The Shell Game of Corrupted Government Exposed

Report: NC hospitals lack price transparency and inflate prices

Publisher's Note: This post appears here courtesy of the Carolina Journal. The author of this post is Theresa Opeka.

North Carolina's hospitals are being called out in a new report from the state treasurer's office that shows a wide range in hospital pricing, huge price markups from Medicare rates, and a lack of price transparency.

"Hospitals in North Carolina, in my opinion, continue to give the middle finger to presidential executive orders issued by both the current and the previous president of the United States," North Carolina State Treasurer Dale Folwell said Tuesday on his monthly call with reporters.

Folwell, who released the report on Monday, had researchers from the NC State Health Plan for Teachers and State Employees investigate hospital prices and compliance with federal price transparency rules across 16 common shoppable services at 140 hospitals. Researchers from the Johns Hopkins Bloomberg School provided data analysis based on June 2023 data from Turquoise Health, a software company that collects and displays hospital prices for patients and researchers to facilitate price transparency in health care.

What they found was troubling.

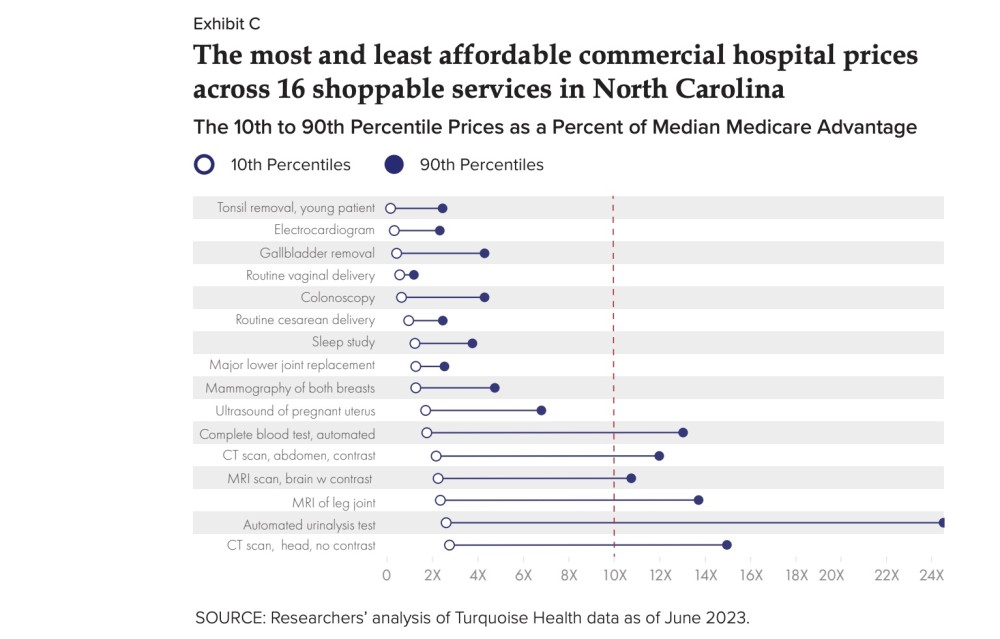

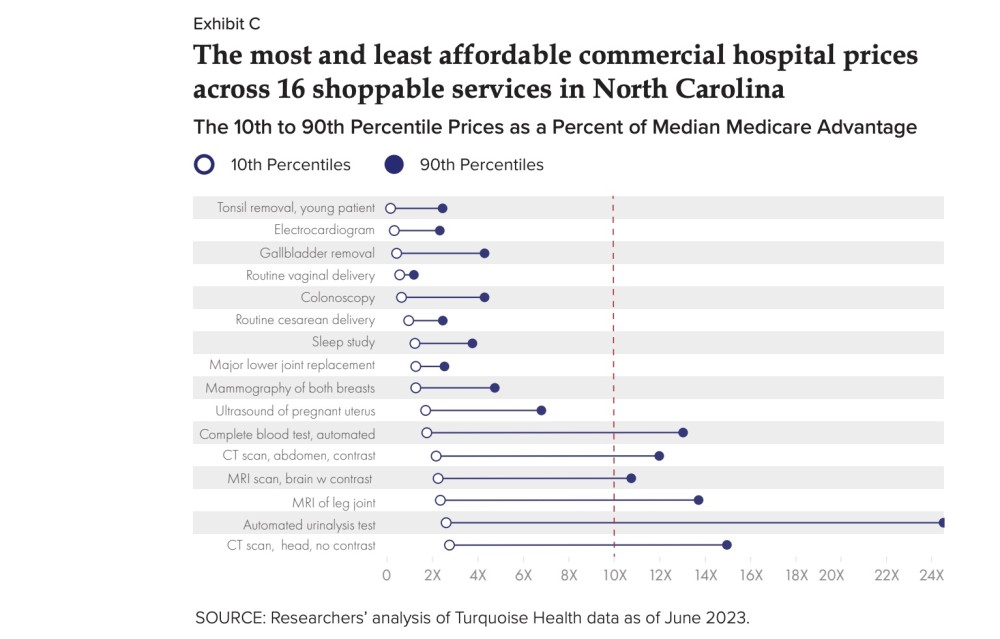

In terms of hospital pricing, North Carolina hospitals levy massive price markups of up to 1,120% on routine care and basic services, with the most expensive subset of hospitals charging commercially insured patients as much as 1,670% more than other hospitals for the same service, which could cost patients and businesses tens of thousands of dollars.

An example would be for gallbladder surgery. A commercially insured patient might pay $1,418.04 at one hospital or as much as $13,469 for the surgery at another, leaving a price difference of 850%.

Other examples include a simple urinalysis, which the most expensive hospitals charge up to 12 times more than affordable hospitals ask patients to pay.

The report found that when it came to Medicare rates, some North Carolina hospitals charge commercially insured patients more than 700% of Medicare rates for some common shoppable services, like a urinalysis test, which can carry a 1,120% median markup from Medicare, forcing patients to pay a median $28.80, while Medicare pays a median of just $2.36.

A previously published report indicates that inflated prices are unnecessary, given that most North Carolina hospitals self-reported profiting off Medicare rates over six years.

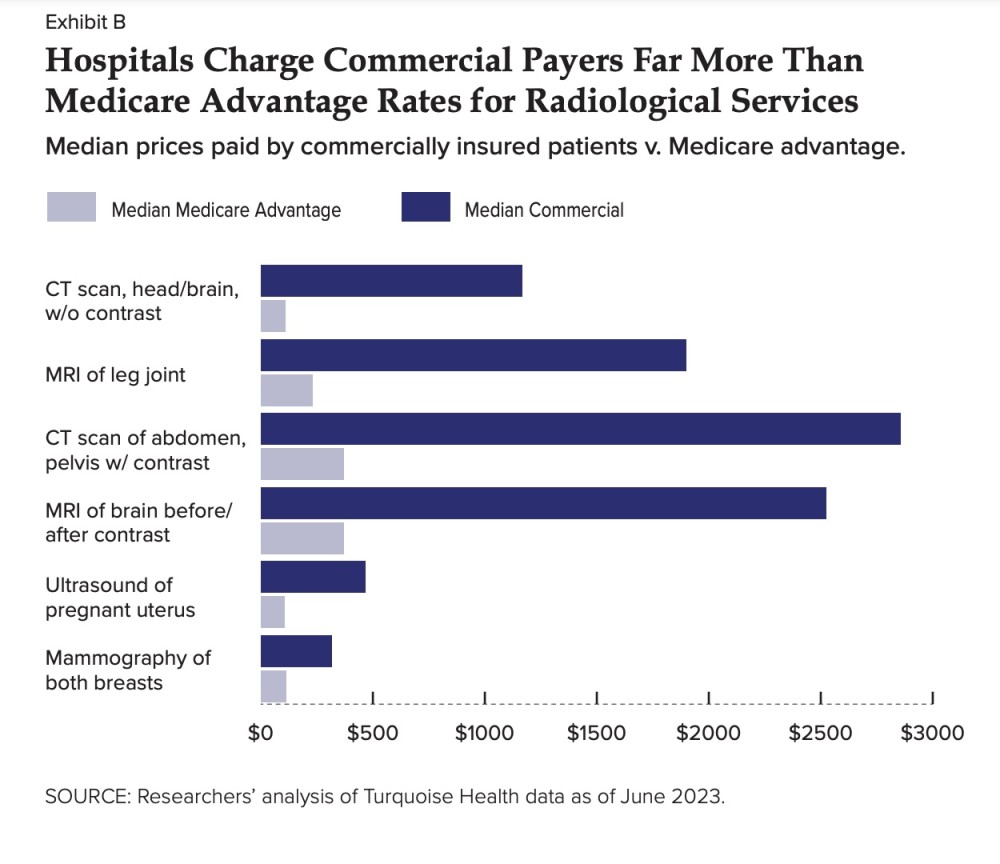

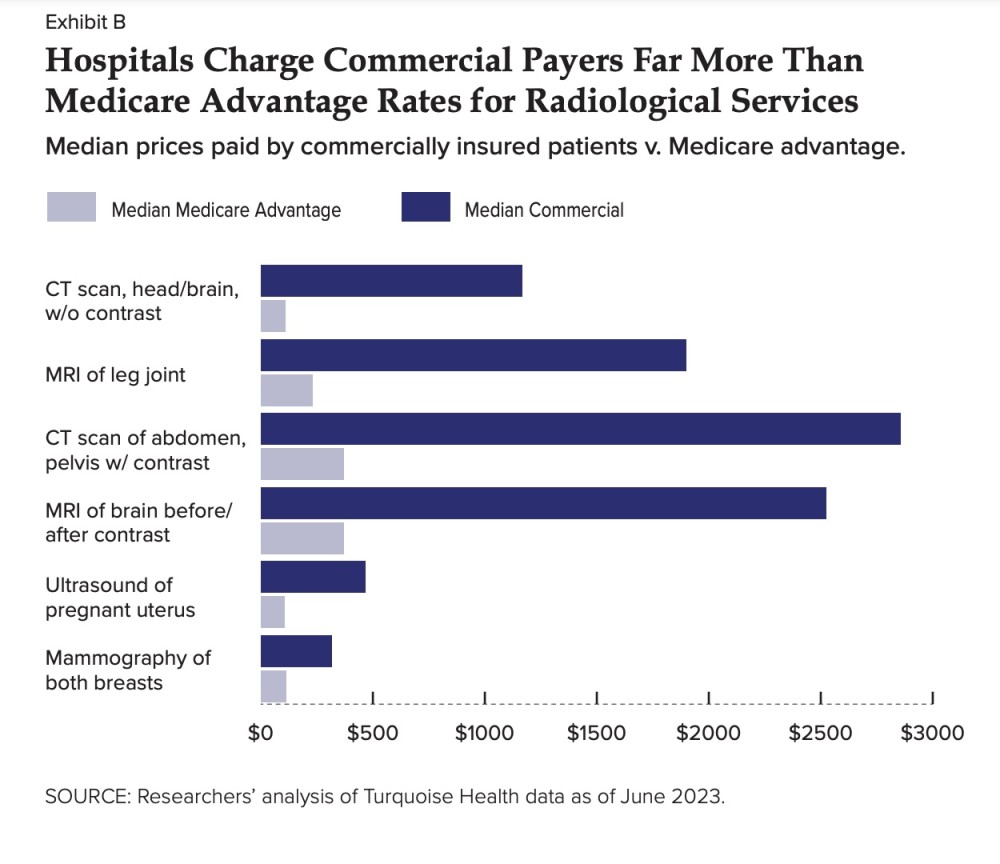

The most significant price disparities included CT and MRI scans. Hospitals inflated their $1,167.23 median commercial price for a CT scan of the brain by 976% from Medicare's $108.44 median rate. These disparities have ties to state Certificate of Need (CON) laws, which restrict the supply of healthcare equipment and facilities.

Folwell said on the reporters' call that he has filed briefs with the North Carolina Court of Appeals and North Carolina Supreme Court regarding certificate of need policies and said it looks like he may get a hearing with the Supreme Court as he is on their calendar. The John Locke Foundation, founding organization of Carolina Journal, is also listed for the hearing.

The report also indicates that hospitals charged uninsured patients more than 150% more than Medicare rates. One-fourth of the 16 analyzed shoppable services had a higher markup on "cash" prices than on commercial rates.

Finally, the report looks at hospital price transparency. As of January 1, 2021, hospitals in the United States were required to provide clear, accessible pricing information about the items and services they provide in two ways: 1. Comprehensive machine-readable file with all items and services. 2. Display of shoppable services in a consumer-friendly format.

The report found that only 51% of hospitals disclosed commercial insurance prices across 16 common shoppable services, and this disclosure rate dropped to 42% for cash prices across the 16 shoppable services. Just five hospitals disclosed commercial prices for every service.

The lack of transparency is especially severe for "cash prices," further hurting uninsured patients already vulnerable to high costs, crippling medical debt, and hospital lawsuits.

Just 27 hospitals published commercial prices for obstetric care during childbirth, denying insured women the opportunity to shop for affordable care when expecting a child.

"Regarding compliance with federal price transparency rules, a majority of North Carolina hospitals are already compliant," said Cynthia Charles, vice-president, communications and public relations, North Carolina Healthcare Association, in an emailed statement to Carolina Journal, responding to the report. "A July 2023 report from patientsrightsadvocate.org found that North Carolina is among the top 10 states with the highest percentage of hospitals complying with the price transparency rule. Moreover, the suggestion that hospitals "hide" prices from patients is absolutely false."

Charles said the NCHA and its members support price transparency for consumers and the effort toward pricing transparency is a work in progress for all U.S. hospitals.

Regarding hospital pricing, she also said it was important to note that hospitals are not price setters, they are rate takers and do not negotiate pricing.

Folwell stressed in this report and on the reporters' call of the importance of the passage of S.B. 321, Medical Debt De-Weaponization Act, which passed unanimously in the Senate and currently sits in the House Rules Committee.

The bill would require large providers to post price information, give enforcement powers to the North Carolina Attorney General, and strengthen consumer protections against medical debt.

"I will say what I've said in the past, that passing the bill could very possibly catapult us to being number two in the country for consumer protection," he said Tuesday.

Folwell said he was also concerned with the latest OPEB (retirement benefits) report for the state health plan's unfunded healthcare liabilities, which went up by billions of dollars but should have gone down by billions this year. He said it is mainly associated with rising healthcare costs in the state.

North Carolina's public employees and taxpayers face a $27 billion unfunded liability for the State Health Plan. Without price relief, its reserves are at risk of falling below the required threshold in less than two years.

Folwell's press release Monday indicated the magnitude of the problems surrounding the current report. An earlier report found that North Carolina hospital systems sued 7,517 patients over medical debt, using the court system to charge interest on medical debt judgments and to place liens on family homes. In addition, workers lose 20% of every paycheck to health care costs, with hospital systems receiving almost half of the health care spending in the United States.

Go Back

North Carolina's hospitals are being called out in a new report from the state treasurer's office that shows a wide range in hospital pricing, huge price markups from Medicare rates, and a lack of price transparency.

"Hospitals in North Carolina, in my opinion, continue to give the middle finger to presidential executive orders issued by both the current and the previous president of the United States," North Carolina State Treasurer Dale Folwell said Tuesday on his monthly call with reporters.

Folwell, who released the report on Monday, had researchers from the NC State Health Plan for Teachers and State Employees investigate hospital prices and compliance with federal price transparency rules across 16 common shoppable services at 140 hospitals. Researchers from the Johns Hopkins Bloomberg School provided data analysis based on June 2023 data from Turquoise Health, a software company that collects and displays hospital prices for patients and researchers to facilitate price transparency in health care.

What they found was troubling.

In terms of hospital pricing, North Carolina hospitals levy massive price markups of up to 1,120% on routine care and basic services, with the most expensive subset of hospitals charging commercially insured patients as much as 1,670% more than other hospitals for the same service, which could cost patients and businesses tens of thousands of dollars.

An example would be for gallbladder surgery. A commercially insured patient might pay $1,418.04 at one hospital or as much as $13,469 for the surgery at another, leaving a price difference of 850%.

Other examples include a simple urinalysis, which the most expensive hospitals charge up to 12 times more than affordable hospitals ask patients to pay.

The report found that when it came to Medicare rates, some North Carolina hospitals charge commercially insured patients more than 700% of Medicare rates for some common shoppable services, like a urinalysis test, which can carry a 1,120% median markup from Medicare, forcing patients to pay a median $28.80, while Medicare pays a median of just $2.36.

A previously published report indicates that inflated prices are unnecessary, given that most North Carolina hospitals self-reported profiting off Medicare rates over six years.

The most significant price disparities included CT and MRI scans. Hospitals inflated their $1,167.23 median commercial price for a CT scan of the brain by 976% from Medicare's $108.44 median rate. These disparities have ties to state Certificate of Need (CON) laws, which restrict the supply of healthcare equipment and facilities.

Folwell said on the reporters' call that he has filed briefs with the North Carolina Court of Appeals and North Carolina Supreme Court regarding certificate of need policies and said it looks like he may get a hearing with the Supreme Court as he is on their calendar. The John Locke Foundation, founding organization of Carolina Journal, is also listed for the hearing.

The report also indicates that hospitals charged uninsured patients more than 150% more than Medicare rates. One-fourth of the 16 analyzed shoppable services had a higher markup on "cash" prices than on commercial rates.

Finally, the report looks at hospital price transparency. As of January 1, 2021, hospitals in the United States were required to provide clear, accessible pricing information about the items and services they provide in two ways: 1. Comprehensive machine-readable file with all items and services. 2. Display of shoppable services in a consumer-friendly format.

The report found that only 51% of hospitals disclosed commercial insurance prices across 16 common shoppable services, and this disclosure rate dropped to 42% for cash prices across the 16 shoppable services. Just five hospitals disclosed commercial prices for every service.

The lack of transparency is especially severe for "cash prices," further hurting uninsured patients already vulnerable to high costs, crippling medical debt, and hospital lawsuits.

Just 27 hospitals published commercial prices for obstetric care during childbirth, denying insured women the opportunity to shop for affordable care when expecting a child.

"Regarding compliance with federal price transparency rules, a majority of North Carolina hospitals are already compliant," said Cynthia Charles, vice-president, communications and public relations, North Carolina Healthcare Association, in an emailed statement to Carolina Journal, responding to the report. "A July 2023 report from patientsrightsadvocate.org found that North Carolina is among the top 10 states with the highest percentage of hospitals complying with the price transparency rule. Moreover, the suggestion that hospitals "hide" prices from patients is absolutely false."

Charles said the NCHA and its members support price transparency for consumers and the effort toward pricing transparency is a work in progress for all U.S. hospitals.

Regarding hospital pricing, she also said it was important to note that hospitals are not price setters, they are rate takers and do not negotiate pricing.

Folwell stressed in this report and on the reporters' call of the importance of the passage of S.B. 321, Medical Debt De-Weaponization Act, which passed unanimously in the Senate and currently sits in the House Rules Committee.

The bill would require large providers to post price information, give enforcement powers to the North Carolina Attorney General, and strengthen consumer protections against medical debt.

"I will say what I've said in the past, that passing the bill could very possibly catapult us to being number two in the country for consumer protection," he said Tuesday.

Folwell said he was also concerned with the latest OPEB (retirement benefits) report for the state health plan's unfunded healthcare liabilities, which went up by billions of dollars but should have gone down by billions this year. He said it is mainly associated with rising healthcare costs in the state.

North Carolina's public employees and taxpayers face a $27 billion unfunded liability for the State Health Plan. Without price relief, its reserves are at risk of falling below the required threshold in less than two years.

Folwell's press release Monday indicated the magnitude of the problems surrounding the current report. An earlier report found that North Carolina hospital systems sued 7,517 patients over medical debt, using the court system to charge interest on medical debt judgments and to place liens on family homes. In addition, workers lose 20% of every paycheck to health care costs, with hospital systems receiving almost half of the health care spending in the United States.

| Federal judge rules Obama / Biden DACA program for illegal aliens illegal | Carolina Journal, Editorials, Op-Ed & Politics | Budget negotiations are in a weird place |