REAL News for REAL People

That's Right North Carolina, A Potential 25 Percent Average Rate Increase For Blue Cross And Blue Shield Obamacare Customers

Publisher's note: The author of this post is Katherine Restrepo, who is the Health and Human Services Policy Analyst for the John Locke Foundation.

It's rate-filing season for health insurance companies, and this week marked the deadline for carriers to disclose and explain any proposed rate increases of ten percent or more for 2016 Obamacare plans sold on the individual market. Blue Cross and Blue Shield of North Carolina made the cut.

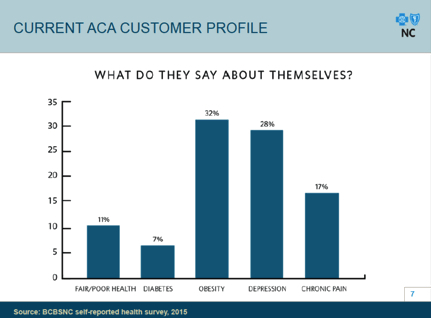

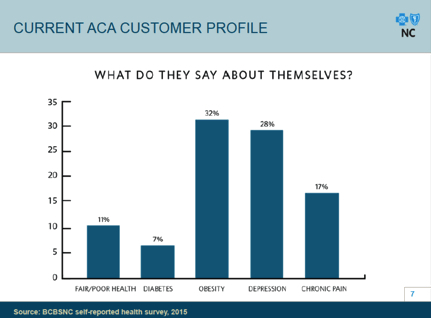

As the state's dominant insurer awaits approval from the Department of Insurance for its proposed 25.7 percent average premium hikes, VP and chief actuary Patrick Getzon explained the rationale in a media briefing held earlier this week. In sum, claims data from January through March of this year indicate that 2015 individual market policyholders skew older and sicker compared to 2014 customers. Self-reported data from policyholders below correlates to increases in hospital admissions, imaging services, Emergency Department usage, chronic health conditions, and specialty medications.

Now that insurers must accept any applicant, regardless of health status, premium increases are not all that surprising. But 25 percent?

Getzon threw out an example to put the underlying rate increase in perspective: a 40 year old male with a Blue Value Silver Plan may now be paying $315 per month for a plan with a $2,500 deductible. Next year, however, that person could be ponying up $391 per month with the same deductible. Despite the fact that 94 percent of BCBS enrollees do qualify for premium or cost sharing assistance, plans are still pricey. It's clear that low-income individuals benefit the most from subsidies, but on Obamacare's sliding scale those greatly tail off once income hits 250 percent of the federal poverty level, which translates to around $29,000 for an individual and $60,000 for a family of four.

As a result, the insurer is seeing a trend where one in five customers has signed up for coverage, paid the first month's premium, used services, and then dropped his plan. So, of the 397,000 second-round BCBS exchange enrollees thus far, the net figure really equates to around 317,600.

The individual market could very well remain on precarious footing over the next couple of years. Since the Obama Administration urged insurers to extend pre-ACA plans until 2017, the anticipated and actual Obamacare risk pools for 2014 didn't quite match up. Many policyholders — especially the young and healthy — decided to hold onto these plans, creating a higher-risk 2014 enrollment mix.

That first blow to insurers triggered Blue Cross to suffer its first financial loss in over 15 years — a total revenue decline of $60 million.

The fact that the federal health law enforces tighter community rating ratios doesn't help one iota, either. Inflated premiums for the young and healthy to offset the medical costs incurred by the old and sick does not attract young and healthy customers — the very population needed to maintain a balanced pool.

And then there are the three "R's" built into Obamacare that sought to mitigate initial market instability for insurers participating in Obamacare's individual marketplace:

Risk adjustment operates as a give and take among insurers. Those with higher-risk pools will be relieved with funds from insurers with lower-risk pools. Risk Corridors operate where funds are shifted from plans with lower than expected claims to offset other plans where actual payments have surpassed projected amounts. Reinsurance, commonly known as the "belly button tax," acts as an insurance company's own insurance policy, in which a fee is assessed on each person, including dependents, covered by most employer-sponsored health insurance. The fund will total over $20 billion up to 2017, and insurers can dip into this fund and be reimbursed 80% of a consumer's annual claims that exceed $45,000. Both the risk corridors and belly button tax are set to expire by 2017.

With policyholders already facing an average 25 percent premium increase, recently-introduced bills that call for more coverage mandates come at a particularly bad time. It's important to note that a majority of the state's insured population — those whose employers self-insure or who are covered under government programs like Medicare or Medicaid — are exempt from additional state-regulated health benefits. Therefore, any further mandates will leave the remaining non-group policyholders and those on employer-purchased plans feeling an even deeper burn in their pockets.

Go Back

It's rate-filing season for health insurance companies, and this week marked the deadline for carriers to disclose and explain any proposed rate increases of ten percent or more for 2016 Obamacare plans sold on the individual market. Blue Cross and Blue Shield of North Carolina made the cut.

As the state's dominant insurer awaits approval from the Department of Insurance for its proposed 25.7 percent average premium hikes, VP and chief actuary Patrick Getzon explained the rationale in a media briefing held earlier this week. In sum, claims data from January through March of this year indicate that 2015 individual market policyholders skew older and sicker compared to 2014 customers. Self-reported data from policyholders below correlates to increases in hospital admissions, imaging services, Emergency Department usage, chronic health conditions, and specialty medications.

Now that insurers must accept any applicant, regardless of health status, premium increases are not all that surprising. But 25 percent?

Getzon threw out an example to put the underlying rate increase in perspective: a 40 year old male with a Blue Value Silver Plan may now be paying $315 per month for a plan with a $2,500 deductible. Next year, however, that person could be ponying up $391 per month with the same deductible. Despite the fact that 94 percent of BCBS enrollees do qualify for premium or cost sharing assistance, plans are still pricey. It's clear that low-income individuals benefit the most from subsidies, but on Obamacare's sliding scale those greatly tail off once income hits 250 percent of the federal poverty level, which translates to around $29,000 for an individual and $60,000 for a family of four.

As a result, the insurer is seeing a trend where one in five customers has signed up for coverage, paid the first month's premium, used services, and then dropped his plan. So, of the 397,000 second-round BCBS exchange enrollees thus far, the net figure really equates to around 317,600.

The individual market could very well remain on precarious footing over the next couple of years. Since the Obama Administration urged insurers to extend pre-ACA plans until 2017, the anticipated and actual Obamacare risk pools for 2014 didn't quite match up. Many policyholders — especially the young and healthy — decided to hold onto these plans, creating a higher-risk 2014 enrollment mix.

That first blow to insurers triggered Blue Cross to suffer its first financial loss in over 15 years — a total revenue decline of $60 million.

The fact that the federal health law enforces tighter community rating ratios doesn't help one iota, either. Inflated premiums for the young and healthy to offset the medical costs incurred by the old and sick does not attract young and healthy customers — the very population needed to maintain a balanced pool.

And then there are the three "R's" built into Obamacare that sought to mitigate initial market instability for insurers participating in Obamacare's individual marketplace:

Risk adjustment operates as a give and take among insurers. Those with higher-risk pools will be relieved with funds from insurers with lower-risk pools. Risk Corridors operate where funds are shifted from plans with lower than expected claims to offset other plans where actual payments have surpassed projected amounts. Reinsurance, commonly known as the "belly button tax," acts as an insurance company's own insurance policy, in which a fee is assessed on each person, including dependents, covered by most employer-sponsored health insurance. The fund will total over $20 billion up to 2017, and insurers can dip into this fund and be reimbursed 80% of a consumer's annual claims that exceed $45,000. Both the risk corridors and belly button tax are set to expire by 2017.

With policyholders already facing an average 25 percent premium increase, recently-introduced bills that call for more coverage mandates come at a particularly bad time. It's important to note that a majority of the state's insured population — those whose employers self-insure or who are covered under government programs like Medicare or Medicaid — are exempt from additional state-regulated health benefits. Therefore, any further mandates will leave the remaining non-group policyholders and those on employer-purchased plans feeling an even deeper burn in their pockets.

| Budget Updates | John Locke Foundation Guest Editorial, Editorials, Op-Ed & Politics | On the air with Hasan Harnett |

Latest Op-Ed & Politics

|

Biden abuses power to turn statute on its head; womens groups to sue

Published: Friday, April 19th, 2024 @ 8:28 pm

By: John Steed

|

|

The Missouri Senate approved a constitutional amendment to ban non-U.S. citizens from voting and also ban ranked-choice voting.

Published: Friday, April 19th, 2024 @ 12:33 pm

By: Daily Wire

|

|

Democrats prosecuting political opponets just like foreign dictrators do

Published: Friday, April 19th, 2024 @ 10:58 am

By: John Steed

|

|

populist / nationalist / sovereigntist right are kingmakers for new government

Published: Friday, April 19th, 2024 @ 10:04 am

By: John Steed

|

|

18 year old boy who thinks he is girl planned to shoot up elementary school in Maryland

Published: Friday, April 19th, 2024 @ 8:46 am

By: John Steed

|

|

Biden assault on democracy continues to build as he ramps up dictatorship

Published: Friday, April 19th, 2024 @ 8:26 am

By: John Steed

|

|

illegal alien "asylum seeker" migrants are a crime wave on both sides of the Atlantic

Published: Thursday, April 18th, 2024 @ 8:10 am

By: John Steed

|

|

UNC board committee votes unanimously to end DEI in UNC system

Published: Thursday, April 18th, 2024 @ 7:54 am

By: John Steed

|