Publisher's Note: This post appears here courtesy of the John Locke Foundation. The author of this post is Brian Balfour.

- All news accounts described the recently passed state budget as spending $30 billion

- But they left out a significant amount of spending: more than $7 billion

- The recent trend of shifting spending "off budget" erodes transparency and honest accounting of state spending

Everywhere you read about the recently approved state budget bill, it is referred to as spending $30 billion. But that doesn't tell the entire story.

Yes, the state's General Fund appropriations total $29.787 billion, which has been the focus of media accounts.

But there's another $7.2 billion in planned expenditures that have been kept

"off budget" and therefore not subject to any scrutiny or mention.

How can this be?

Every year, a certain amount of available funds are set aside into special

"reserve" funds. Traditionally, the set-asides were limited to contributions into the state's Savings Reserve Fund and reserved for repairs and renovations. Notably, up until recently, even contributions to the state's Disaster Relief Fund - along with reserves like the Information Technology (IT) Reserve, debt service payments, and contributions to

"economic development" programs like JDIG (Job Development Investment Grant fund) - were all

"on budget"; i.e., included in the General Fund (for instance, see the

"money reports" for the 2015, 2016, and 2017 budgets).

Unfortunately, however, over the past few years budget writers have been expanding the number of such

"reserves" into which money is set aside, money that should instead be included in the General Fund appropriations.

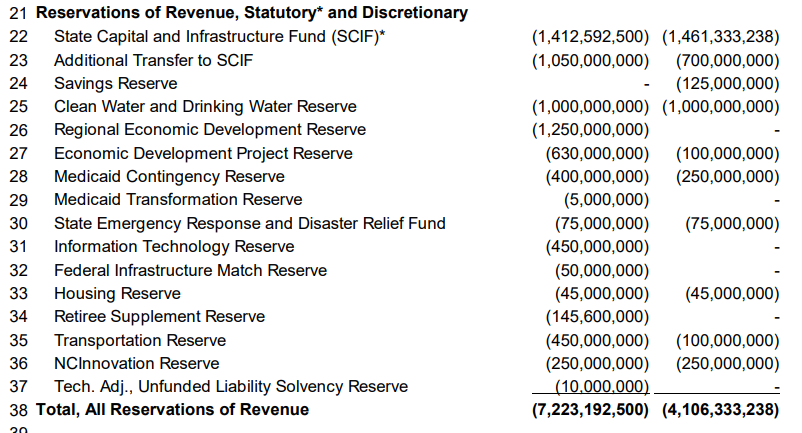

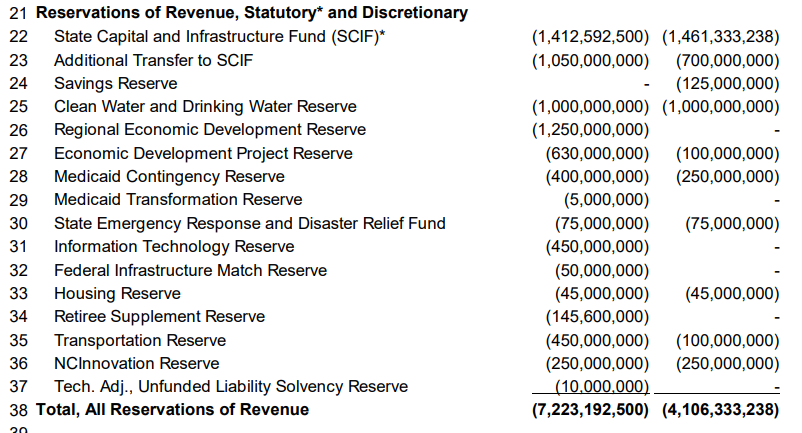

For instance, below is the section of this year's budget itemizing these set-asides:

As you can see, additional funding was set aside this year for the Savings Reserve Fund. As noted previously, even monies set aside into reserves set up as a contingency against potential emergencies or unpredictable program requirements that exceed what was budgeted - such as the Disaster Relief Fund, Medicaid Contingency Reserve, and the IT Reserve - used to be included in the General Fund with few exceptions. Contributions to the Clean Water Management Trust Fund used to be

"on budget," so there is no reason the billion-dollar set-aside into the Clean Water and Drinking Water Reserve shouldn't be.

The Regional Economic Development Reserve is a newly created fund through which taxpayer dollars will flow to finance corporate welfare schemes. Similarly, the Economic Development Project Reserve was created in 2021. Combined, these two

"reserves" receive nearly $2 billion this year, but this funding is not counted in the General Fund.

The controversial NCInnovation will receive $500 million over two years, but their funding will also be kept off budget and not counted as part of official budgetary expenditures.

Last year's budget also saw the creation of the

"World University Games Reserve" and the

"Local Project Reserve" funds, which combined to keep more than $100 million in expenditures off budget. In total, last year's budget bill set aside $7.7 billion off budget.

The trend of shifting more spending

"off budget" can largely be traced back to the creation of the State Capital and Infrastructure Fund (SCIF). Appropriations into SCIF have been

"off budget" since its inception. The fund is dedicated to financing capital and transportation infrastructure as well as paying down state debt. Proactively dedicating funds to finance such projects on a pay-as-you go basis as opposed to incurring debt is a laudable goal. A certain amount is statutorily required to be set aside each year.

However, keeping such spending off-budget obscures the true amount of state spending, and such expenditures had traditionally been included in the General Fund. The establishment of this fund and moving its contributions

"off budget" caused confusion and difficulties in comparisons to other budgets when it began in 2019.

Perhaps because they liked the fact that shifting significant amounts of state spending

"off budget" via contributions to SCIF gave the appearance of smaller budgets, state budget writers have rapidly expanded the practice to several various

"reserves" in recent years.

This trend is important for two primary reasons. First, when the money is set aside into a reserve, there is often minimal transparency for how the money will end up being spent. Once sent into a special

"reserve" fund, there is little to no discussion focused on where the money ends up. Second, when money is diverted into reserve funds and not counted in the General Fund budget, legislators can take credit for

"limiting" state spending by pointing to the artificially lower General Fund budget.

If the state were ever to create a formal cap to annual budgetary increases, such as a Taxpayer Bill of Rights, the hiding of significant amounts of spending will enable budget writers to skirt such limitations by shifting more spending off budget.

For instance, adding the $7.2 billion of this year's set-asides to the General Fund results in total state spending of about $37 billion, nearly 24% more than the $30 billion budget widely reported.

In the name of fiscal responsibility and transparency, North Carolina budget writers should reverse this trend.