May 2010: Tax credit expiration removes crutch | Eastern North Carolina Now

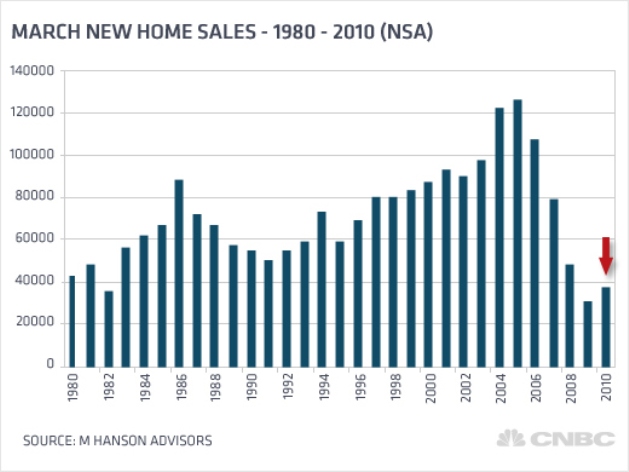

Though the month of March saw a 27-percent increase in new home sales, I'm unconvinced we're close to real recovery.

|

Discover the real cost of living in North Carolina for renters. Explore housing expenses, utilities, and budgeting tips.

Published: Thursday, February 1st, 2024 @ 3:05 pm

By: Stan Deatherage

|

|

October in the central Blue Ridge Mountains of Virginia is a magical place at this climatic interchange to nature's next phase - dormant winter.

Published: Saturday, October 17th, 2015 @ 6:46 am

By: Stan Deatherage

|

|

Dare County real estate developer Ray Hollowell was counting on Dolly Parton and her family to help him transform the Pine Mountain development, located in southern Burke County, into a more upscale community that he renamed "The South Mountain Preserve." Hollowell also was counting on Gov. Bev...

Published: Tuesday, June 10th, 2014 @ 5:27 pm

By: John Locke Foundation

|

|

Each year, without fail, I procrastinate to the near end of the required period given, to take my continuing education class, to continue my real estate eligibility.

Published: Tuesday, May 21st, 2013 @ 5:18 pm

By: Stan Deatherage

|

|

For the better part of a century, U.S. politicians have made it one of their major goals to maximize the proportion of Americans who purchase rather than rent their primary dwellings.

Published: Thursday, June 14th, 2012 @ 8:38 am

By: John Locke Foundation

|

|

On Thursday, March 8th, 2012 at 12:30 pm at the front door of the Beaufort County Courthouse, 102 W. 2nd St., Washington , N. C., a sale to the last highest bidder will be conducted for one parcel of approximately 80.0 acres of land located on the east side of Cherry Run Road, Washington, NC.

Published: Monday, February 13th, 2012 @ 5:33 pm

By: Stan Deatherage

|

|

Every Friday, a list of the current foreclosure inventory in Beaufort County is compiled for your reference.

Published: Saturday, July 23rd, 2011 @ 1:06 pm

By: Leslie Schneider

|

|

Every Friday, a list of the current foreclosure inventory in Beaufort County is compiled for your reference.

Published: Friday, June 24th, 2011 @ 4:00 pm

By: Leslie Schneider

|

|

Every Friday, a list of the current foreclosure inventory in Beaufort County is compiled for your reference.

Published: Saturday, June 11th, 2011 @ 10:30 am

By: Leslie Schneider

|

|

Every Friday, a list of the current foreclosure inventory in Beaufort County is compiled for your reference.

Published: Friday, June 3rd, 2011 @ 2:31 pm

By: Leslie Schneider

|

|

Those who argue in favor of the Due Diligence Fee say that it will weed out disingenuous, unqualified buyers by requiring them to have some 'skin in the game.'

Published: Tuesday, January 25th, 2011 @ 1:20 pm

By: BCN

|

|

Already this November, according to the National Association of Realtors Residential Sold Report, 12 homes have been sold countywide, nine of those in Washington.

Published: Wednesday, November 17th, 2010 @ 3:16 pm

By: BCN

|

|

To illustrate this fact, I have taken a snapshot of Washington's market activity in August, September and October, by generating a Residential Sold Report via the Realtors' MLS database.

Published: Wednesday, October 27th, 2010 @ 12:25 am

By: BCN

|