolina

- Over the coming weeks, the North Carolina General Assembly will convene to agree upon a conference budget to send to Gov. Cooper

Budget talks are underway in Raleigh as the state Senate and House come together to arrange a conference budget for the upcoming biennium. The Senate and House have each already released their budget proposals, and Gov. Roy Cooper released his recommended budget in March.

Though budget proposals have copious elements ranging from health care to capital spending, this article examines differences in just four key areas: the bottom-line spending number, taxpayer savings, teacher pay increases, and Rainy Day Fund savings.

The Price Tag

The bottom-line spending number of a state budget is extremely important. Overspending produces unsustainable budgets, leaving taxpayers on the hook. In our state's past, legislators have paid for such spending with tax hikes and state employee layoffs. Over the past decade, however, conservative leaders in the General Assembly have restrained spending, allowing for ample tax cuts that ensure more money remains in the pockets of those who earned it.

The House and Senate budget versions propose to increase spending by 6.5% in the first year, increasing the total spending to $29.8 billion in the fiscal year (FY) 2023-24. Both propose spending $30.9 billion for the second year, though that number would likely be adjusted during next year's short session.

Gov. Cooper, however, would increase spending by 18% to $32.95 billion in the first year if he had his way. This would be an egregious increase, especially on the eve of a recession. Such government expansion would ultimately harm North Carolinians footing the bill.

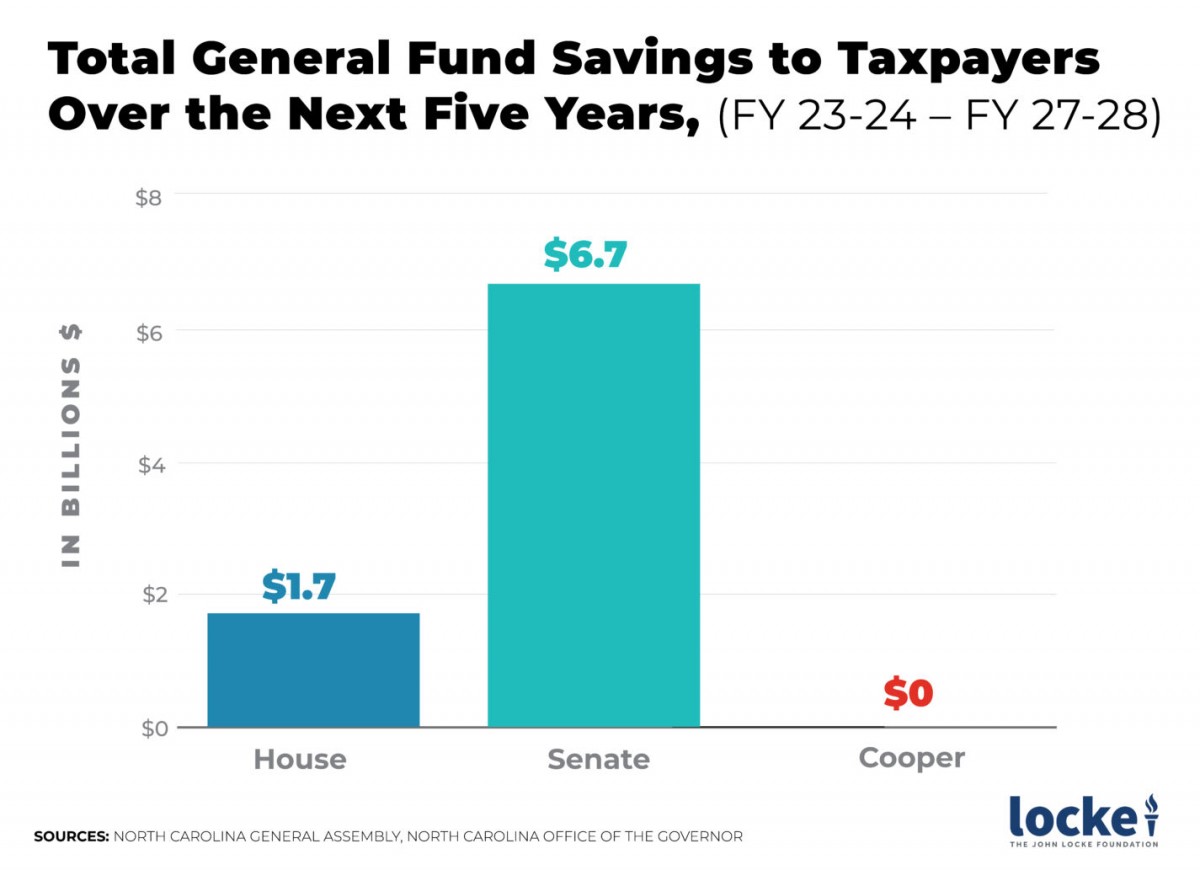

Taxpayer Savings

Taxpayer Savings

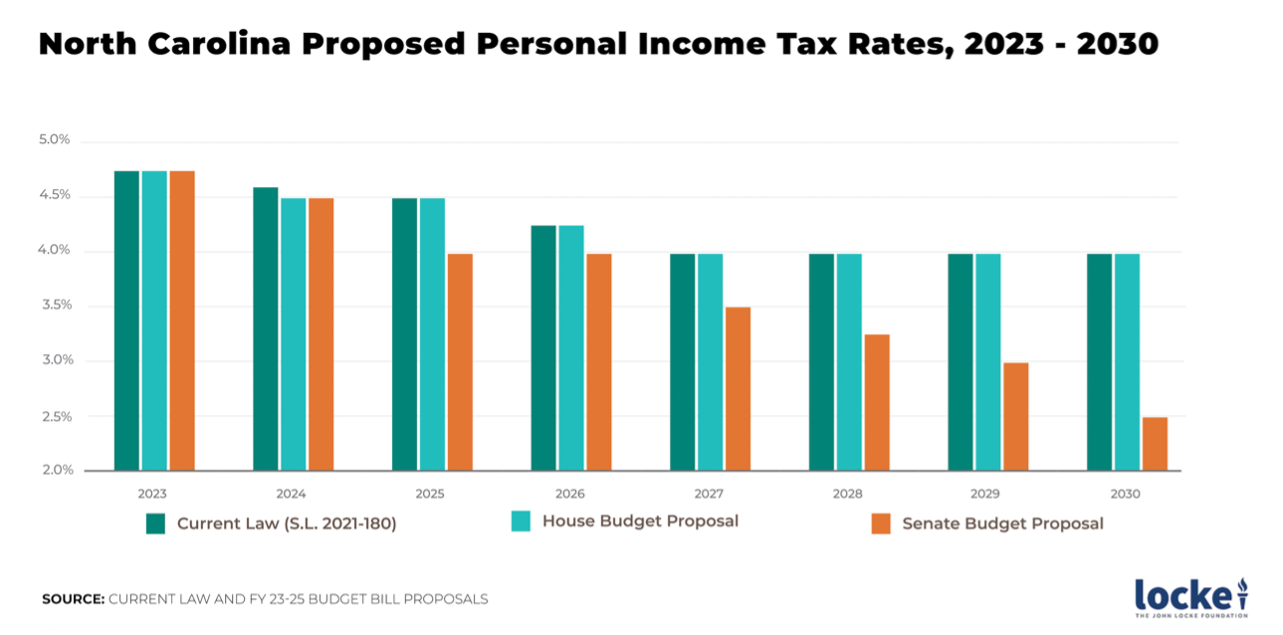

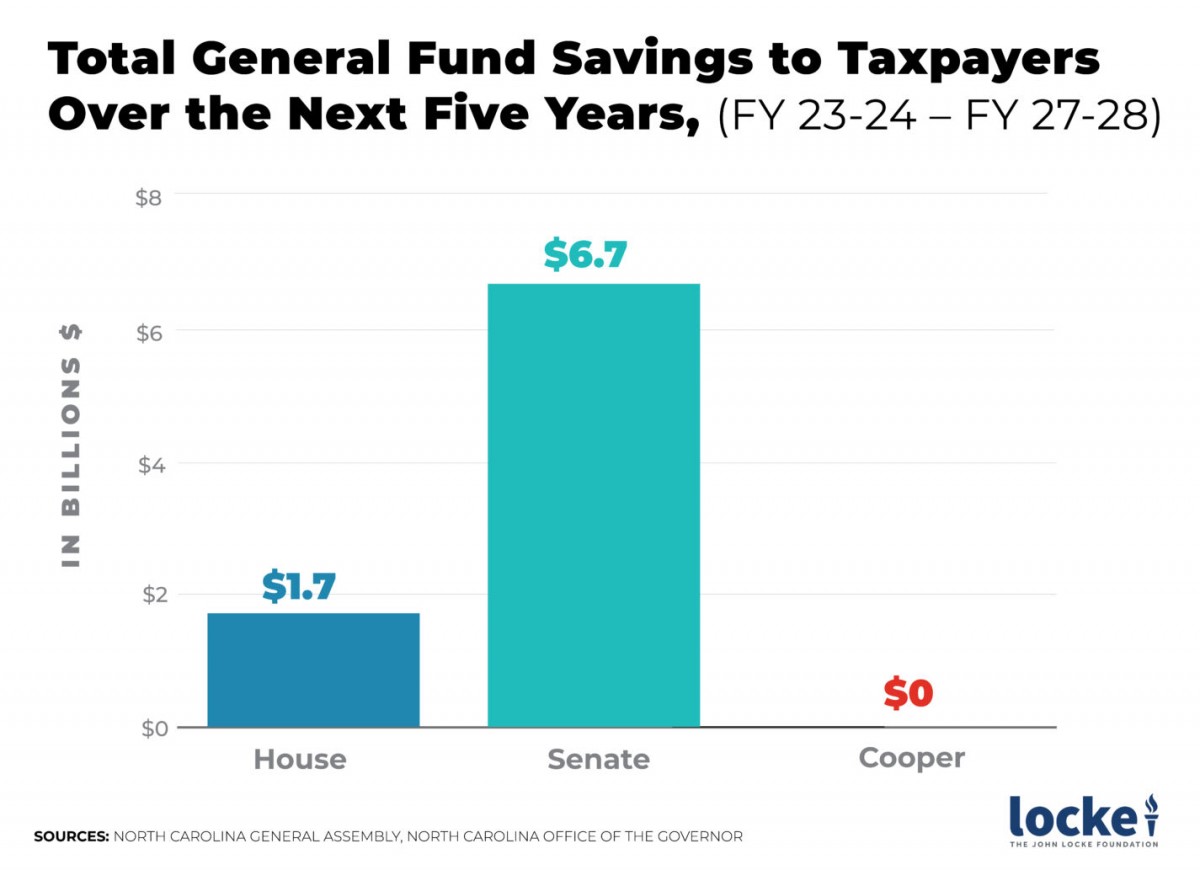

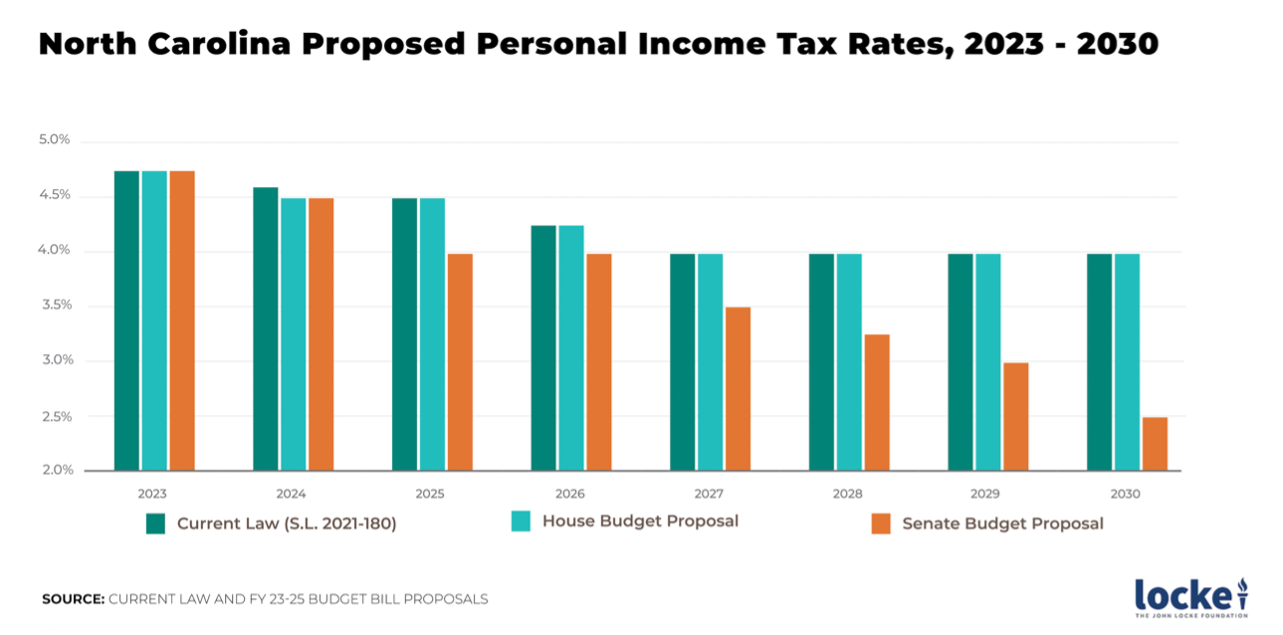

Both the House and Senate budget proposals would cut taxes. By law the personal income tax rate is already scheduled to decrease to 3.99% by 2027. The Senate budget would bring the flat rate to 2.49%, the lowest flat rate in the nation (among states that tax personal income), by 2030. While the House budget wouldn't go that far, it would accelerate the current rate decreases. See the below chart for an illustration of the proposed cuts:

Concerning the corporate income tax rate, by law it is scheduled to be phased out entirely by 2030. The current rate is 2.5%. The rate decreases are scheduled to begin in 2025, when the rate will be lowered to 2.25%. Neither the House nor Senate budget proposals make any changes to this schedule.

Though the Senate proposed more aggressive cuts to the personal income tax, the House budget proposal would raise the standard deduction, increase the child tax deduction, establish a refundable adoption tax credit, repeal the privilege license tax, and reduce franchise tax liabilities.

Cooper's proposed budget would take our flat personal income tax rate back to a progressive, two-tiered rate, halting tax reform for some. And he would stop the corporate income tax phaseout, denying workers bigger paychecks and more job options as this tax is passed down to workers.

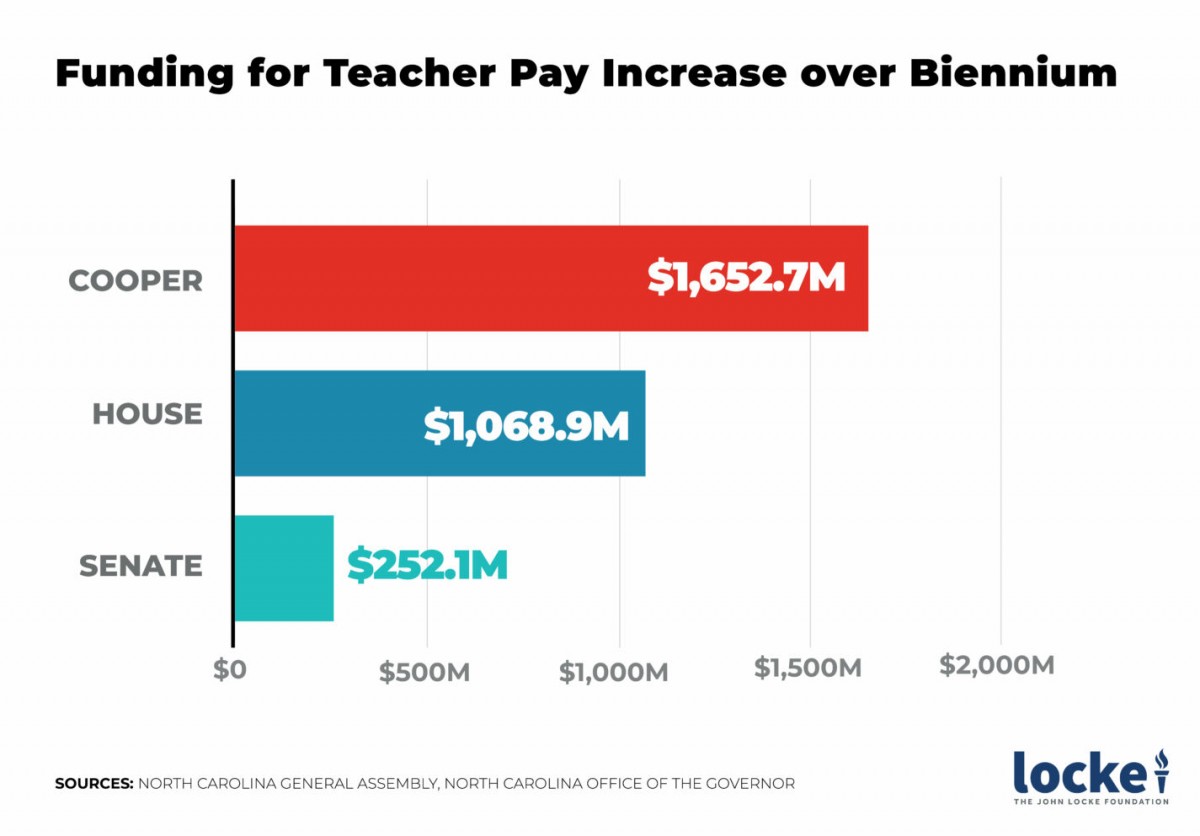

Teacher Pay

Teacher Pay

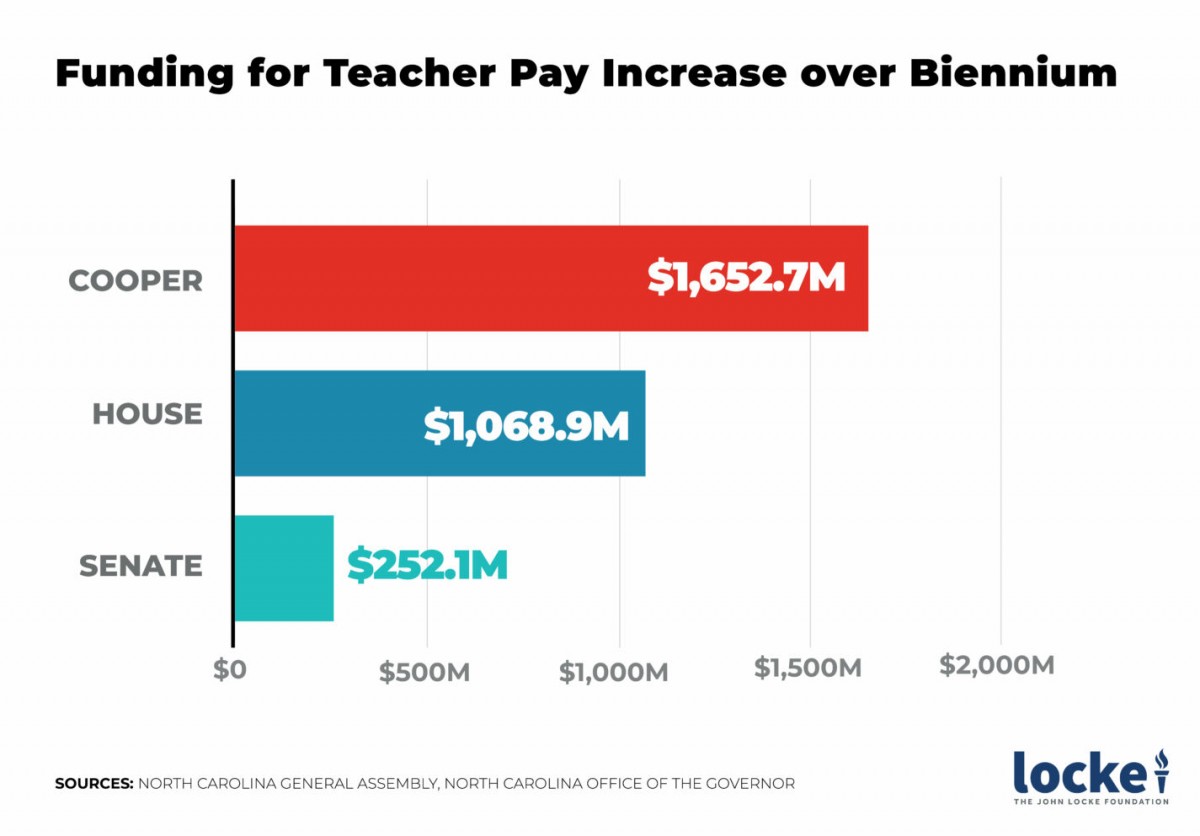

Each budget proposal would increase teacher pay, although the approaches differ. Cooper included a 16.6% average increase in teacher pay over the biennium. The Senate included a 4.5% average increase, and the House called for a 10.2% increase in pay over the same period, when step increases are included. The table below shows the estimated dollar amounts associated with just the proposed teacher salary increases over the biennium.

The House proposal and Cooper's proposal would reinstate master's pay for teachers with advanced degrees, despite evidence showing master's degrees for teachers do not translate into better student achievement.

Separate from the teacher pay issue, which dominates much of the public discourse, Cooper's plan would eliminate the Opportunity Scholarship Program, which allows working parents access to funds to send their children to the private school of their choice, while the House and Senate plans would expand eligibility for the program.

Rainy Day Fund

State law requires 15% of the estimated growth in state tax revenues to be allocated for the Rainy Day Fund (the Savings Reserve) for each fiscal year of the upcoming biennium. The graph below looks at the proposed contribution to the Savings Reserve on top of the statutory requirement for the first fiscal year of the biennium only. Savings Reserve funds can be allocated only by the General Assembly.

The Senate is the only chamber that proposed additional funding for the Savings Reserve, a move that would bring the total fund to $5 billion. Cooper called the Savings Reserve

"overfunded" and proposed to transfer $500 million out of it.

Negotiations are underway between the state House and Senate to develop a conference budget plan. The plan is largely expected to be released before the fiscal year begins on July 1. The last long session included the first time Cooper signed a state budget into law. This time, with a Republican supermajority able to override his veto, Gov. Cooper's signature is not crucial to the passage of this budget.