In Difficult Times Good People gravitate towards Absolute Truth

3 Reasons Why Obamacare's Cadillac Tax Is Due For Inspection

Publisher's note: The author of this post is Katherine Restrepo, who is the Health and Human Services Policy Analyst for the John Locke Foundation.

Since the World War II era, workers have benefited from a rather large implicit tax subsidy on health coverage provided by their employers. Every dollar an employee spends from earned income is taxed, but every dollar spent on health care is not. Those who purchase health plans on their own lose out on this advantage.

So when it comes to health reform, the remedy to fix the unequal tax treatment between group and non-group coverage is endlessly debated by those having either of the following opinions:

The Obama Administration, a lot of economists, and even some conservative policy wonks out there endorse the latter, a reason being that tax-free health insurance results in a lot of potential government revenue left on the table — $270 billion in 2010 alone. This figure is almost equivalent to what the feds poured into Medicaid the same year. The benefit also induces firms to substitute taxable wage increases for generous health coverage. In turn, workers increase their health care usage — a chunk of it arguably wasteful — since they are in large part shielded from the true cost of care.

Obamacare's idea of nudging businesses and their workers to be more cost-conscious on health care spending is to levy a hefty tax on loaded health plans. 'Repeal and Replace' proposals aim to do so by capping the employer tax exclusion. Both proposals share similarities, but Obamacare's 'Cadillac tax' fares worse. Even Hillary and Bernie don't approve.

Set for implementation in 2018, a 40 percent tax will kick in on the amount exceeding the following thresholds:

Here's why the Caddy is due for an inspection:

For more information on the bipartisan-panned tax, check out these articles here, here, and here.

Go Back

Since the World War II era, workers have benefited from a rather large implicit tax subsidy on health coverage provided by their employers. Every dollar an employee spends from earned income is taxed, but every dollar spent on health care is not. Those who purchase health plans on their own lose out on this advantage.

So when it comes to health reform, the remedy to fix the unequal tax treatment between group and non-group coverage is endlessly debated by those having either of the following opinions:

- Allow all health insurance plans to be tax-free

- Tax employer-sponsored health insurance

The Obama Administration, a lot of economists, and even some conservative policy wonks out there endorse the latter, a reason being that tax-free health insurance results in a lot of potential government revenue left on the table — $270 billion in 2010 alone. This figure is almost equivalent to what the feds poured into Medicaid the same year. The benefit also induces firms to substitute taxable wage increases for generous health coverage. In turn, workers increase their health care usage — a chunk of it arguably wasteful — since they are in large part shielded from the true cost of care.

Obamacare's idea of nudging businesses and their workers to be more cost-conscious on health care spending is to levy a hefty tax on loaded health plans. 'Repeal and Replace' proposals aim to do so by capping the employer tax exclusion. Both proposals share similarities, but Obamacare's 'Cadillac tax' fares worse. Even Hillary and Bernie don't approve.

Set for implementation in 2018, a 40 percent tax will kick in on the amount exceeding the following thresholds:

- Individual health plans costing more than $10,200

- Family health plans costing more than $27,500

Here's why the Caddy is due for an inspection:

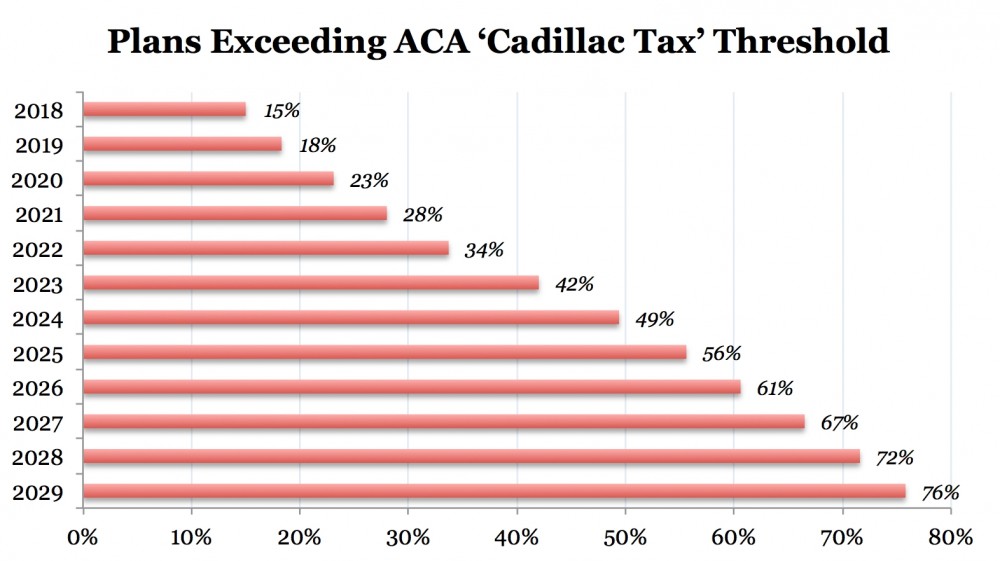

- The thresholds are adjusted annually to keep up with the Consumer Price Index (CPI) + 1 percent, but not medical inflation. Because medical inflation surpasses CPI, this means that the tax will creep up on an increasing number of health plans in subsequent years. Estimates of the percentage of plans affected over the next decade ranges from 42 to 90 percent.

- Combined with the fact that the thresholds don't keep up with medical inflation, the Cadillac tax ironically prevents the consumer awareness behavior that it tries to promote. For an individual, that $10,200 cap includes any health savings account (HSA) contribution made by his or her employer.

- Low-income workers will take a stronger financial hit under the penalty over an employer tax-exclusion cap. Chris Conover at Forbes explains:

"Thus a minimum wage janitor will be paying the same 40% tax as the CEO making $1 million. In contrast, if the tax exclusion were capped, the minimum wage janitor would pay only 15.3% (i.e., FICA payroll taxes for Social Security and Medicare) whereas the CEO might pay in excess of 50%."

For more information on the bipartisan-panned tax, check out these articles here, here, and here.

Comment

Latest Op-Ed & Politics

|

Biden wants to push this in public schools and Gov. deSantis says NO

Published: Thursday, April 25th, 2024 @ 9:19 pm

By: John Steed

|

|

eve 45% of Latinos support mass deportation

Published: Thursday, April 25th, 2024 @ 12:40 pm

By: John Steed

|

|

this at the time that pro-Hamas radicals are rioting around the country

Published: Thursday, April 25th, 2024 @ 8:01 am

By: John Steed

|

|

Pro death roundtable

Published: Wednesday, April 24th, 2024 @ 12:39 pm

By: Countrygirl1411

|

|

populist / nationalist anti-immigration AfD most popular party among young voters, CDU second

Published: Wednesday, April 24th, 2024 @ 11:25 am

By: John Steed

|

|

political scheme behhind raid on Mar-a-Lago

Published: Wednesday, April 24th, 2024 @ 9:16 am

By: John Steed

|

|

how many of these will come to North Carolina?

Published: Tuesday, April 23rd, 2024 @ 1:32 pm

By: John Steed

|

|

Barr had previously said he would jump off a bridge before supporting Trump

Published: Tuesday, April 23rd, 2024 @ 11:37 am

By: John Steed

|

|

Babis is leader of opposition in Czech parliament

Published: Tuesday, April 23rd, 2024 @ 10:28 am

By: John Steed

|

|

illegal alien "asylum seeker" migrants are a crime wave on both sides of the Atlantic

Published: Tuesday, April 23rd, 2024 @ 9:44 am

By: John Steed

|

|

only one holdout against acquital

Published: Tuesday, April 23rd, 2024 @ 9:01 am

By: John Steed

|

|

DEI now includes criminals?

Published: Monday, April 22nd, 2024 @ 8:33 pm

By: John Steed

|

The real problems still to be addressed:

(1) Cost of healthcare rising at 3-5% greater rate than inflation

(2) False belief that we should live forever and spend more than half our healthcare expenses in the last 10 years of life

(3) Associated costs of healthcare like hospitals / big pharma / suing lawyers

At the least this article offers some solutions instead of the constant criticism starting with the derisive title "Obamacare." It was passed by Congress and suggested by the Executive Branch. If all would work together, any country which went to and back from the moon could solve these kinds of problems for the betterment of all citizens paying their taxes.