REAL News for REAL People

How Progressive is Our Tax System? The Answer: More Than We Thought

Publisher's Note: This post appears here courtesy of the John Locke Foundation. The author of this post is Paige Terryberry.

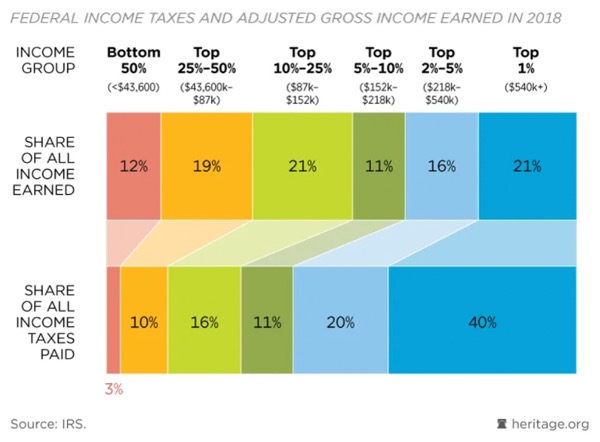

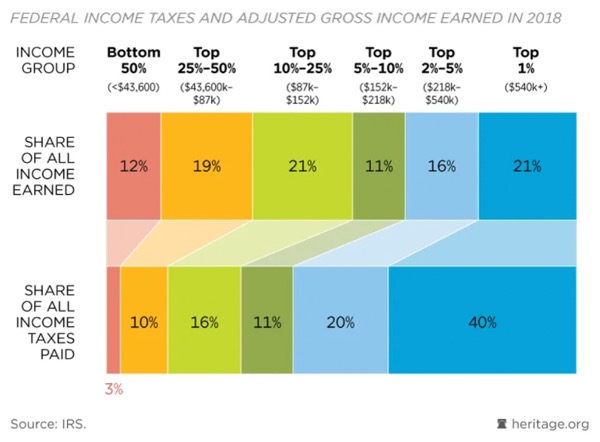

The progressive left often argues that the rich do not pay enough in taxes. The tax code is not progressive enough, they say. But, the tax code is much more progressive than they would like to admit. See the below graph from The Heritage Foundation.

And now a new study from the Tax Foundation shows that when income transfer programs are accounted for, the overall fiscal system is even more progressive.

Transfer payment examples include Medicaid, disability, retirement, and housing services at the federal level and CHIP and unemployment at the state and local levels.

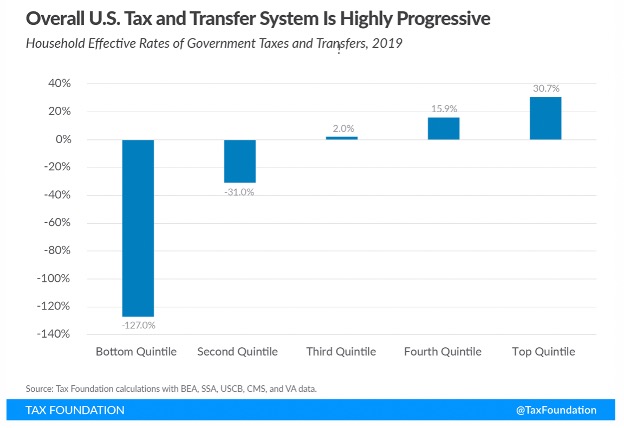

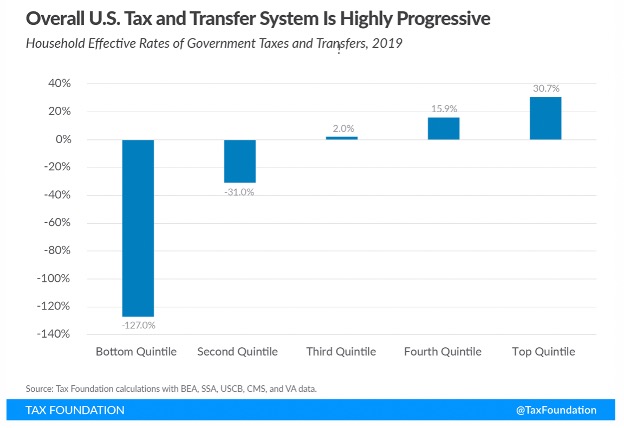

The Tax Foundation divided Americans into five groups and found that, although individuals at both ends of the spectrum pay taxes and receive government transfers (though some indirectly), for "high earners, tax liability vastly outstrips the value of benefits received, whereas for low income-earners, tax payments pale in comparison to the value of transfers received."

For each dollar the bottom quintile earned, "they received an additional $1.27 from the government, netting transfers (gains) and taxes (losses), while the top quintile had a rate of positive 30.7 percent, meaning on net they paid just under $0.31 for every dollar earned."

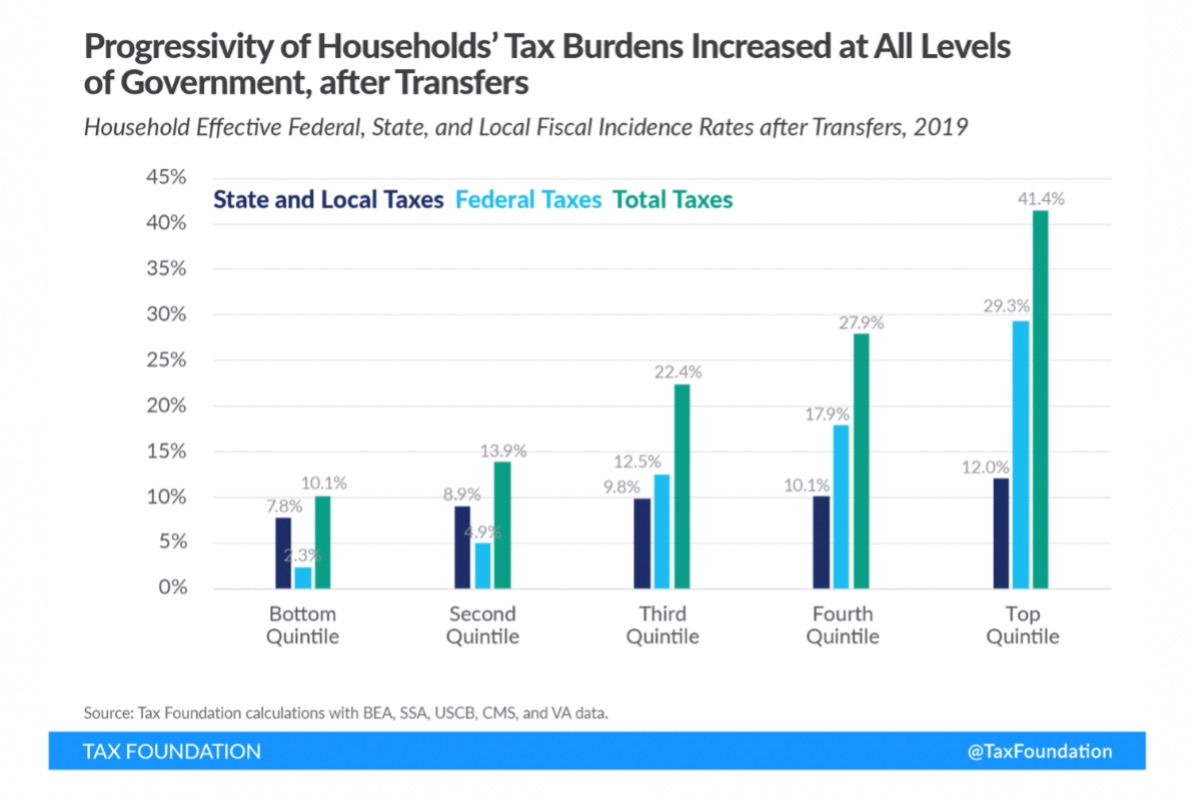

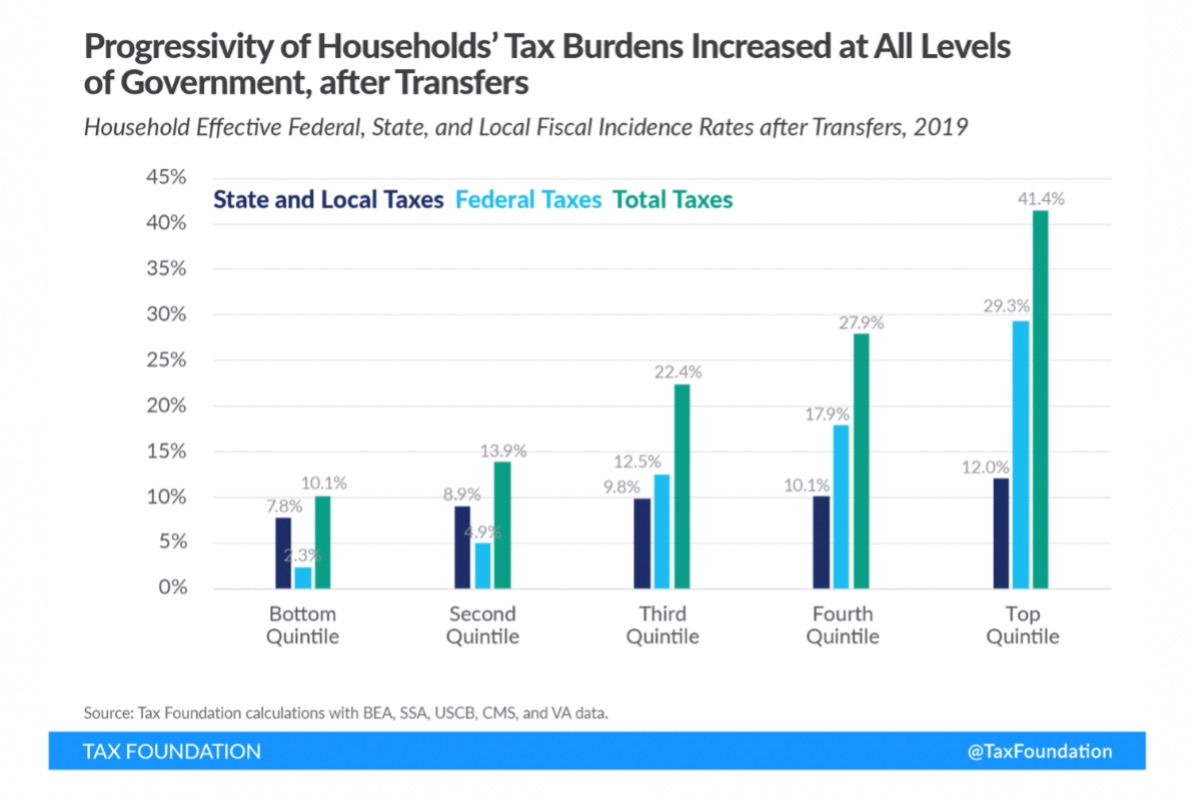

Progressivity at the federal level is found in both taxes and transfers, while progressivity at the state level comes mostly through transfers according to the study.

Once transfers are accounted for, household burdens to federal, state, and local governments are "robustly" progressive. The bottom quintile faces a rate of 10.1% while the top quintile's effective burden is 41.4%.

Arguments in favor of making our system more progressive at any level of government are weakened by the findings of this study. In North Carolina, this study is important given the progressive push to convert our state's income tax rate back to a multi-tiered, progressive structure.

Moreover, some are calling to put an end to the state's corporate income tax phase-out. The Tax Foundation study found, however, that "about one-sixth of the tax burden borne by households in the lowest quintile is not personal taxes-like income, sales, and property taxes-but taxes remitted by businesses that are economically borne by taxpayers-like corporate income taxes, tariffs, severance taxes, and a variety of taxes on capital."

Our overall tax structure is already highly progressive.

Go Back

The progressive left often argues that the rich do not pay enough in taxes. The tax code is not progressive enough, they say. But, the tax code is much more progressive than they would like to admit. See the below graph from The Heritage Foundation.

And now a new study from the Tax Foundation shows that when income transfer programs are accounted for, the overall fiscal system is even more progressive.

Transfer payment examples include Medicaid, disability, retirement, and housing services at the federal level and CHIP and unemployment at the state and local levels.

The Tax Foundation divided Americans into five groups and found that, although individuals at both ends of the spectrum pay taxes and receive government transfers (though some indirectly), for "high earners, tax liability vastly outstrips the value of benefits received, whereas for low income-earners, tax payments pale in comparison to the value of transfers received."

For each dollar the bottom quintile earned, "they received an additional $1.27 from the government, netting transfers (gains) and taxes (losses), while the top quintile had a rate of positive 30.7 percent, meaning on net they paid just under $0.31 for every dollar earned."

Progressivity at the federal level is found in both taxes and transfers, while progressivity at the state level comes mostly through transfers according to the study.

Once transfers are accounted for, household burdens to federal, state, and local governments are "robustly" progressive. The bottom quintile faces a rate of 10.1% while the top quintile's effective burden is 41.4%.

Arguments in favor of making our system more progressive at any level of government are weakened by the findings of this study. In North Carolina, this study is important given the progressive push to convert our state's income tax rate back to a multi-tiered, progressive structure.

Moreover, some are calling to put an end to the state's corporate income tax phase-out. The Tax Foundation study found, however, that "about one-sixth of the tax burden borne by households in the lowest quintile is not personal taxes-like income, sales, and property taxes-but taxes remitted by businesses that are economically borne by taxpayers-like corporate income taxes, tariffs, severance taxes, and a variety of taxes on capital."

Our overall tax structure is already highly progressive.

Latest State and Federal

|

The Missouri Senate approved a constitutional amendment to ban non-U.S. citizens from voting and also ban ranked-choice voting.

Published: Friday, April 19th, 2024 @ 12:33 pm

By: Daily Wire

|

|

Police in the nation’s capital are not stopping illegal aliens who are driving around without license plates, according to a new report.

Published: Wednesday, April 17th, 2024 @ 8:59 am

By: Daily Wire

|

|

House Judiciary Chair Jim Jordan (R-OH) is looking into whether GoFundMe and Eventbrite cooperated with federal law enforcement during their investigation into the financial transactions of supporters of former President Donald Trump.

Published: Sunday, April 14th, 2024 @ 6:56 pm

By: Daily Wire

|

|

Far-left Rep. Alexandria Ocasio-Cortez (D-NY) was mocked online late on Monday after video of her yelling at pro-Palestinian activists went viral.

Published: Thursday, April 11th, 2024 @ 10:36 pm

By: Daily Wire

|

|

Daily Wire Editor Emeritus Ben Shapiro, along with hosts Matt Walsh, Andrew Klavan, and company co-founder Jeremy Boreing discussed the state of the 2024 presidential election before President Joe Biden gave his State of the Union address on Thursday.

Published: Thursday, April 11th, 2024 @ 6:27 pm

By: Daily Wire

|

|

Former U.N. Ambassador Nikki Haley said this week that the criminal trials against former President Donald Trump should happen before the upcoming elections.

Published: Wednesday, April 10th, 2024 @ 1:38 pm

By: Daily Wire

|

|

Vice President Kamala Harris ignored recommendations while attorney general of California to investigate an alleged pyramid scheme at a company linked to her husband, according to documents obtained by The New York Post.

Published: Tuesday, April 9th, 2024 @ 8:02 am

By: Daily Wire

|

|

Harvard Jewish Law Students Association slammed the divestment resolution as antisemitic

Published: Sunday, April 7th, 2024 @ 7:53 pm

By: Daily Wire

|

|

'The entire value add of Hunter Biden to our business was his family name and his access to his father, Vice President Joe Biden'

Published: Sunday, April 7th, 2024 @ 7:47 pm

By: Daily Wire

|

|

Robert F. Kennedy Jr. announced on Tuesday that he has selected Nicole Shanahan to be his vice presidential running mate as he continues to run as an Independent after dropping out of the Democratic Party’s presidential primary late last year.

Published: Sunday, April 7th, 2024 @ 8:24 am

By: Daily Wire

|

|

The campaign for former President Donald Trump released a statement Saturday afternoon condemning the White House’s declaration of Easter Sunday as “Transgender Day of Visibility.”

Published: Thursday, April 4th, 2024 @ 1:31 pm

By: Daily Wire

|

|

On Tuesday, another Republican announced that he plans to retire early from the House, a decision that would further diminish a narrow GOP majority in the lower chamber.

Published: Tuesday, April 2nd, 2024 @ 11:50 pm

By: Daily Wire

|

|

"President Trump is moved by the invitation to join NYPD Officer Jonathan Diller’s family... "

Published: Monday, April 1st, 2024 @ 3:58 pm

By: Daily Wire

|