Press Release:

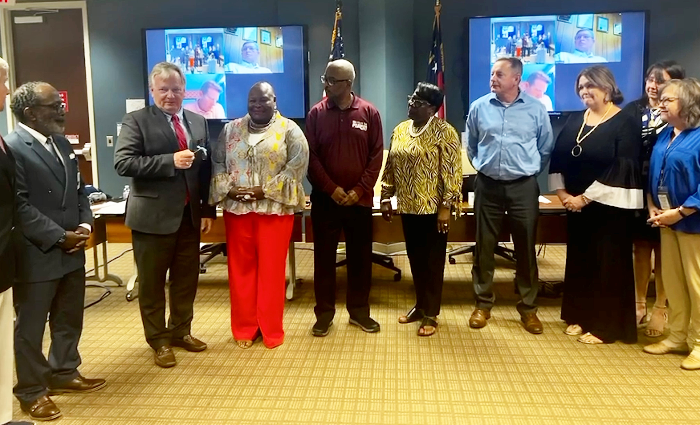

State Treasurer Dale R. Folwell (second from left) presents a symbolic key to Robersonville Mayor Tina Brown during the September Local Government Commission meeting. A brief ceremony was held for LGC members to congratulate town elected officials and staff. The LGC returned financial control to the town after town officials corrected financial and operational issues that led to the state assuming control of their books.

(Raleigh, N.C.)

State Treasurer Dale R. Folwell (second from left) presents a symbolic key to Robersonville Mayor Tina Brown during the September Local Government Commission meeting. A brief ceremony was held for LGC members to congratulate town elected officials and staff. The LGC returned financial control to the town after town officials corrected financial and operational issues that led to the state assuming control of their books.

(Raleigh, N.C.) Robersonville Mayor Tina Brown is appreciative of the intensive assistance the Local Government Commission provided in getting her Martin County town back on financial track. But she is committed to never being in that position again.

Mayor Brown and other town officials were at the Local Government Commission (LGC) meeting on Tuesday, Sept. 12, during which commission members voted to remove Robersonville from the list of local government units under their financial control and return bookkeeping and fiscal affairs to town staff. State Treasurer Dale R. Folwell, CPA, who chairs the LGC, presented Mayor Brown with a symbolic key to the city during a brief recognition ceremony.

Robersonville, located in the Inner Banks, incorporated in 1872 and flourished in the tobacco trade. But the town of about 1,300 residents experienced governance and financial problems in recent years. It had failed to submit two consecutive annual audits as required, did not maintain an accounting system to detail assets, liabilities, revenues and expenditures, didn't comply with generally accepted principles of government accounting and didn't create a plan to remedy the issues.

The LGC exercised its statutory authority to impound the town's books and assume control of its financial affairs on Oct. 6, 2020. The commission, which is staffed by the Department of State Treasurer (DST) personnel, went to work immediately with town officials on an action plan to correct the deficiencies. On Tuesday, the efforts paid off when the state relinquished control of the town's books.

"We have 549 mayors in North Carolina. Mayor Brown stands out because she came before the commission in 2020 and thanked the LGC staff for making a difficult choice that was in the best interest of her town and her constituents. We never want to assume financial control of a town, and don't take that decision lightly. But we are blessed with great staff that can step in immediately to fix broken systems," Treasurer Folwell said.

"When she ran for mayor, she had no idea the town was in the condition it was in. Through tough choices, discipline and communication with our staff, she and other town officials reversed course. They determined what was right, how to get it right, and are now on course to keep it right," Treasurer Folwell said.

"We weren't expecting to have to surrender our town to the state, but I am glad that we went through what we went through because it makes us better and stronger, and it just shows that we are resilient. And this is just the beginning," Mayor Brown said. Town officials are excited to resume authority over their affairs,

"as much as we love you guys and we appreciate everything," she said.

"This doesn't mean we're just walking away," said Deputy Treasurer Sharon Edmundson, who heads DST's State and Local Government Finance Division.

"We will still be available for consultation and assistance when needed, and we will check in with them regularly." The LGC staff provided the town with a check list of to-do items over the next six months to a year.

In other action, the LGC approved two requests for airport projects and another for Spectrum Center Arena improvements in Charlotte. Those were among numerous applications on the agenda.

The LGC has a statutory duty to approve most debt issued by units of local government and public authorities in the state. The commission examines whether the amount of money that units borrow is adequate and reasonable for proposed projects and confirms the governmental units can reasonably afford to repay the debt. It also monitors the financial well-being of more than 1,100 local government units.

LGC members gave the go-ahead to $475 million in revenue bonds for a major expansion of the terminal at Charlotte Douglas International Airport and other capital projects, as well as to refinance existing debt. A second approval for the airport allows for issuance of $280 million in bond anticipation notes to begin a variety of work on the capital improvement plan. Bond Anticipation Notes (BAN) are short-term, interest-bearing securities that are paid off later through a long-term bond issue.

Charlotte also was approved for issuance of $110 million in bond anticipation notes (BANs) for Spectrum Center renovations and modernization, including energy efficiency upgrades. The money also will be used to make improvements to a city-owned fire station.

Durham got a green light to issue $138 million in limited obligation bonds to fund new facilities, and for improvements to streets, parks and recreation, a fire station and public safety, sidewalks, IT infrastructure, public works and general facility repairs. The financing also will refund $5 million in 2013 bonds for savings.

Inlivian Housing Redefined (Mecklenburg County) was given the go-ahead to issue $24.5 million in conduit revenue bonds. Proceeds will be loaned to Shamrock Drive A to finance a portion of the cost of ground leasing construction and equipping a low-income rental housing development to be called Aldersgate Apartments. The development will comprise 100 units for seniors and 36 for families.

The Raleigh Housing Authority (Wake County) applied for and received approval of $21 million in conduit revenue bonds for loan to Terrace at Rock Quarry Limited Partnership. Proceeds will be used to finance a portion of the cost to acquire, build and equip a 132-unit, multifamily rental housing development to be called Terrace at Rock Quarry. The housing will benefit low-income residents, with some units set aside for the mobility impaired, disabled and homeless people.

Holly Springs (Wake County) received a thumbs up for its request for $17 million in limited obligation bonds to build a new fire station, purchase a fire truck and perform street work for a new operations center.

In other financing items,

- New Bern (Craven County) got the OK for a $10 million installment purchase to build a new Stanley White Recreation Center, and a separate revenue bond of $6.1 million for sewer system infrastructure. An installment purchase allows for repayment over time, instead of paying all debt cost up front.

- The LGC voted in favor of a $7.5 million installment purchase for the town of Maiden (Catawba and Lincoln counties), to build a new fire station on Main Street. No tax increase is anticipated.

- LGC members passed a request from Mount Pleasant (Cabarrus County) for $6 million in interim financing with U.S. Department of Agriculture revenue bonds for a regional pump station, and to rehabilitate sewer lines and manholes. No tax increase is anticipated.

- Conover (Catawba County) needs wastewater treatment equipment, and the commission approved its application for an installment purchase of $4.9 million.

- Oxford (Granville County) submitted two requests for state revolving fund loans. The commission voted to approve both. One is a nearly $4.8 million project for wastewater treatment plant improvements, and the other for $1.5 million for sewer system improvements. No tax increase is anticipated.

- The town of Apex (Wake County) got a green light to issue a $3.46 million two-thirds general obligation bond to build a new municipal building for Planning and Inspection departments. No tax increase is anticipated. A two-thirds bond is an exception to general obligation bonds, which usually require a public vote to issue. A municipality can issue the bond in an amount up to two-thirds of the unit's general obligation indebtedness that was retired in the previous year.

- Middlesex (Nash County) won approval of $839,000 for rehabilitation of its wastewater collection system. No tax increase is anticipated.

Two towns on the Unit Assistance List due to late audits and other concerns came before the commission with requests to fund vehicle purchases. Staff said both were making progress and showed the need for the financing:

- Roxboro (Person County) received LGC assent for $544,000 to replace a 22-year-old fire truck that must be taken out of service in three years. The town will enter into a long-term installment purchase, and be reimbursed with financing from Piedmont Electric Membership Corporation. The replacement will allow the town to avoid higher insurance rates.

- The town of Belhaven (Beaufort County), was granted the go-ahead to purchase one police vehicle and three work trucks through a $160,000 installment purchase. The town's aging vehicle fleet ranges from 6 to 29 years, and cost $40,000 in repairs over the past year. No tax increase is anticipated.

In other matters, LGC members questioned New Hanover County commissioners and county staff about Project Grace. It was a discussion-only item and no vote was taken. The matter will be on the agenda for a vote at the October LGC meeting.

Contact:

Email: press@nctreasurer.com

Phone: (919) 814-3820